Best Buy BBY and CVS CVS are two retail giants that value investors may have their eyes on with both stocks rebounding of late but still closer to their 52-week lows.

Similarly, Best Buy and CVS stock both trade around $70 a share at the moment with solid dividends and sizable top and bottom lines. However, neither has participated in the sharp rebound among broader indexes this year largely attributed to fears of slowing growth.

With that being said, Best Buy and CVS stock continue to stand out in terms of value and it’s worth having the conversation of if now is a good time to buy.

Image Source: Zacks Investment Research

Strong Value

Starting with the case of valuation, Best Buy and CVS stock each have an “A” Zacks Style Scores grade for Value. To that point, CVS shares trade at just 8.2X forward earnings with BBY at an 11.3X forward earnings multiple.

Attractively beneath the S&P 500”s 20.4X, CVS stock trades 62% below its decade-long high of 21.8X and at a 29% discount to the median of 11.6X. Best Buy shares trade 43% below its own decade-long-high of 19.8X and offer a 13% discount to the median of 13X.

Image Source: Zacks Investment Research

In terms of price to sales, Best Buy and CVS have a P/S ratio of 0.3X and 0.2X respectively which is intriguingly below the optimum level of less than 2X and the benchmark’s 3.7X.

Image Source: Zacks Investment Research

Examining Growth Concerns

Despite weaker demand for electronics and appliances, Best Buy’s stock currently has an “A” Style Scores grade for Growth as the company has been able to sustain its bottom line despite slowing sales.

Fears of such may be overdone, with Best Buy’s annual earnings forecasted to dip -12% in its current fiscal 2024 but rebound and rise 10% in FY25 to $6.83 per share. Total sales are projected to be down -4% in FY24 and be virtually flat in FY25 at $43.97 billion.

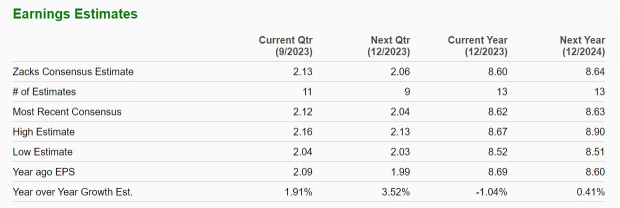

Image Source: Zacks Investment Research

With a “C” Style Scores grade for Growth, the price performance woes of CVS stock have been attributed to the company losing some of its business as a pharmacy benefit manager to companies like Blue Shield which has looked to other providers such as Amazon AMZN. ‘

CVS’ annual earnings are now expected to dip -1% in FY23 and be virtually flat in FY24 at $8.64 per share. Total sales are projected to rise 9% this year but drop -3% in FY24 to $341.59 billion.

Image Source: Zacks Investment Research

Generous Dividends

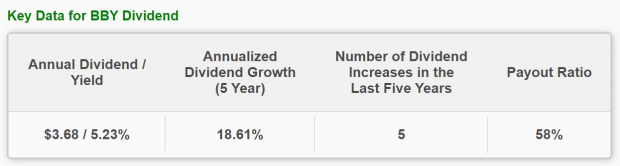

Income seekers may look at this year’s drop in Best Buy and CVS stock as an opportunity. To their delight, Best Buy’s annualized dividend growth over the last five years is over 18% with a current yield of 5.23%.

Image Source: Zacks Investment Research

CVS has increased its dividend by 4% over the last five years with a current yield of 3.41% which remains well above the S&P 500’s 1.47% average.

Image Source: Zacks Investment Research

Bottom Line

When it comes to value investing, Best Buy and CVS stock should certainly be on investors’ radars. For now, both stocks land a Zacks Rank #3 (Hold) as there could be better buying opportunities but they may reward patient investors at current levels considering their generous dividends.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

CVS Health Corporation (CVS) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.