The Zacks Aerospace sector has displayed remarkable resiliency in 2022, down roughly 9% and easily outperforming the S&P 500.

An absolute titan in the sector, Lockheed Martin Corp. LMT, is on deck to unveil quarterly results on October 18th before the market open.

Lockheed Martin is the largest defense contractor in the world. The company’s main focus areas are defense, space, intelligence, homeland security, information technology, and cyber security.

Currently, the company carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of an A.

How does the defense titan shape up heading into its print? Let’s take a closer look.

Share Performance & Valuation

LMT shares have been notably strong in 2022, up a double-digit 12% and crushing the general market’s performance.

Image Source: Zacks Investment Research

Over the last three months, shares have continued on their market-beating trajectory, down 1.6% vs. the S&P 500’s 4.7% decline.

Image Source: Zacks Investment Research

The strong price action of LMT shares indicates that buyers have defended the stock much higher than most, undoubtedly a positive in a historically volatile 2022.

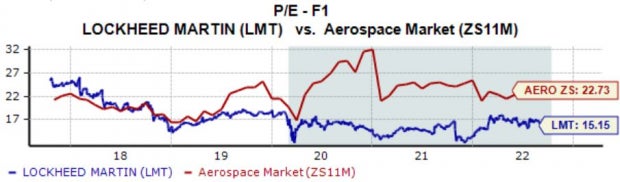

Further, LMT shares trade at solid valuation levels, with its 15.2X forward earnings multiple sitting below its five-year median and reflecting a sizable 33% discount relative to its Zacks Aerospace sector.

Image Source: Zacks Investment Research

The company sports a Style Score of a B for Value.

Quarterly Estimates

A singular analyst has lowered their quarterly outlook over the last several months, with the Consensus Estimate Trend slipping marginally. The Zacks Consensus EPS Estimate of $6.60 suggests a slight Y/Y decline of 0.9%.

Image Source: Zacks Investment Research

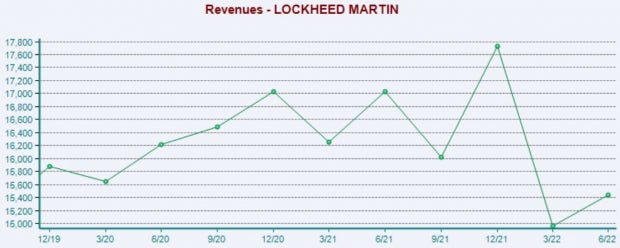

Still, LMT’s top-line appears to be in better shape; the Zacks Consensus Sales Estimate of $16.8 billion suggests Y/Y revenue growth of a solid 5%.

Quarterly Performance & Market Reactions

LMT has been on a strong earnings streak, exceeding bottom-line estimates in six consecutive quarters. Just in its latest print, the defense titan posted a solid double-digit 14.4% EPS beat.

However, revenue has come in under expectations in two consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Further, the market has had mixed reactions in response to the company’s quarterly prints as of late, with shares moving downwards twice and upwards twice following its last four earnings releases.

Putting Everything Together

LMT shares have been notably strong in 2022, outperforming the general market across several timeframes.

Valuation levels appear sound, with the company’s forward P/E ratio sitting below its five-year median and Zacks sector.

One analyst has lowered their earnings outlook for the quarter, with estimates indicating a marginal Y/Y decline in earnings but a solid uptick in revenue.

Additionally, LMT has consistently beaten bottom-line estimates, but revenue results have come in under expectations for two consecutive quarters.

Heading into the print, Lockheed Martin LMT carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 1.4%.

FREE Report: The Metaverse is Exploding! Don’t You Want to Cash In?

Rising gas prices. The war in Ukraine. America’s recession. Inflation. It’s no wonder why the metaverse is so popular and growing every day. Becoming Spider Man and fighting Darth Vader is infinitely more appealing than spending over $5 per gallon at the pump. And that appeal is why the metaverse can provide such massive gains for investors. But do you know where to look? Do you know which metaverse stocks to buy and which to avoid? In a new FREE report from Zacks’ leading stock specialist, we reveal how you could profit from the internet’s next evolution. Even though the popularity of the metaverse is spreading like wildfire, investors like you can still get in on the ground floor and cash in. Don’t miss your chance to get your piece of this innovative $30 trillion opportunity – FREE.>>Yes, I want to know the top metaverse stocks for 2022>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.