As stocks continue to hover near the lows of the year, the question of whether we’ve hit a bottom for this bear market remains. A lot of damage has occurred, particularly in growth and technology stocks, as the Nasdaq has fallen over 33% from its November 2021 peak. Much has been discounted in the stock market in terms of the slowing growth that lies ahead.

Will we encounter heavy selling on outsized volume, marking a capitulation meltdown as we’ve seen at previous troughs, or will it be more of a quiet bottom and slow, gliding trend back upward?

The two big questions marks are inflation and the Fed. As we’ve seen with September’s inflation readings for both PPI and CPI, higher prices continue to linger despite the Fed’s thwarting attempts. However, certain inflation components appear to have peaked, potentially paving the way for the Fed to take its foot off the gas pedal.

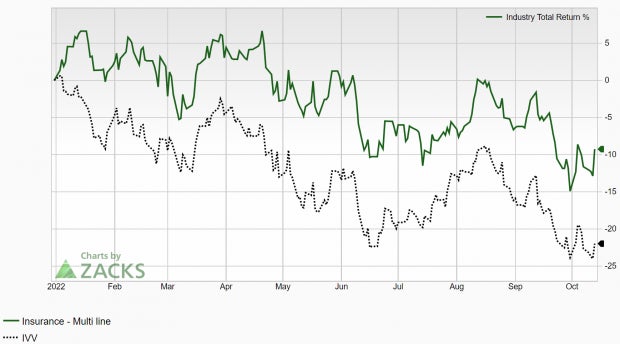

Despite a very difficult year for most stocks, we’ve seen pockets of strength in several different sectors such as energy and insurance. These pockets have illustrated resilience, and rather than succumb to higher inflation, they’ve actually benefitted from higher prices. We’re going to focus on the latter, which has held up very well this year.

The Zacks Insurance – Multi Line is ranked in the top 31% out of approximately 250 industry groups. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform the market over the next 3 to 6 months. We can see below that this group has outperformed the market this year at nearly every turn:

Image Source: Zacks Investment Research

Also note the favorable valuation characteristics for this industry:

Image Source: Zacks Investment Research

Let’s take a deeper look at a top-rated stock within this leading industry.

Cigna Corp. (CI)

Cigna provides insurance and related products and services in the United States. The company offers pharmacy, benefits management, care delivery, and intelligence solutions to health plans, employers, government organizations, and health care providers. CI distributes its products and services through insurance brokers and consultants, as well as directly to employers and other groups.

CI has exceeded earnings estimates in each of the past four quarters, with an average surprise of 10.74% over that timeframe. The insurance giant most recently reported Q2 EPS back in August of $6.22/share, a 14.34% beat over the $5.44 consensus estimate. Shares have bucked the trend this year, rising nearly 30% and showing relatively little volatility.

Image Source: StockCharts

What the Zacks Model Reveals

The Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity. The technique has proven to be very useful for finding positive earnings surprises. In fact, when combining a Zacks #3 rank or better and a positive earnings ESP, stocks produced a positive surprise 70% of the time.

Cigna’s ESP presently sits at +0.07%. As a Zacks Rank #2 (Buy) stock, it appears CI is yet again primed for another positive earnings surprise when the company reports Q3 earnings on November 3rd.

Make sure to put CI on your watchlist if you haven’t already done so.

Disclaimer: The Zacks Income Investor Service currently has a position in Cigna.

FREE Report: The Metaverse is Exploding! Don’t You Want to Cash In?

Rising gas prices. The war in Ukraine. America’s recession. Inflation. It’s no wonder why the metaverse is so popular and growing every day. Becoming Spider Man and fighting Darth Vader is infinitely more appealing than spending over $5 per gallon at the pump. And that appeal is why the metaverse can provide such massive gains for investors. But do you know where to look? Do you know which metaverse stocks to buy and which to avoid? In a new FREE report from Zacks’ leading stock specialist, we reveal how you could profit from the internet’s next evolution. Even though the popularity of the metaverse is spreading like wildfire, investors like you can still get in on the ground floor and cash in. Don’t miss your chance to get your piece of this innovative $30 trillion opportunity – FREE.>>Yes, I want to know the top metaverse stocks for 2022>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cigna Corporation (CI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.