Merchants who open a merchant business account with Intergiro are to receive free banking services.

In an attempt to ease the squeeze of inflation, Intergiro is offering free banking services to merchants opening a merchant business account with the company.

This offering forms part of the Swedish business account provider and payment processor’s response to the ongoing economic crisis, and the increasing pressure on businesses to reduce their costs.

By providing free business banking services, Intergiro is seeking to help merchants save money and better navigate the challenging economic times.

“We understand that running a business can be tough, especially in times of economic instability,” Johan Ryer, CCO of Intergiro, recognises.

Ryer confirms the move as a business lifeline during “turbulent times of high prices and economic volatility.” The move, he explains is ultimately to “help merchants reduce the rising costs of doing business.”

New customers now have access to banking services free of charge through the Intergiro customer portal.

Same-day settlements

Additionally, merchants who open a merchant business account with Intergiro will soon benefit from same-day settlements (T+0). Same-day settlements guarantee access to funds and reduce the need for businesses to carry costly working capital.

Delays in settlement can have a negative impact on working capital. Delays can jeopardise a business’s ability to continue operating and require them to seek alternative sources of liquidity. However, rising interest rates are seeing this option becoming increasingly expensive.

“As we move into 2023, many businesses are finding it difficult to maintain a strong cash flow position,” continues Ryer.

“With supply chain issues, staff shortages and rising prices all putting pressure on operating costs, it’s more important than ever to carefully manage company finances,” he comments.

Ryer subsequently describes tackling delays between customer payments and the settlement of funds in these accounts as an “industry-wide priority.”

Adding to this, Nick Root, the company’s CEO, says “Our rapid settlements give merchants the ability to access their funds faster.” This he describes as a “huge advantage in today’s fast-paced business environment.”

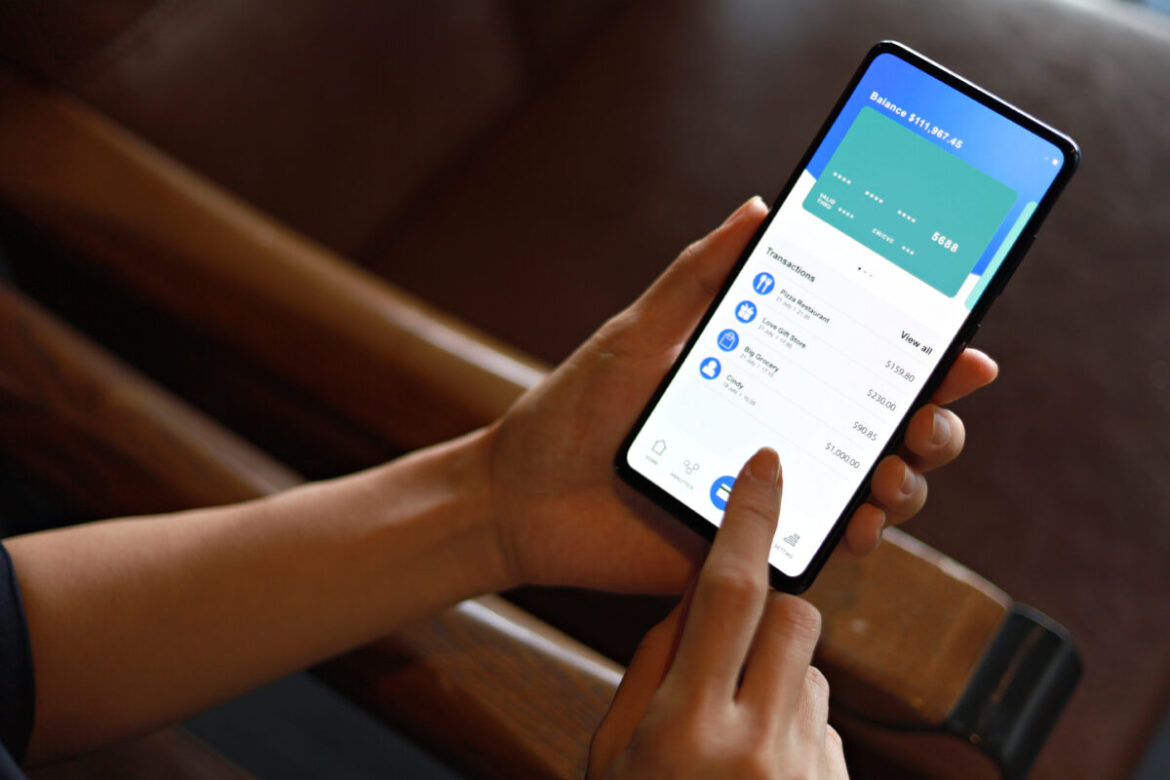

Intergiro’s free business banking services include a range of features such as online banking, mobile banking, physical and virtual cards, merchant accounts and integrated payment solutions.

The suite is tuned to help businesses save time and increase efficiency by enabling the unified management of both business and merchant accounts.

Image and article originally from thefintechtimes.com. Read the original article here.