The Zacks Consumer Staples sector has held up relatively well in 2022 vs. the general market, down roughly 13%.

Companies in the sector can generate revenue in the face of good and bad economic situations, helping explain why it’s been a bright spot in an otherwise dim market in 2022.

A titan in the sector, Procter & Gamble PG, is on deck to unveil quarterly results on October 19th before the market open.

Procter & Gamble (often referred to as P&G) is a branded consumer products company that markets its products primarily through mass merchandisers, grocery stores, membership club stores, drug stores, department stores, distributors, baby stores, specialty beauty stores, e-commerce, high-frequency stores, and pharmacies.

As it stands, Procter & Gamble carries a Zacks Rank #3 (Hold) with an overall VGM Score of a D.

How does everything else shape up for the Consumer Staples titan heading into its print? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, PG shares have underperformed the Zacks Consumer Staples sector by a fair margin, down just above 20%.

Image Source: Zacks Investment Research

Over the last three months, shares have continued to underperform their Zacks sector, down more than 10%.

Image Source: Zacks Investment Research

The company’s 21.4X forward earnings multiple is well above its Zacks sector average, reflecting a 15% premium. Still, the value is nicely below its 23.8X five-year median and highs of 27.7X in 2021.

PG carries a Style Score of a D for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bearish for the quarter to be reported, with seven negative earnings estimate revisions hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $1.55 suggests a 3.7% Y/Y decline in earnings.

Image Source: Zacks Investment Research

The company’s top-line is in better shape; the Zacks Consensus Sales Estimate of $20.5 billion reflects a marginal 0.8% Y/Y uptick in revenue.

Quarterly Performance & Market Reactions

PG has an impressive earnings track record, exceeding bottom-line estimates in nine of its last ten prints. However, the one miss came in its latest print; PG fell short of the Zacks Consensus EPS Estimate by 1.6%.

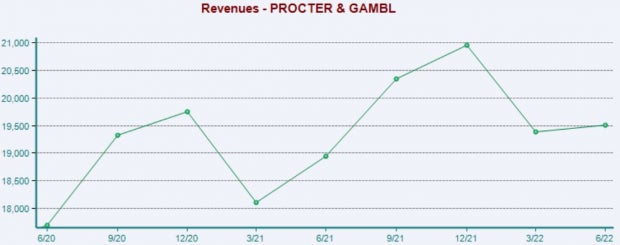

Top-line results have also been strong – PG has exceeded revenue estimates in nine consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Further, the market has had mixed reactions in response to the company’s quarterly prints as of late, with shares moving downwards twice and upwards twice following its last four earnings releases.

Putting Everything Together

PG shares have been weaker than their Zacks Consumer Staples sector across several timeframes, indicating that sellers have been in control.

Shares could be considered pricey, with the company carrying a Style Score of a D for Value.

Analysts have been bearish in their earnings outlook, with estimates suggesting a decline in earnings but a slight uptick in revenue.

Further, the company has consistently exceeded quarterly estimates, with the market having mixed reactions following its last four prints.

Heading into the release, Procter & Gamble PG carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -0.5%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Procter & Gamble Company The (PG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.