This week, J&J JNJ announced its decision to end a late-stage study evaluating its drug Opsumit (macitentan) for a rare form of pulmonary hypertension. The European Commission approved Merck’s MRK Ebola vaccine for children as young as one year. The FDA issued AstraZeneca (AZN) a complete response letter (CRL) for its application seeking approval of its drug Ultomiris for a new rare disease indication.

Recap of the Week’s Most Important Stories

J&J To Stop Label Expansion Study on Opsumit: J&J is stopping a phase III study called MACiTEPH, evaluating Opsumit (macitentan) for another indication called chronic thromboembolic pulmonary hypertension (CTEPH). CTEPH is a rare form of pulmonary hypertension that occurs when there is abnormally high pressure in the lungs’ small blood vessels.

The decision to end the CTEPH study due to futility was made at the recommendation of the study’s independent data monitoring committee following a pre-planned interim analysis. J&J presently markets Opsumit to treat PAH, WHO Group 1. PAH means there is high blood pressure in the arteries of the lungs.

J&J announced positive top-line data from a phase III study evaluating regimens based on its new cancer drug, Rybrevant, in the broader EGFR-mutated non-small cell lung cancer (NSCLC) population,

The MARIPOSA-2 study evaluated Rybrevant plus chemotherapy with and without lazertinib versus chemotherapy alone in patients with EGFR-mutated NSCLC after disease progression on osimertinib. The study met its dual primary endpoint, resulting in statistically significant and clinically meaningful improvement in progression-free survival versus chemotherapy alone in both experimental treatment arms. Rybrevant is approved for patients with locally advanced or metastatic NSCLC with EGFR exon 20 insertion mutations whose disease progressed on or after platinum-based chemotherapy.

FDA’s CRL to AstraZeneca for Ultomiris for NMOSD Indication: The FDA issued a CRL to AstraZeneca’s supplemental biologics license application (sBLA) seeking approval for long-acting C5 complement inhibitor Ultomiris for the treatment of adult patients with neuromyelitis optica spectrum disorder (NMOSD) who are AQP4 Ab+.

The sBLA was based on data from the CHAMPION-NMOSD phase III study. However, the FDA has not requested any additional analyses of data from the CHAMPION-NMOSD phase III study, nor has it raised any concerns about efficacy and safety data from the study.

The CRL instead requests modifications in the Ultomiris Risk Evaluation and Mitigation Strategy (REMS) safety program. Ultomiris is already approved for NMOSD in the EU and Japan. Ultomiris is presently approved for treating three indications — generalized myasthenia gravis, paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome in the United States.

European Commission Approves Merck’s Ebola Vaccine for Kids: The European Commission (EC) approved Merck’s vaccine for Ebola called Ervebo, for use in children aged one year and older. Ervebo is now approved for preventing disease caused by Zaire ebolavirus in children as young as 12 months old. The EC approved Ervebo for adults in Europe in November 2019

The FDA approved Ervebo for children aged 12 months and older last month and for adults in December 2019

The NYSE ARCA Pharmaceutical Index rose 0.44% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

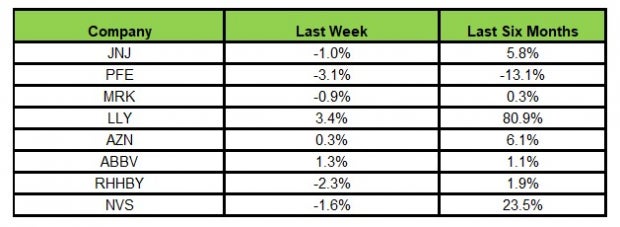

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, Lilly rose the most (up 3.4%), while Pfizer declined the most (3.1%).

In the past six months, Lilly has risen the most (80.9%), while Pfizer has declined the most (13.1%).

(See the last pharma stock roundup here: J&J’s New ’23 View After Kenvue Separation, Regulatory Updates)

What’s Next in the Pharma World?

Watch out for regular pipeline and regulatory updates next week.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.