Investors love few things more than consistent, reliable dividend payouts.

After all, who doesn’t love the thrill of getting paid?

And the feeling is even sweeter when the paydays come from your investments.

In a highly-volatile 2022, dividends have quickly become a prized item for investors, helping to cushion the impact of drawdowns in other positions and providing a passive income stream.

When seeking dividend-paying stocks, many turn to the Dividend Aristocrats.

Dividend Aristocrats have consistently paid and increased their dividends for a minimum of 25 consecutive years, putting their dedication to shareholders on full display.

Three members of the elite group – Caterpillar CAT, Archer Daniels Midland ADM, and General Dynamics GD – could all be of interest to those looking for reliable dividend payouts.

The chart below illustrates the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, on top of rewarding their shareholders handsomely, all three stocks have handily outperformed the S&P 500 year-to-date, indicating positive momentum. Let’s take a closer look at each one.

Caterpillar

Caterpillar is the world’s largest construction-equipment manufacturer. The company designs, develops, engineers, manufactures, markets, and sells machinery, engines, financial products, and insurance to customers.

The company’s earnings outlook has turned bright over the last several months, landing CAT into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

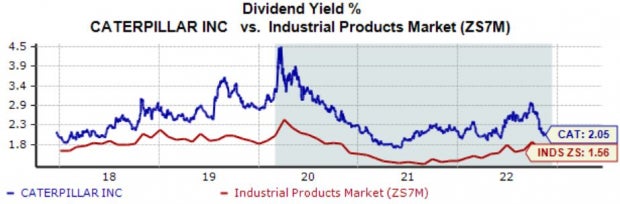

Caterpillar’s annual dividend currently yields a solid 2.1%, nicely above its Zacks Industrial Products sector average. In addition, the company’s payout has grown 9% over the last five years.

Image Source: Zacks Investment Research

Archer Daniels Midland

Archer Daniels Midland is one of the leading producers of food and beverage ingredients and goods made from various agricultural products.

Like CAT, Archer Daniels Midland has seen its near-term earnings outlook improve over the last several months, pushing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

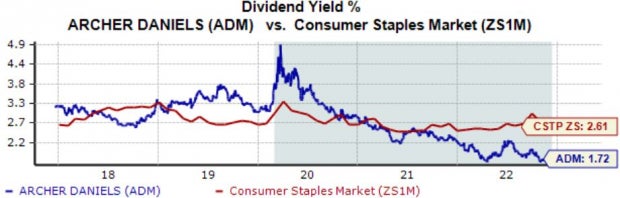

ADM’s annual dividend currently yields 1.7%, below its Zacks Consumer Staples sector average. Still, the company’s 4.1% five-year annualized dividend growth rate picks up the slack in a big way.

Image Source: Zacks Investment Research

General Dynamics

General Dynamics, an A&D company, engages in mission-critical information systems and technologies, land and expeditionary combat vehicles, armaments and munitions, shipbuilding and marine systems, and business aviation.

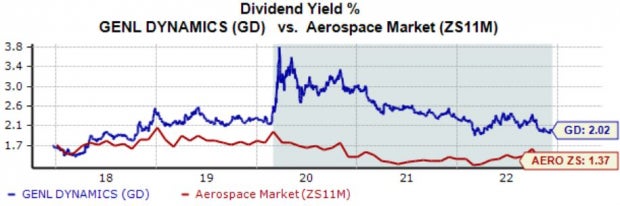

GD’s annual dividend yields a respectable 2%, visibly higher than its Zacks Aerospace sector average. Further, General Dynamics’ payout has grown by an impressive 8.7% over the last five years.

Image Source: Zacks Investment Research

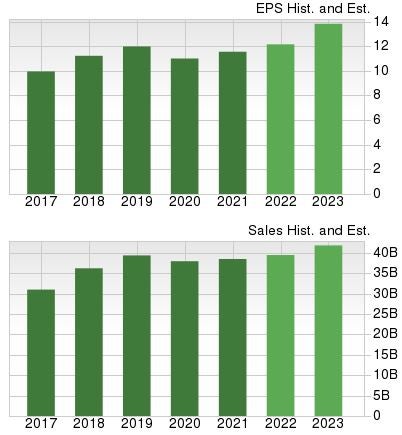

The company also sports a favorable growth profile; earnings are forecasted to climb more than 5% in its current fiscal year (FY22) and a further 15% in FY23.

The projected earnings growth comes on top of forecasted Y/Y revenue increases of 2.1% in FY22 and 7.4% in FY23.

Image Source: Zacks Investment Research

Bottom Line

Dividend Aristocrats are top-tier investments for those focusing on income, as these companies have successfully upped their dividend payouts for a minimum of 25 consecutive years.

Since these companies have been able to up their dividend payouts for such an extended period of time, it’s more than valid to expect them to continue this trajectory.

Of course, it goes without saying that investors have cherished dividends in a historically-volatile 2022.

For income-focused investors, all three stocks above – Caterpillar CAT, Archer Daniels Midland ADM, and General Dynamics GD – are worthy considerations.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention.

General Dynamics Corporation (GD) : Free Stock Analysis Report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.