Call volume is running at 12 times the average intraday volume

Options bulls are hitting World Wrestling Entertainment, Inc. (NYSE:WWE) in the options pits today, with 1,245 calls exchanged so far — or 12 times the average intraday volume — compared to just 140 puts. The January 2023 80-strike call is seeing the most activity, while the 85 call in that same monthly series is trailing not too far behind. It’s still unclear what is sparking interest in the equity, which was last seen down 1.8% to trade at $79.44.

This penchant for calls is far from being the norm. Over at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the security’s 10-day put/call volume ratio of 3.52 sits higher than all but 5% off annual readings, suggesting puts have been getting picked up at a much quicker-than-usual clip.

Now looks like an ideal time to speculate on the stock’s next moves with options, given its Schaeffer’s Volatility Index (SVI) of 30% stands in the low 5th percentile of readings from the past year. This means options traders are pricing in low volatility expectations for WWE right now.

Analysts are mostly skeptical, with five of the nine in coverage calling the equity a “hold” or worse. What’s more, the 8.15 million shares sold short make up a hefty 19% of World Wrestling Entertainment stock’s available float, or more than two week’s worth of pent-up buying power.

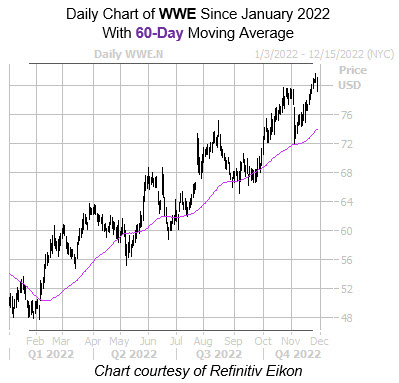

The shares yesterday notched a roughly three-year high of $81.58, however, as well as a sixth-straight daily win. This win streak followed a bounce off the $72 region, while the 60-day moving average has also been acting as a level of support for the shares. Year-to-date, WWE is up 61%.

Image and article originally from www.schaeffersresearch.com. Read the original article here.