Investors love dividends, as they provide a passive income stream and help cushion the impact of drawdowns in other positions.

And when seeking income, many investors turn to the Dividend Aristocrats, a group of S&P 500 companies that have upped their dividend payouts for a minimum of 25 consecutive years.

However, a step above is the elite Dividend Kings group, companies that have increased their dividend payouts for a minimum of 50 consecutive years.

Three members of the club – Johnson & Johnson JNJ, PepsiCo PEP, and Sysco SYY – all deserve consideration from those seeing reliable dividend payouts. Let’s take a closer look at each.

Johnson & Johnson

Headquartered in New Jersey, Johnson & Johnson is an American multinational corporation that develops medical devices, pharmaceuticals, and consumer packaged goods. Shares currently yield a solid 2.9% annually paired with a payout ratio sitting sustainably at 44% of earnings.

As we can see below, the company has shown a commitment to increasingly rewarding shareholders.

Image Source: Zacks Investment Research

In addition, shares could entice value-focused investors, with the current 15.2X forward earnings multiple sitting beneath the 16.8X five-year median and the Zacks Medical sector average.

Image Source: Zacks Investment Research

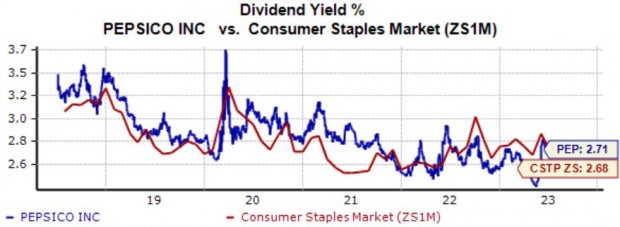

PepsiCo

PepsiCo is an American multinational beverage, food, and snack corporation headquartered in New York. Shares yield 2.7% annually, with the company’s payout growing by an impressive 5.5% over the last five years.

Image Source: Zacks Investment Research

PEP is a consistent earnings outperformer, exceeding earnings and revenue estimates in five consecutive quarters. Just in its latest release, the consumer staples titan delivered a 10% EPS beat and reported revenue 4% above expectations.

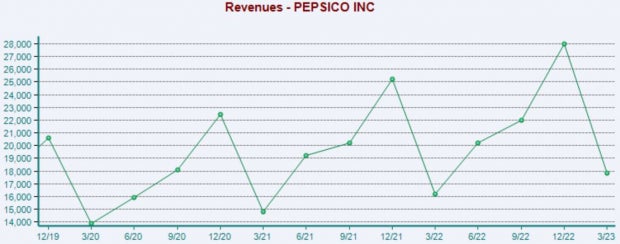

As we can see below, the company’s revenue growth is somewhat-seasonal but overall reflects stability.

Image Source: Zacks Investment Research

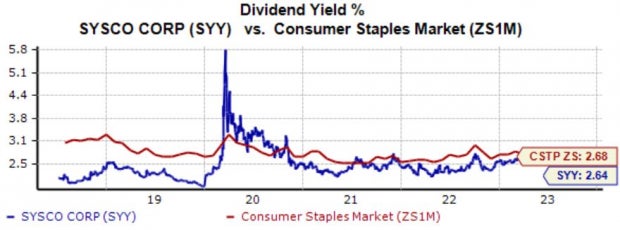

Sysco Corp.

Sysco markets and distributes a range of food and related products primarily to the food service or food-away-from-home industry. Shares currently yield 2.6% annually, with the payout growing by a solid 7.5% over the last five years.

Image Source: Zacks Investment Research

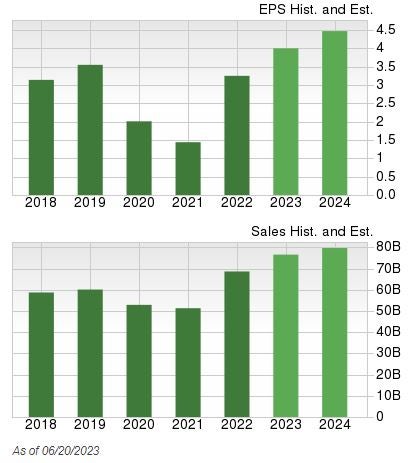

It’s hard to ignore the company’s growth profile, further reflected by its Style Score of “B” for Growth. Estimates suggest nearly 25% earnings growth in its current fiscal year (FY23) on 12% higher revenues. And in FY24, current projections call for an additional 12% earnings growth paired with a 4% sales climb.

Image Source: Zacks Investment Research

Bottom Line

Targeting dividend-paying stocks is an excellent strategy that investors can deploy.

Dividends soften the blow from drawdowns in other positions, provide more than one way to reap a return from an investment, and allow maximum returns through dividend reinvestment.

And all three stocks above – Johnson & Johnson JNJ, PepsiCo PEP, and Sysco SYY – are Dividend Kings, upping their dividend payouts for a minimum of 50 consecutive years.

For those seeking a reliable income stream, all three deserve serious consideration.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to “insane levels,” and they’re likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Johnson & Johnson (JNJ) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.