Earnings recession comes to an end

A few weeks ago, we did a Q3 earnings preview, noting at the time that analysts were expecting S&P 500 earnings to contract nearly 1% YoY. However, we said that there was a chance the earnings recession would end this quarter — spoiler alert: it did.

This week, we analyze why companies surpassed earnings expectations, which sectors performed best and what the end of the earnings recession means for the market in the long term.

Companies beating earnings estimates at above-average pace

As we said in our Q3 preview, “U.S. companies tend to manage expectations down, then beat … [so] there’s a very good chance … we could see earnings growth move back into positive territory.”

That’s exactly what we’ve seen. With almost 90% of S&P 500 companies having reported earnings at this point, 80% have beaten their projected earnings (chart below, green line) – better than the 10-year average of 74%.

Q3 earnings on track for 4% YoY growth, led by consumer-driven sectors

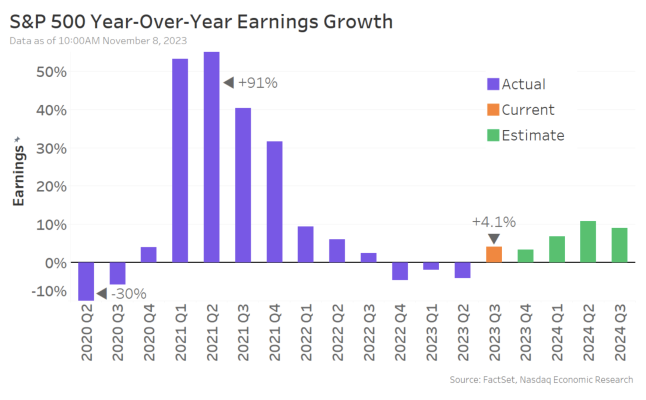

With this above-average beat rate, Q3 S&P 500 earnings are now on track to increase 4.1% YoY (chart below, orange bar) – a five percentage point improvement from expectations three weeks ago.

So, after three quarters, the earnings recession is over.

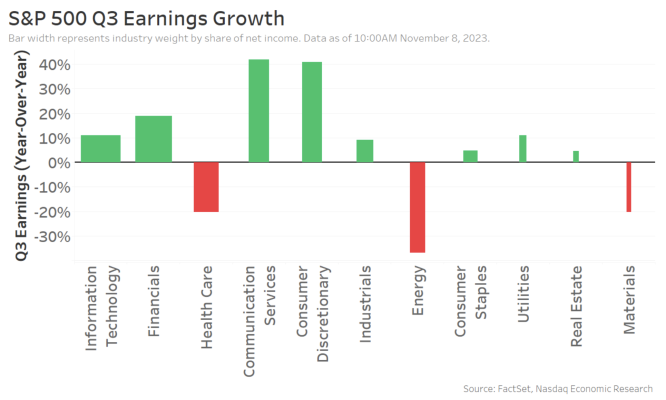

Last month, we highlighted that, with consumer demand remaining robust, the consumer-driven Communication Services and Consumer Discretionary sectors were set to lead the way, and they’ve outperformed already lofty expectations. Both sectors are on pace for 40+% YoY earnings growth (chart below).

Some of the big outperformers in those sectors included several Nasdaq-listed companies, such as Airbnb (+303% YoY), Amazon (+241% YoY), Meta (+161% YoY), Alphabet (+40% YoY), Starbucks (+31%) and Netflix (+18% YoY).

And as we expected, only the Health Care, Energy, and Materials sectors saw negative earnings growth (red bars). The eight other sectors, though, are on track for growth of at least +4.5% YoY (green bars).

Cost cutting supported margin expansion

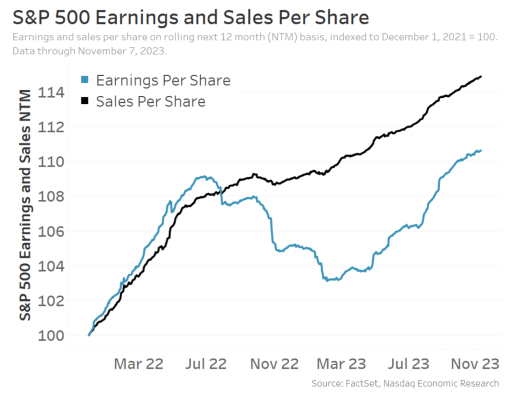

Earnings turned out so well because companies were able to expand their margins.

Undoubtedly, the earnings recession incentivized companies to cut costs (helped by falling input costs, slower wage growth and in the case of big tech around the start of the year, layoffs), and they’re reaping the benefits of those actions this quarter.

That helps explain why we’ve seen projected earnings (chart below, blue line) rising since the spring. With consumer demand staying resilient in the face of rate hikes, projected sales (black line) have been rising for a couple years.

Earnings growth expected to pick up over the next year, which is good news for returns

With projected earnings and sales rising, there’s no sign of another earnings recession on the horizon.

Right now, analysts expect Q4 S&P 500 earnings to grow 3.3% YoY and pick up from there (second chart, green bars).

That’s important since research shows that over the long term, earnings explain around 80% of stock price performance (even if the big driver of stocks over the last week has been the increased optimism that the Fed is done hiking rates – although, lower rates support valuations, too).

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2023. Nasdaq, Inc. All Rights Reserved.

Image and article originally from www.nasdaq.com. Read the original article here.