Stop me if you’ve heard this before, but artificial intelligence (AI) is Wall Street’s new obsession in 2023, with companies discussing the technology in a snowballing fashion. And following back-to-back blowout quarters from NVIDIA NVDA, the conversation won’t be going anywhere anytime soon.

Analysts have become notably bullish on NVDA’s outlook nearly all year, helping land the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

And recently, it was unveiled that NVIDIA has expanded its partnership with Alphabet’s GOOGL Google Cloud to advance AI computing, software, and services. The market reacted highly positively to the news, with both GOOGL and NVDA shares seeing plenty of buying pressure.

NVIDIA’s generative AI technology used by Google DeepMind and Google Research teams has been optimized and is now available to Google Cloud customers worldwide.

Jensen Huang, CEO and founder of NVIDIA, said, “Our expanded collaboration with Google Cloud will help developers accelerate their work with infrastructure, software and services that supercharge energy efficiency and reduce costs.”

It’s a significant announcement, further fueling the bullish sentiment we’ve seen within AI-related stocks in 2023. With NVIDIA firing on all cylinders, it raises a valid question – How do things currently stack up for Alphabet? Let’s take a closer look.

Alphabet

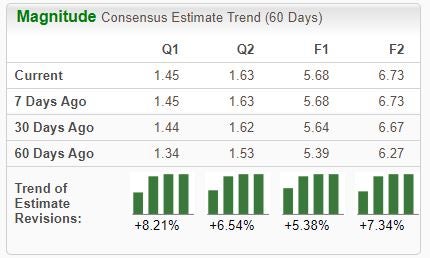

Analysts have taken a bullish stance on Alphabet’s earnings outlook, with expectations increasing across all timeframes over the last several months.

Image Source: Zacks Investment Research

The technology titan posted results well above expectations in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 9% and delivering a 3% revenue surprise. Investors were impressed with the results, as we can see illustrated below.

In fact, shares have seen bullish activity post-earnings in back-to-back releases.

Image Source: Zacks Investment Research

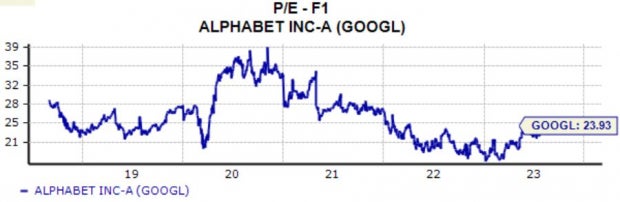

In addition, GOOGL shares aren’t expensive given the company’s growth trajectory, with the current 23.9X forward earnings multiple nicely beneath the 24.5X five-year median and highs of 26.8X in 2022. Earnings are forecasted to climb 25% on 9% higher revenues in its current year.

Image Source: Zacks Investment Research

Bottom Line

It’s more than reasonable to assume artificial intelligence will continue to dominate market headlines. It’s easy to see why, of course, as the technology allows us to achieve feats that otherwise felt impossible.

And when it comes to AI, NVIDIA NVDA is the titan in the ring, with Alphabet GOOGL also expected to enjoy favorable tailwinds.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.