Today’s episode of Full Court Finance at Zacks dive into where the stock market sits as big tech results continue to flood the market. Amid all of the recent reports from Apple, Amazon, and others, let’s explore two highly-ranked technology stocks trading at attractive valuations that offer investors long-term growth opportunities.

The Nasdaq and the S&P 500 posted big declines in the middle of the week as Wall Street digested the Fitch downgrade of U.S. government debt and a ton of other news. Meanwhile, 10-year U.S. Treasury yields have rebounded as investors price in the likelihood of higher rates for longer as the Fed attempts to bring inflation down to its 2% target amid a persistently strong economy.

The July jobs report that dropped Friday morning showed the U.S. added 187K jobs last month vs. the 200K estimate and June’s 209K. Unemployment also slipped back down to 3.5%. Beyond of the jobs market, Wall Street is engrossed with earnings and reports from Apple and other market movers.

Image Source: Zacks Investment Research

The S&P 500 and the Nasdaq slipped below their 21-day moving averages earlier this week. Despite the possibility of more near-term volatility and selling throughout earnings season, the bulls are attempting to remain firmly in control—trying to hold that 21-day line.

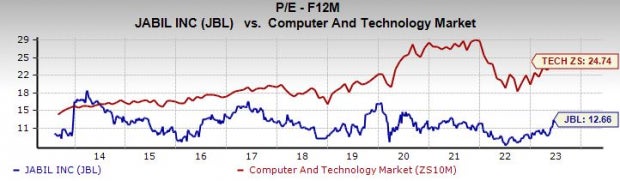

Jabil (JBL)

Jabil is a tech-focused manufacturing services giant that works with the likes of Apple (AAPL) and other leaders across consumer tech, health care, energy and beyond. The company’s global scope and highly diversified customer base helped JBL grow steadily over the years. Jabil posted 12% average revenue expansion between FY18 and FY22, including 14% sales growth in its fiscal 2022.

Image Source: Zacks Investment Research

The manufacturing solutions provider topped our Q3 FY23 estimates in mid-June and provided upbeat guidance that helps it land a Zacks Rank #2 (Buy) right now. JBL’s recent positivity is part of long-term upward earnings momentum for the stock. Zacks estimates call for JBL’s revenue to climb again in FY23 and FY24 to help boost its adjusted earnings by 11% and 9%, respectively.

Jabil is part of Zacks Electronics – Manufacturing Services industry that ranks in the top 2% of over 250 Zacks industries. JBL’s 4% dividend payout ratio (0.3% yield) offers huge long-term upside, and five out of the six brokerage recommendations Zacks has are “Strong Buys.” On top of that, Jabil is poised to grow alongside the wider world of intricate and complex manufacturing for tech and beyond. Plus, JBL could be a long-term winner amid the onshoring/reshoring push in the U.S.

Image Source: Zacks Investment Research

Shares of JBL have climbed 360% during the last 10 years vs. the Zacks tech sector’s 260%, including a 285% run in the past five years. Jabil is up 60% YTD and trades around 5% below its recent records and solidly above its 50-day moving average. Despite its recent and long-term outperformance, Jabil trades at a 50% discount to the Zacks Tech sector at 12.7X forward 12-month earnings and 31% below its own decade-long highs.

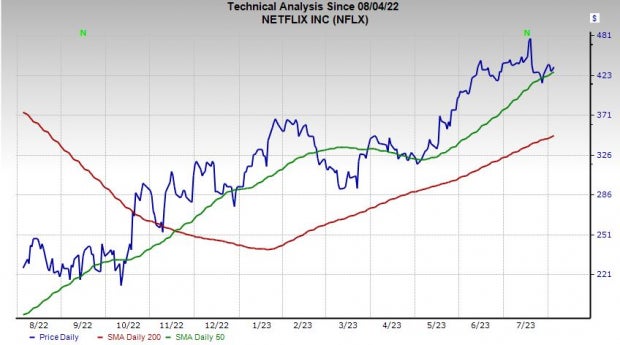

Netflix (NFLX)

Netflix shares skyrocketed 160% off their 2022 lows as investors decided it was time to buy into the beaten-down tech giant as it started to act and trade more like an established industry leader and not a rapid expansion engine. Despite the comeback and its 45% YTD climb, NFLX still trades over 35% below its peaks. And it recently found support at its 50-day moving average.

Image Source: Zacks Investment Research

On the valuation front, Netflix trades at a 60% discount to its 10-year median at 30.7X forward earnings—and nearly 95% below its highs. Netflix is now trading at levels it was at in 2010 and more closely in line with the wider Zacks Tech sector. In fact, Netflix is trading at a PEG ratio, which factors in its growth outlook, of 1.2 vs. Tech’s 2.0 and at a 36% discount to its own five-year median.

Netflix was the streaming TV pioneer that helped permanently change the way people consume TV and movies. NFLX’s head start and growing content library has seen it maintain an edge over Disney, Apple, Amazon, and countless other streamers. NFLX beat our Q2 earnings and sales estimate on July 19 on the back of a nice user gain that saw it hit 238 million paid memberships, up 8% from the year-ago period.

Image Source: Zacks Investment Research

The natural slowdown in Netflix’s growth propelled it to roll out a lower-cost ad-based tier, set up paid sharing features, and explore new growth areas. NFLX’s recent upward EPS revisions help it land a Zacks Rank #1 (Strong Buy), with it projected to post 20% adjusted earnings growth in FY23 and 32% stronger earnings next year on 7% and 13% higher sales, respectively.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to “insane levels,” and they’re likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Apple Inc. (AAPL) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.