The start of this week’s trading session was highlighted by WTI crude oil prices climbing another +1.53% today to $92.29 a barrel.

Investors may be wondering if it’s time to buy stock in oil conglomerates Chevron CVX and Exxon Mobil(XOM with more and more analysts seeing the possibility of crude prices topping $100 a barrel.

Let’s check the current outlook for Chevron and Exxon to see if now is indeed an opportune time to buy their stocks.

Image Source: Yahoo Finance

Highly Anticipated Third Quarter

There will be much anticipation for the third-quarter results from oil and energy companies with crude prices spiking over the last few months. Still a ways out, Chevron and Exxon are expected to release their Q3 reports in late October.

Despite the recent surge in oil prices Chevron and Exxon are expecting dips on their Q3 top and bottom lines as they face tougher to compete against periods.

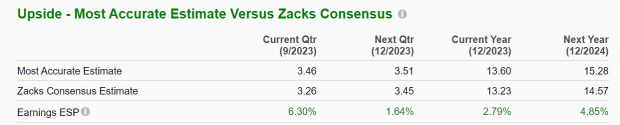

Chevron’s Q3 earnings are forecasted to be down -41% to $3.26 a share compared to EPS of $5.56 in Q3 2022. Sales are projected to dip -21% to $52.56 billion versus $66.64 billion a year ago. However, at the moment the Zacks Expected Surprise Prediction (ESP) does indicate Chevron could beat earnings expectations with the Most Accurate Estimate having Q3 EPS at $3.46 and 6% above the Zacks Consensus.

Image Source: Zacks Investment Research

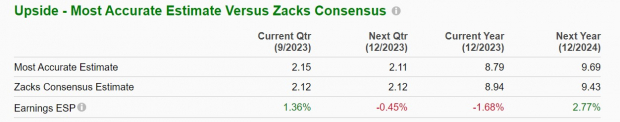

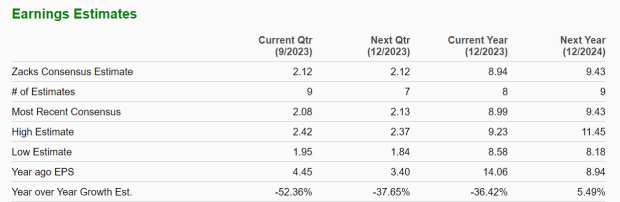

As for Exxon, its Q3 earnings are expected to drop -52% at $2.12 per share compared to EPS of $4.45 in the prior-year quarter. Exxon’s Q3 sales are prjoected at $85.60 billion, down -23% from $112.07 billion in Q3 2022.

With that being said, the Zacks ESP also indicates Exxon could top its third-quarter EPS estimates with the Most Accurate Estimate having Q3 earnings at $2.15 a share and 1% above the Zacks Consensus.

Image Source: Zacks Investment Research

EPS Outlook & Valuation

In regard to their annual outlook, Chevron’s fiscal 2023 EPS is now expected to dip -30% but rebound and rise 10% in FY24 to $14.57 per share. Chevron’s stock currently trades at 12.5X forward earnings which is not a stretched premium to the Zacks Oil and Gas-Integrated-International industry average of 9.3X and well below the S&P 500’s 20.8X.

Image Source: Zacks Investment Research

Pivoting to Exxon, annual earnings are expected to drop -36% this year but stabilize and rise 5% in FY24 at $9.43 a share. Exxon’s stock trades at a 13X forward earnings multiple which is also above the Oil and Gas-Integrated-International average but a nice discount to the benchmark.

Image Source: Zacks Investment Research

Performance Takeaway

Over the last three years, Exxon Mobil’s stock has skyrocketed +223% with Chevron shares up +119%. Both companies have rebounded well from the pandemic but Exxon’s stock is up a modest +6% this year and Chevron is down -6%.

For now, Chevron and Exxon’s stock land a Zacks Rank #3 (Hold). While their P/E valuations are reasonable and it may be enticing to buy stock in these oil giants with crude prices surging again, Chevron and Exxon’s Q3 reports may be critical to more upside after such impressive performances over the last few years.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution expands, investors have a chance to target huge gains. Millions of lithium batteries are being made & demand is expected to increase 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.