Plus, another 24 stocks to avoid despite a stellar start to 2023

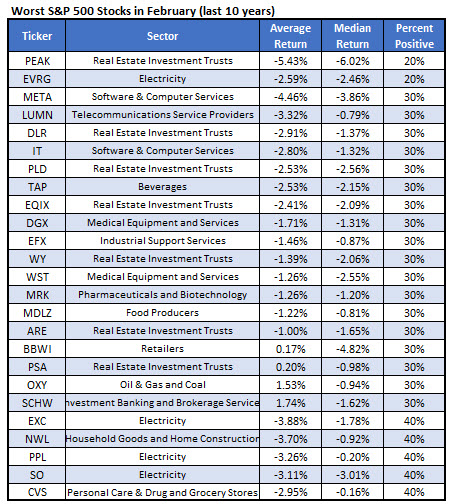

Schaeffer’s Senior Quantitative Analyst Rocky White has pulled a list of the 25 worst S&P 500 Index (SPX) names to own in February, including Molson Coors Beverage Co (NYSE:TAP). According to White’s study, TAP averaged a -2.5% return during the past 10 years, and managed to score a monthly win just three times.

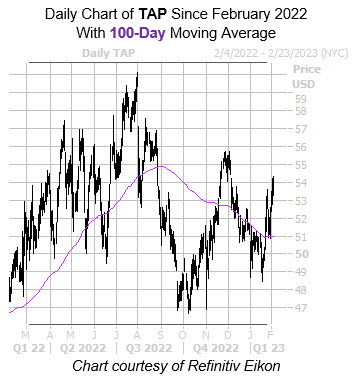

Molson Coors Beverage stock is clinging to a 9.3% year-over-year lead, and has just bounced off support at the 100-day moving average. The $56 level kept a lid on TAP’s December rally attempt, though, which still was far away from its 2022 peak of $60.12.

Options traders are remain overwhelmingly bullish toward the beverage stock. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), TAP’s 50-day call/put volume ratio of 5.29 sits higher than all annual readings. Should some of this pessimism start to unwind, TAP could tumble even lower.

Image and article originally from www.schaeffersresearch.com. Read the original article here.