Investors remain busy sorting through an extensive list of quarterly results daily, with many more scheduled in the weeks ahead.

Soon, we’ll hear from a few big names in the retail space, Dollar Tree DLTR and Kroger KR.

Dollar Tree is scheduled to reveal its results on March 1st, whereas Kroger reports the day after on March 2nd.

How do the retailers stack up heading into their releases? We can use results from a peer in the same sector, Walmart WMT, as a small gauge. Let’s take a closer look.

Walmart Q4

Walmart posted strong bottom line results, exceeding the Zacks Consensus EPS Estimate by more than 12% and reporting EPS of $1.71.

Quarterly revenue also exceeded expectations, reported at $164 billion and growing roughly 7% year-over-year. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Walmart U.S. comparable sales climbed 8.3% year-over-year, and eCommerce witnessed 17% growth while the company continued to gain market share in grocery.

In addition, Walmart International net sales tallied $27.6 billion, growing a solid 2.1% year-over-year. Impressively, Sam’s Club comparable sales climbed by 8.3%, with the company exiting the quarter with memberships at an all-time high.

And to top it off, the titan retailer’s global advertising business grew more than 21%, primarily driven by solid growth within Walmart Connect in the U.S.

Doug McMillion, CEO, on the solid quarter, “We’re excited about our momentum. The team delivered a strong quarter to finish the year, and as our results in the last two quarters show, they acted quickly and aggressively to address the inventory and cost challenges we faced last year. We built momentum in the third quarter and that continues. We are well-positioned to start this fiscal year.”

Let’s pivot to Dollar Tree and Kroger.

Dollar Tree

Quarterly Estimates –

Analysts have primarily been bullish in their earnings outlook, with two positive earnings estimate revisions hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $2.03 suggests a slight 1% uptick in earnings year-over-year.

Image Source: Zacks Investment Research

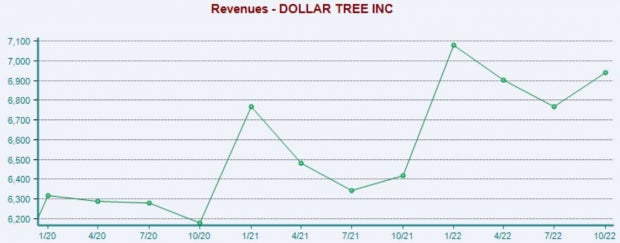

Our consensus revenue estimate stands at $7.6 billion, indicating a positive 7.4% change from year-ago quarterly sales of $7.1 billion.

Quarterly Performance –

DLTR has consistently exceeded bottom line expectations, penciling in 12 consecutive EPS beats. In its latest quarter, the company delivered a 2.6% surprise.

Top line results have been less consistent, with DLTR exceeding revenue expectations in two of its last four quarters.

Image Source: Zacks Investment Research

Kroger

Quarterly Estimates –

A singular analyst has upped their earnings outlook over the last several months, with the Zacks Consensus EPS Estimate of $0.89 indicating a 2% year-over-year pullback within earnings.

Image Source: Zacks Investment Research

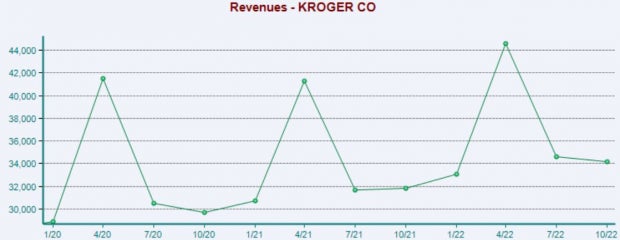

Further, the Zacks Consensus Sales Estimate presently sits at $34.8 billion, suggesting a climb of more than 5% from year-ago revenue of $33.1 billion.

Quarterly Performance –

Kroger sports an impressive earnings track record, exceeding both earnings and revenue estimates in seven consecutive quarters.

In the company’s latest release in December 2022, Kroger delivered revenue modestly above expectations and registered a 7% EPS beat.

Image Source: Zacks Investment Research

Putting Everything Together

Earnings season continues to chug along, with many retailers scheduled to report this week.

Two in particular, Dollar Tree DLTR and Kroger KR, are a part of that group.

A peer, Walmart WMT, posted better-than-expected results in the face of a challenging environment. Following the release, shares climbed modestly.

Heading into their releases, Dollar Tree is a Zacks Rank #4 (Sell), and Kroger is a Zacks Rank #2 (Buy).

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

Walmart Inc. (WMT) : Free Stock Analysis Report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.