After several challenging quarters, the set up for cloud stocks is significantly more favorable in 2H23. While flight-to-safety is providing support for the mega-cap stocks, the valuation gap is becoming difficult to ignore.

Contents

- Takeaways from earnings reports: AWS, Azure, GCP

- Positioning for 2H – easy comps and AI tailwinds

- Mid-caps lagging mega caps creating outsized opportunities

Cloud data-points from earnings – not getting worse

While earnings from the hyperscalers did not meaningfully surprise to the upside, any incremental positive commentary resulted in outsized reactions. Microsoft reported the strongest results, while GCP and AWS were in-line to disappointing. The most important takeaway echoed by all companies was that cloud optimization trends are not getting better, but also are not getting worse. This is important as we believe that in order to find the bottom during downturns, it is all about focusing on the second derivative. This comment signaled a bottom.

- Microsoft’s Azure grew 31% on a ~$60bn base. The company guided to 26-27% growth with 1% coming directly from AI. While this may not seem like a lot, it is roughly >$400mm run-rate for AI services, a strong starting point. The interesting commentary that came out of the earnings call is that while companies are still optimizing spend, Microsoft is starting to see new workloads pick up in areas that they have not seen before (life-sciences etc.). Moreover, management made a comment that while optimization is expected to continue, “at some point workloads can not be optimized any further”.

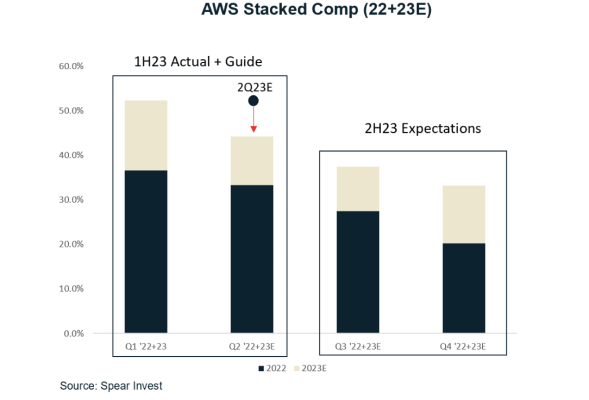

- Amazon’s AWS revenue grew 16% on a ~$85bn base (vs. the guide for mid-teens). While this was interpreted as significantly positive at first, management noted that April is tracking towards 11% growth. Investors were already expecting a slower growth in 2Q23 vs.1Q23, but the magnitude of the delta was not well received.

- Google’s GCP grew 28% on a ~$30bn base and generated an operating profit in the quarter. Google is the smallest and least profitable from the three.

Overall, Microsoft results stood out as the company is now guiding to higher $ growth in 2Q23 vs. Amazon, if April trends were to persist through the quarter. The biggest takeaway was that while companies are expecting slower growth in 2Q23, the underlying trends (client optimizations) are not getting worse.

Easy comps short term; AI long term

While the down-trend in cloud spending growth over the past four quarters is easy to spot, what is not as obvious is the difference in set-up in 1H23 vs. 2H23. As we get into the second half of 2023, the comparables get significantly easier, especially in the fourth quarter, as this is when we observed the first sign of the slowdown.

While we expect easy comps to set a floor for the cloud stocks, we believe we are the cusp of a major cloud spending wave. Three key points:

- While cloud bills are high, cloud is still more cost effective than on-premise for most use cases. In fact, one of the reason why we are going through a down-cycle is because customers have the ability to scale down their usage based on demand, rather than having to commit capital.

- We expect AI to be a catalyst for the next cloud spending cycle. Large AI Language Models are expensive to train. Access and flexibility will be paramount. Outside of a select group of mega-caps that are likely to train their own models, most companies will be leveraging the hyperscalers. In fact, Nvidia is in the process of partnering with several cloud vendors to make their hardware available as a service.

- Significant runway ahead: 90%+ of global IT spend is still on premise, per Amazon’s CEO Andy Jassy (1Q23 earnings call), providing the company with confidence for the next cycle.

Mid-caps lagging mega-caps creating outsized opportunities

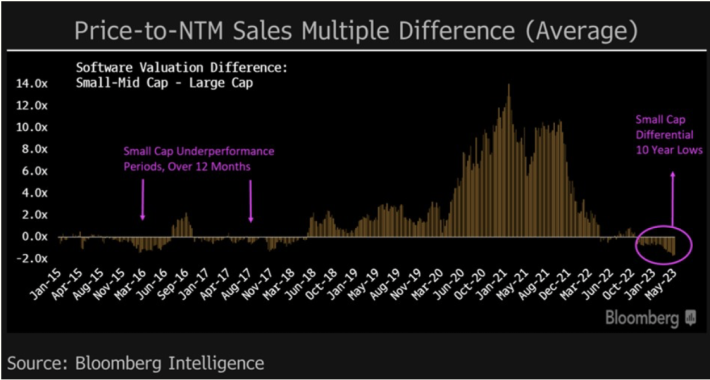

While “flight to safety” favors the mega-caps, the valuation gap is becoming too large to ignore. The multiple differential between small caps and large caps in the software space is now at a 10 year low.

Mid-cap companies such as Snowflake, Datadog, Cloudflare, and Zscaler generally grow revenues at a multiple of the hyperscalers’ growth.

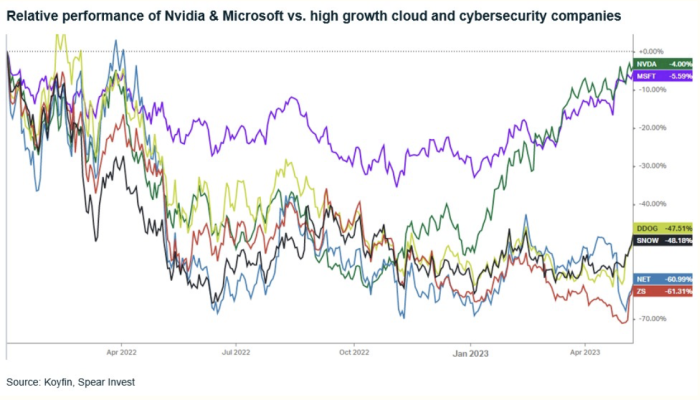

What stood out to us during this quarter is that while these mid-cap stocks have been getting hard hit (down ~50-60% since Jan/22) diverging in performance from the hyperscalers/semis, the gap in fundamentals is not widening. Generally, a company like Datadog historically has grown 2x the AWS growth rate. In the most recent quarter, the company guided to 2Q23 growth of 23% at the mid-point vs. AWS at 11%, implying that the gap is, at the minimum, staying constant.

What is especially appealing for fundamental investors is that these mid-cap companies have proven business models (already generating $1 billion in revenues) and maintain positive free cash flow. Their growth and volatility profiles resemble a company like Nvidia, with the primary distinction being that Nvidia is “early-cycle.” Consequently, while we still expect strong performance from Nvidia, the gap could significantly narrow over time.

For more research visit spear-invest.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.