The Zacks Retail and Wholesale sector has underperformed the S&P 500 by a fair margin in 2022, down roughly 26%.

Image Source: Zacks Investment Research

One company residing in the sector, McDonald’s MCD, is on deck to report quarterly results before the market open on October 27th.

We’re all familiar with the fast-food chain and see those golden arches at seemingly every stop.

Currently, the fast-food titan carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a D.

How does everything else stack up? Let’s find out.

Share Performance & Valuation

McDonald’s shares have been a bright spot in an otherwise dim market in 2022, down roughly 3% and easily outperforming the S&P 500.

Image Source: Zacks Investment Research

Over the last three months, shares have continued on their market-beating trajectory, up a marginal 0.2% vs. the S&P 500’s decline of 2.7%.

Image Source: Zacks Investment Research

The company’s valuation multiples could be seen as a bit stretched, with its 26.1X forward earnings multiple sitting above its 25.5X five-year median and reflecting a 10% premium relative to the Zacks Retail and Wholesale sector.

Image Source: Zacks Investment Research

MCD carries a Value Style Score of a D.

Quarterly Estimates

Over the last several months, five downwards earnings estimate revisions have come in, with the Zacks Consensus Trend pulling back marginally. The Zacks Consensus EPS Estimate of $2.57 suggests a Y/Y earnings decline of roughly 6.8%.

Image Source: Zacks Investment Research

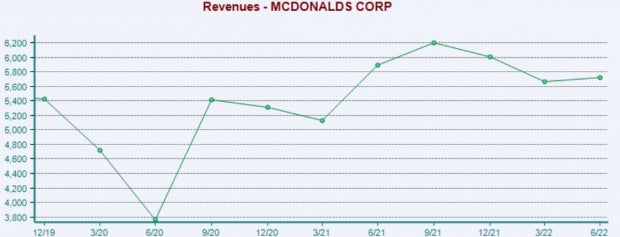

Further, the Zacks Consensus Sales Estimate of $5.7 billion indicates an 8% decline from year-ago quarterly revenue of $6.2 billion.

Quarterly Performance & Market Reactions

McDonald’s has primarily exceeded earnings estimates, beating the Zacks Consensus EPS Estimate by an average of 4.4% over its last four quarters. In its latest print, the company penciled in a 4% bottom-line beat.

Revenue results have been mixed across its last four prints, with the company exceeding the Zacks Consensus Sales Estimate twice during the timeframe. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Additionally, it’s worth noting that the market has liked what it’s seen from the company’s results as of late, with shares moving upward following each of its last four prints.

Putting Everything Together

McDonald’s shares have been relatively strong in 2022, outperforming the general market across several timeframes.

Valuation levels could be seen as a bit stretched, with the company’s forward earnings multiple sitting above its five-year median and Zacks sector average.

Analysts have been bearish in their earnings outlook, with estimates suggesting a Y/Y decline in earnings and revenue.

Further, the company has consistently beaten earnings expectations as of late, but revenue results have been mixed across its last four.

Heading into the release, McDonald’s MCD carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of -1.3%.

Just Released: Zacks Unveils the Top 5 EV Stocks for 2022

For several months now, electric vehicles have been disrupting the $82 billion automotive industry. And that disruption is only getting bigger thanks to sky-high gas prices. Even titans in the financial industry including George Soros, Jeff Bezos, and Ray Dalio have invested in this unstoppable wave. You don’t want to be sitting on your hands while EV stocks break out and climb to new highs. In a new free report, Zacks is revealing the top 5 EV stocks for investors. Next year, don’t look back on today wishing you had taken advantage of this opportunity.>>Send me my free report revealing the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald’s Corporation (MCD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.