Georgijevic

With the broader market (SPY) struggling, moving down in market capitalization (IWM) makes sense, Jefferies says.

“We feel today is much like ’99/00 in which we saw sharp declines and rallies by Growth,” strategist Steven DeSanctis wrote in a note. “Value has lagged since June 16, now cheaper than Growth with model in 35th percentile; relative performance follows 2-year, higher supports Value.”

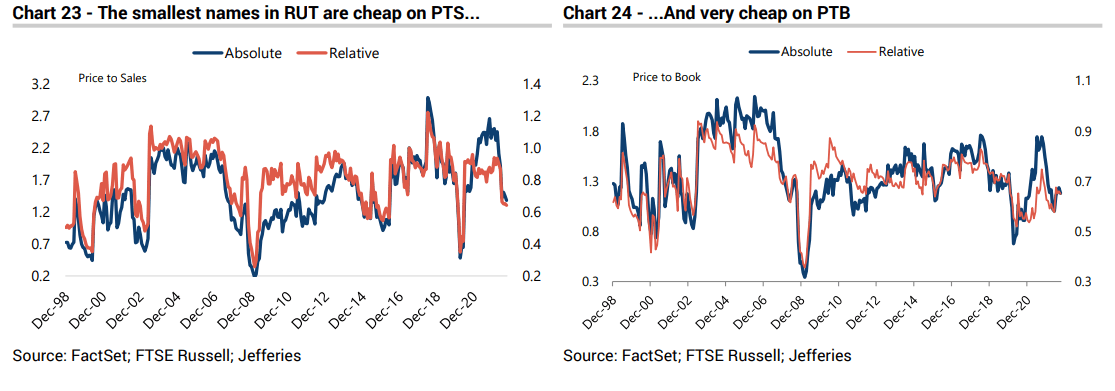

“We feel like more interest in small these days with 47% passive ownership, inflows will boost smaller names, mgrs need to get down cap,” DeSanctis said.

“We help by looking for liquid names that trade like smaller caps stocks, found 14 ideas.”

Those stocks are:

- Tapestry (NYSE:TPR)

- LKQ (LKQ)

- Wyndham Hotels (WH)

- Gentex (GNTX)

- Wintrust (WTFC)

- Capital One (COF)

- Zions Banc (ZION)

- Arch Capital (ACGL)

- Dentsply (XRAY)

- Textron (TXT)

- Cummins (CMI)

- Juniper Networks (JNPR)

- FMC (FMC)

- Berry Global (BERY)

See why BofA still likes the look of small-cap stocks despite outflows.

Image and article originally from seekingalpha.com. Read the original article here.