The latest stock pick from Playbook of the Week is a bullish play on MRO

The below is an excerpt from this past Monday’s episode of Schaeffer’s Playbook of the Week, featuring Schaeffer’s Senior Market Strategist Matthew Timpane, CFA. Below, Matthew makes a bullish case for Marathon Oil Corporation (NYSE: MRO).

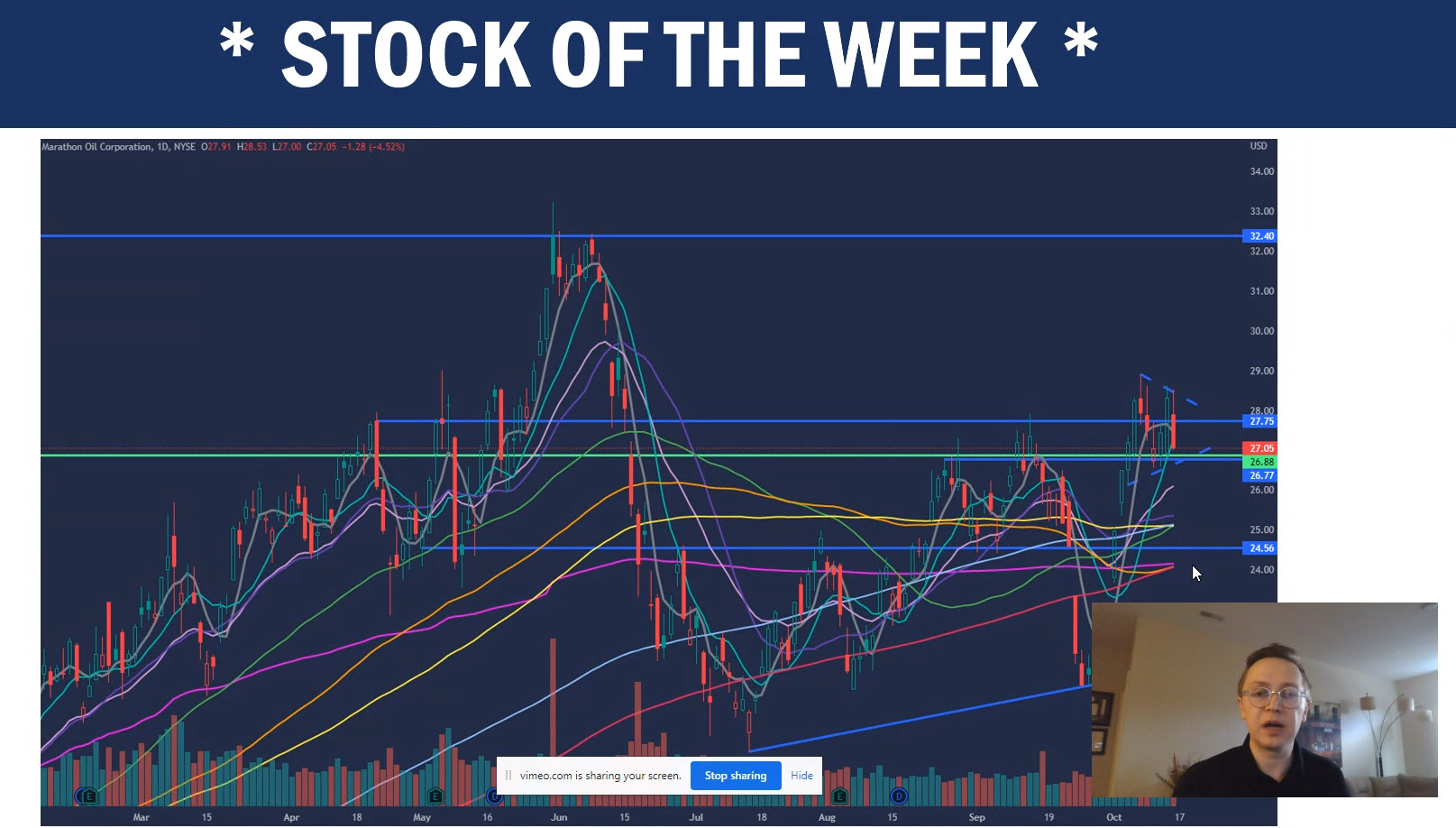

If you want to get into oil, this is the opportunity to take your shot. MRO is currently in a pennant formation, with a confluence of moving averages below the supporting price, per the chart below. Last seen at $27.31, the shares are above peak call open interest at the 25-strike right now. As a result, the $30-$31 strikes could become magnets. There’s seasonality in play here too, November is the second-most bullish month in the last five years, being up about 8% on average.

Short-term options traders have been much more put-heavy than usual lately. This is per the MRO’s Schaeffer’s put/call open interest ratio (SOIR) of 0.72, which ranks higher than 88% of annual readings. When SOIR is this high we’ve seen some pretty massive rallies from MPC in the past, historically.

The analyst community shows plenty of “buy” or better ratings, but also nine “holds” and two “sells.” So while the positioning is slightly tilted bullish, but we could conceivably see some more upgrades in the near future.

Join Schaeffer’s Playbook of the Week now and tune in every Monday morning at 8:30 a.m. to get ready for the trading week with me. Click here for more information to get started.

Image and article originally from www.schaeffersresearch.com. Read the original article here.