An abundance of tech companies are showing signs of increased profitability amid easing inflation and investors might be wondering if social media operators will continue to benefit as well.

Meta Platforms META certainly comes to mind and Pinterest PINS and Snapchat formally known as Snap SNAP are worthy of this conversation as well. Let’s see if now is a good time to buy these social media stocks going into 2024.

Recent Performance Overview

Renowned for one of the world’s most popular social media platforms in Facebook, Meta Platform’s stock has spiked +195% in 2023 to help yield the strong performance of the Nasdaq this year.

Providing a visual recommendation platform where users can interact based on their tastes and interests, Pinterest’s stock has climbed +53% YTD with Snap shares soaring +87% as a mobile camera application that allows people to communicate through short videos and images called Snaps.

Image Source: Zacks Investment Research

Growth Trajectories

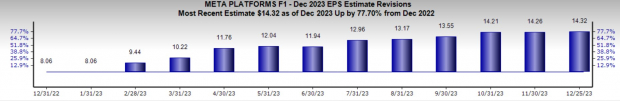

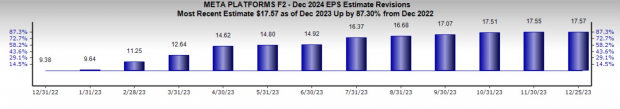

Social media platforms collect most of their revenue from advertising and ad spending has continued to bounce back upon easing inflation. No one has benefited more from the resurgence in ad spending than Meta Platforms, with the trend of earnings estimate revisions for both fiscal 2023 and FY24 rebounding and rising sharply over the last year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

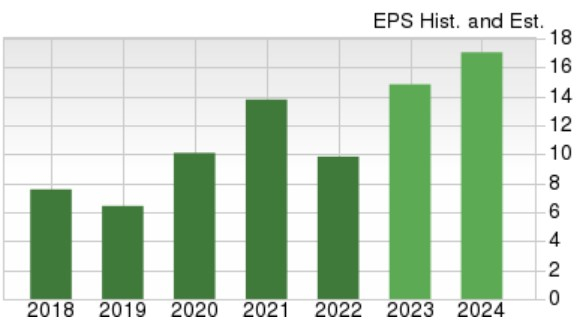

Rising EPS estiamtes have continued to propel Meta Platforms stock with annual earnings now projected to soar 45% this year and climb another 23% in FY24 to $17.57 per share.

Image Source: Zacks Investment Research

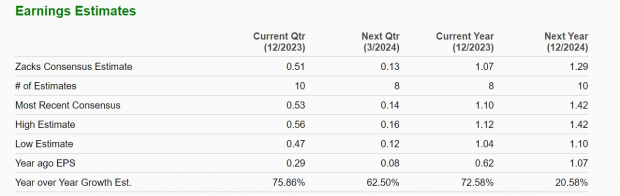

The growth and recovery of Pinterest and Snap’s bottom line continues to be compelling as well. To that point, Pinterest’s annual earnings are forecasted to more than double in FY23 at $1.07 per share versus $0.62 a share last year. Fiscal 2024 EPS is expected to expand another 20% to $1.29 per share. More importantly, over the last 60 days, FY23 and FY24 EPS estimates have risen 10% and 11% respectively.

Image Source: Zacks Investment Research

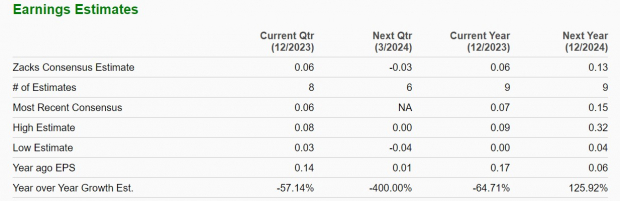

As for Snap, earnings are anticipated at $0.06 a share in FY23 compared to $0.17 a share last year but FY24 EPS is forecasted to rebound and soar 126% to $0.13 a share. Plus, FY23 and FY24 EPS estimates are slightly up over the last 30 days.

It’s also noteworthy that like Meta Platforms and Pinterest, Snap is expecting double-digit top line growth next year as well with sales forecasted to be up 13% in FY24 to $5.24 billion.

Image Source: Zacks Investment Research

Bottom Line

At the moment, Meta Platforms, Pinterest, and Snap’s stock all land a Zacks Rank #2 (Buy). Notably, each of these social media stocks has an “A” Zacks Style Scores grade for Growth as they continue to look like strong investments going into 2024.

Zacks Naming Top 10 Stocks for 2024

Want to be tipped off early to our 10 top picks for the entirety of 2024?

History suggests their performance could be sensational.

From 2012 (when our Director of Research, Sheraz Mian assumed responsibility for the portfolio) through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2024. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>

Snap Inc. (SNAP) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.