Palisade Bio PALI announced that it is in-licensing exclusive worldwide rights from private biotech, Giiant Pharma, to develop and commercialize gastrointestinal therapies targeting Inflammatory Bowel Disease (IBD). In response to this development, shares of PALI soared 109% on Sep 06.

The therapies targeting the IBD therapeutic area, which has multi-billion-dollar potential, will be developed by leveraging Giiant’s proprietary targeted prodrug platform.

The licensed technologies include Giiant’s precision delivery technology platform and all of its promising pipeline candidates. Giiant’s lead candidate, GT-2108, is currently in pre-clinical development for patients suffering from moderate to severe ulcerative colitis. GT-2108 is a colon-specific phosphodiesterase-4 (PDE4) inhibitor prodrug that can be orally administered.

Palisade aims to submit an investigational new drug application to the FDA by the third quarter of 2024 to start clinical studies on GT-2108.

Palisade will also gain the rights to develop a pre-clinical candidate, GT-1908, which is an oral PDE4 compound targeting fibro stenotic Crohn’s Disease. GT-1908 will be developed as a second program by PALI.

Under the terms of the licensing agreement, Palisade will partially contribute to the development costs until the first regulatory approval of Giiant’s pipeline candidates. Subsequently, PALI will take on full responsibility for the costs associated with the in-licensed candidate’s development, manufacturing and commercialization.

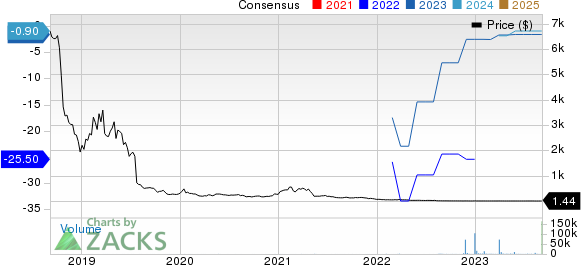

Shares of Palisade have plunged 87.3% year to date compared with the industry’s 12.0% decline.

Image Source: Zacks Investment Research

The collaboration will strengthen the company’s existing portfolio, which includes its lead candidate LB1148, being developed in a late-stage study for accelerating the time to return of postoperative bowel function.

LB1148 is a broad-spectrum serine protease inhibitor that aims to neutralize digestive enzymes and potentially reduce intestinal damage.

Palisade Bio, Inc. Price and Consensus

Palisade Bio, Inc. price-consensus-chart | Palisade Bio, Inc. Quote

Zacks Rank & Stocks to Consider

Palisade currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same industry are ANI Pharmaceuticals ANIP, Annovis Bio ANVS and Corcept Therapeutics CORT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the Zacks Consensus Estimate forANI Pharmaceuticals’ earnings has gone up from $3.31 per share to $3.73 for 2023. The bottom-line estimate has increased from $4.32 to $4.35 for 2024 during the same time frame. Shares of the company have rallied 60.5% year to date.

ANIP’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 91.56%.

In the past 90 days, the Zacks Consensus Estimate for Annovis Bio has narrowed from a loss of $4.89 per share to a loss of $4.38 for 2023. The bottom-line estimate has narrowed from a loss of $3.18 to $2.77 for 2024 during the same time frame. Shares of the company have lost 8.1% year to date.

ANVS’ earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 13.40%.

In the past 90 days, the Zacks Consensus Estimate for Corcept’s earnings has gone up from 62 cents per share to 78 cents for 2023. The bottom-line estimate has also improved from 61 cents to 83 cents for 2024 during the same time frame. Shares of the company have rallied 62.9% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

Palisade Bio, Inc. (PALI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.