Emerging markets payments fintechs have enjoyed high user base growth over the past decade by servicing the financially excluded, but it is typically a thin-margin business. Therefore, once their business reaches scale, digital payments firms usually expand their offering to include higher margin products, such as loans.

Although lending can be highly profitable, this is contingent upon effective risk management. The sector is also very sensitive to the macroeconomic environment and can be subject to significant regulatory oversight.

In this report, we consider the profitability of various fintech segments and examine the recent experience of StoneCo, a pioneering Brazilian digital payments provider that has diversified into higher-margin credit products.

Payments – typically, not a very profitable business model

Digital payments is often the first fintech segment to develop in emerging economies. Once established, digital payments provides the basic infrastructure onto which other fintech sectors, such as lending, insurtech and investech, can be built.

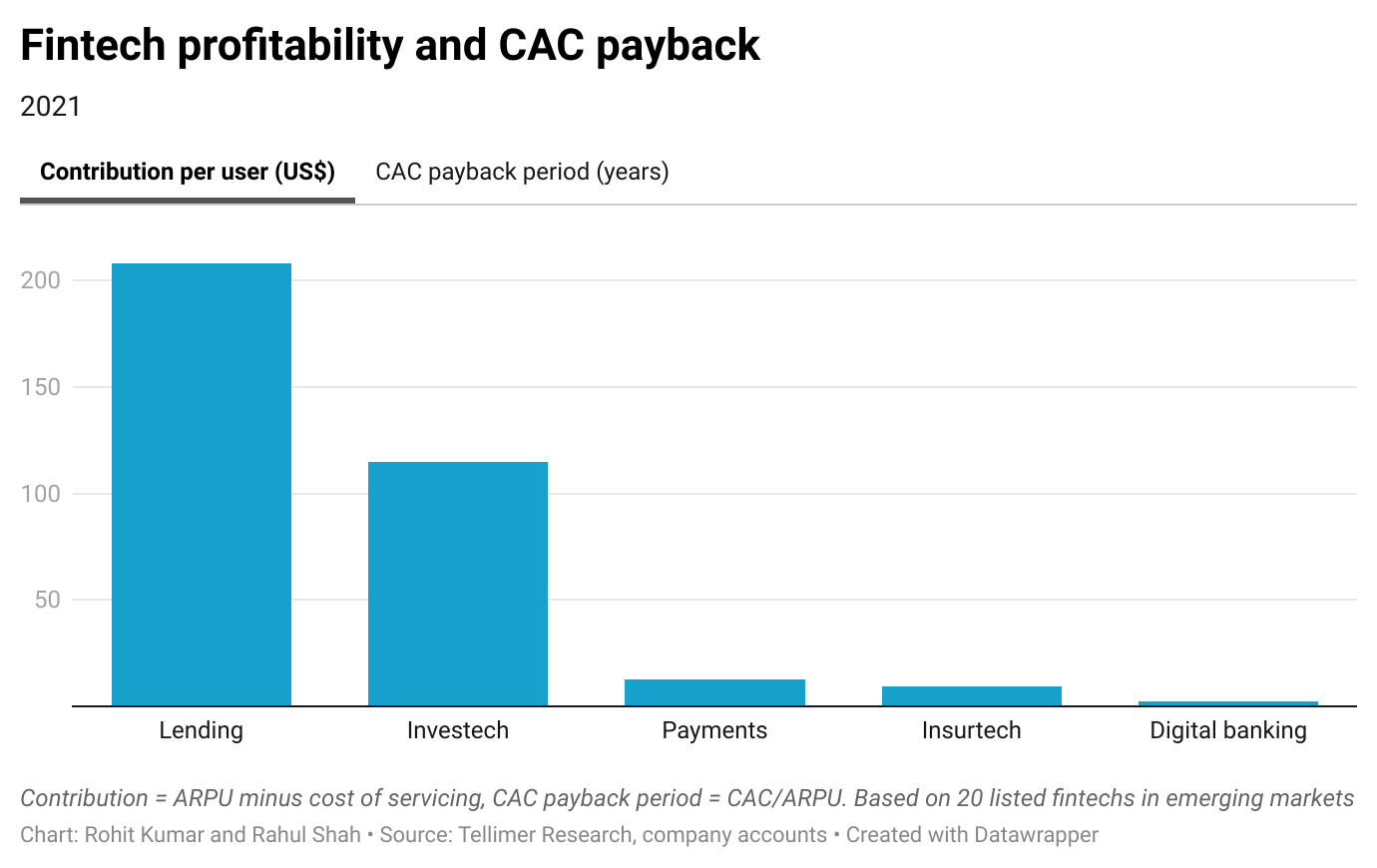

Despite the important role they play, consumer-focused digital payments providers can struggle to generate strong financial returns, reflecting low ARPUs, and high marketing and servicing costs. Other fintech segments, notably lending and investech, appear much more attractive for investors.

Most payments providers are looking to add new products to lift returns

In their search for profitability, most payments providers look to expand their product offerings once they achieve scale. Lending is usually the first target for payments providers; the core payments business can provide a rich dataset from which to build credit risk models and potential access to funding (via digital wallet floats).

As highlighted above, lending margins are also typically attractive. Other common areas of diversification for payments firms include investech and insurtech.

Lending is profitable but highly sensitive to the macro environment

As noted, lending is a profitable business model, but carries significant credit risk, which has become more visible in the recent challenging times (eg the recent BNPL woes).

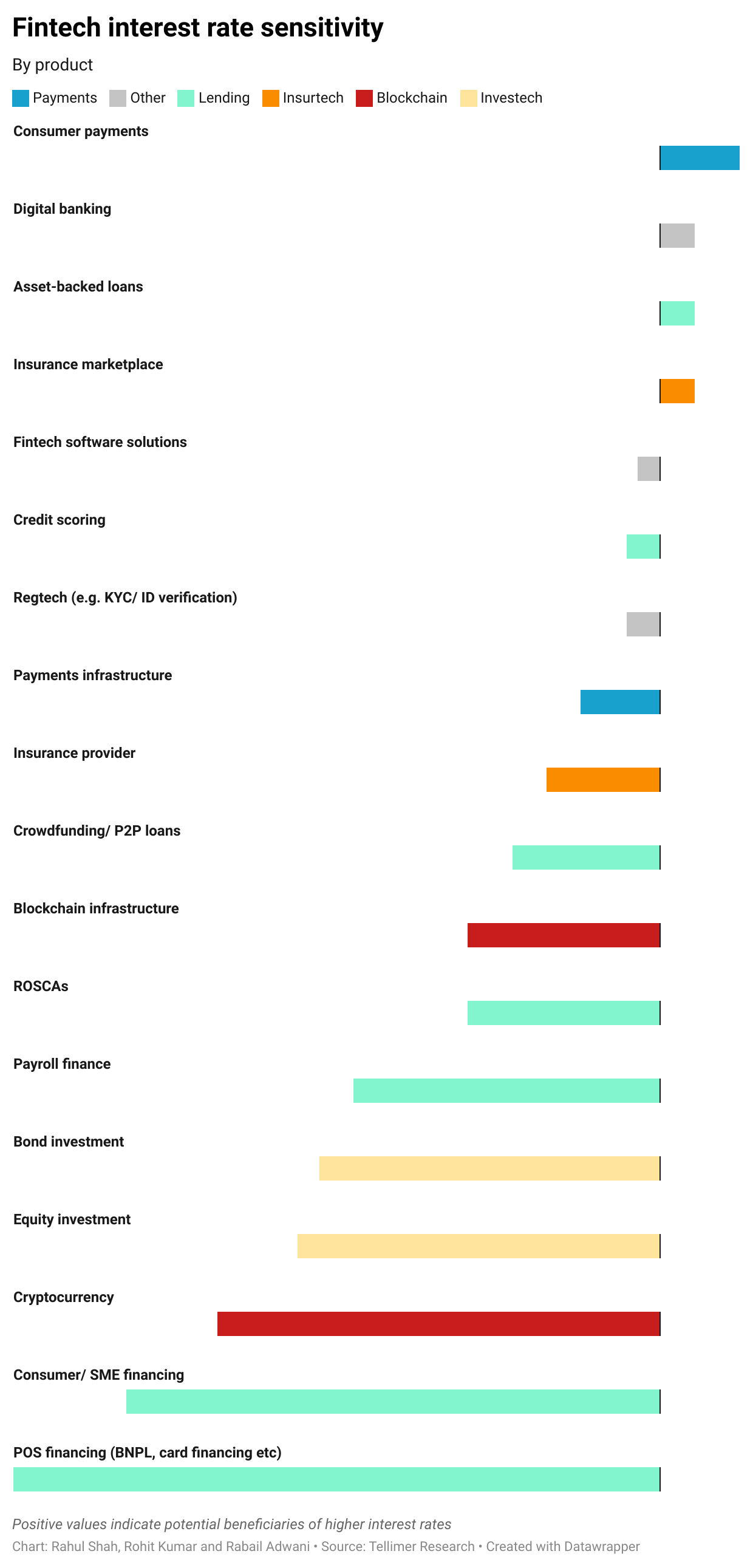

In addition, lending is sensitive to rising interest rates (in terms of higher funding costs for the fintech, and squeezed finances for the borrower), and is also prone to attracting regulatory attention, as observed in the case of China and, more recently, India.

The recent experience of StoneCo highlights the vulnerability of digital payments providers

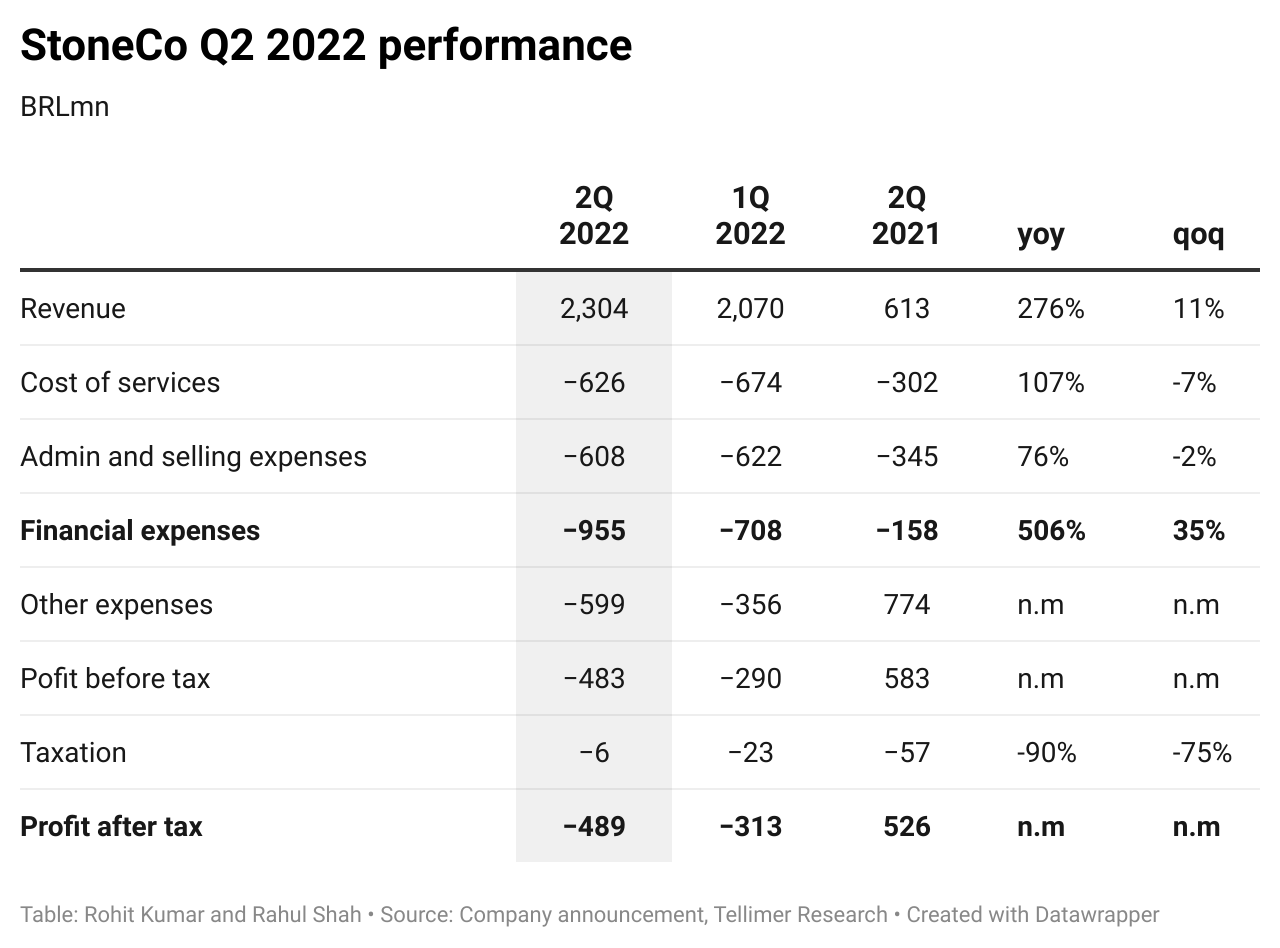

StoneCo, a leading payments provider in Brazil, has been offering credit services to its customers but stopped this in mid-2021 as bad debts grew out of control. NPLs for StoneCo rose to over 60% of the company’s total loan portfolio, impacting the overall profitability of the company.

More recently, the company also suffered from rising interest rates (the policy rate in Brazil rose to 13.75% from 2.00% in 2021), and financial expenses rose by over 5x yoy, eating up 40% of revenues. Therefore, despite growing revenues by 276% yoy, the company’s bottom line suffered due to macroeconomic challenges.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.