Trading 67% off its highs, Netflix NFLX is set to report Q3 earnings on 10/18/2022. The company’s earnings are always heavily covered with the stock tending to have big movements in either direction after reporting. The direction of the stock usually hinges on the company’s guidance for subscriber growth above all else.

The streaming leader’s revenue and subscriber growth are critically analyzed during earnings season, with consumers now having more options for streaming content. Apple AAPL, Amazon AMZN, and Disney DIS are all respectable competitors in the streaming market.

During Q2, Netflix expected to lose 2 million subscribers and was excited to lose far less at 970,000. The company will hope to stop the bleeding going forward. There are still growth opportunities with linear tv largely replaced by streaming.

Along with monitoring subscriber growth, investors will want to pay attention to Netflix’s guidance on its advertising initiative. Netflix recently announced it plans to officially launch a cheaper subscription service in November that will feature ads.

Some analysts believe the company could make billions from monetizing ad revenue. The potential growth in ad revenue could help NFLX get its mojo back as Wall Street and investors look for the chance to possibly get back in on Netflix stock again.

Performance

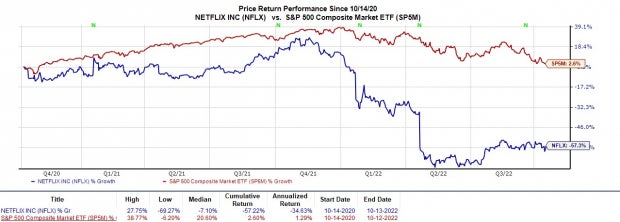

Netflix is down -61% year to date, with a large drop coming in April as investors strayed away from growth stocks. The company also announced it lost subscribers during Q1 for the first time in 10 years, adding fuel to the fire.

Despite a recent string of earnings beats, the stock has plummeted on any shaky guidance as Wall Street fears Netflix’s growth may already be behind it.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Netflix’s growth is largely reflected in itsstellar priceperformance over the last decade. NFLX is still up a mind-blowing +2,395% over the last 10 years, crushing the benchmark and its peer groups +92%.

Wall Street was ok with paying a premium for NFLX in the past because of its pioneer-like growth prospects. Netflix was what many might consider the stock of the decade and one of the best large cap performers,

Outlook

The Zacks Consensus Estimate for NFLX’s Q3 earnings is $2.12 per share, which would represent a -33% decrease from Q3 2021. Operating and expansion costs appear to be weighing on Q3 earnings as sales are expected to be up 5% at $7.85 billion.

Earnings revisions have also trended down significantly from $2.71 at the beginning of the quarter.

Year over year, NFLX earnings are expected to decline 11% in 2022 but rise 9% in FY23 at $10.98 a share. Top line growth is expected, with FY22 sales projected to rise 6% and another 7% in FY23 to $33.89 billion.

This growth is much slower than what it was in the past and is attributed to its stalling subscriber growth. Netflix is expected to add 1 million subscribers during the third quarter compared to 4.4 million in Q3 2021.

Full-year estimate revisions have also trended down for the current year and FY23.

Valuation

Trading around $232 a share, NFLX has a P/E of 22X. NFLX trades much lower than the 65.1X it saw earlier in the year. Even better, NFLX trades far more reasonably than its 2,640.6X high over the last decade and the median of 111.9X.

Image Source: Zacks Investment Research

Bottom Line

Investors are hoping that NFLX can start to rebound after a disastrous year thus far.

Netflix currently lands a Zacks Rank #3 (Hold). It will be important to see if the optimism about the company’s potential to capitalize on ad revenue comes to fruition in its outlook. If management can pinpoint the reemergence of growth, the stock could rebound.

The average Zacks Price Target offers 19% upside from current levels and patient investors could be rewarded for holding the stock.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.