Subscribers to our Schaeffer’s Weekly Options Trader just scored a 110% profit

Subscribers to our Schaeffer’s Weekly Options Trader service scored a 110% profit with our recommended Spotify Technology SA (NYSE:SPOT) September 23, 2022 112-strike put in under two weeks. Below, we’ll explain why we recommended the put in the first place, and how the trade played out so quickly.

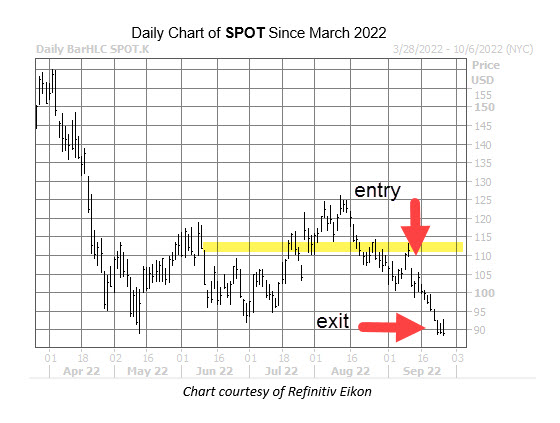

At the time of our recommendation on Tuesday, September 13, SPOT faced some resistance at the $110 level, while a trendline connecting higher lows since June was also sitting in this area prior to the stock’s bear gap.

Despite SPOT’s somewhat gloomy price action, sentiment surrounding the music streaming name was surprisingly high in mid-September. There were a large number of “buy” and “strong buy” ratings on the table, even as Spotify stock sported a -55% year-to-date return. What’s more, the equity’s 10-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) sat at 1.63, suggesting a preference for calls among options traders.

We also noted that the stock’s Schaeffer’s Volatility Scorecard (SVS) was sitting at a high 99, suggesting that SPOT has, historically, delivered high returns for buyers.

The optimism we noted did unwind, with SPOT’s 10-day put/call volume ratio at the ISE, CBOE, PHLX now sitting at 0.69. Also, a look at the chart shows SPOT didn’t even come close to the $110 level we pointed out, as the stock bent to the whims of the broader market and strung together six-consecutive daily drops, allowing traders to quickly double their money.

Image and article originally from www.schaeffersresearch.com. Read the original article here.