The Zacks Computer and Technology sector has been hit hard in 2022 amid a Fed pivot to a hawkish nature, with geopolitical issues and lingering COVID-19 uncertainties also spoiling the fun.

A widely recognized company in the sector, International Business Machines IBM, is on deck to unveil quarterly results on October 19th after the market close.

International Business Machines has gradually evolved as a provider of cloud and data platforms, with its Red Hat acquisition strengthening its position in the hybrid cloud market.

Currently, the company carries a Zacks Rank #4 (Sell) paired with an overall VGM Score of a D.

How does everything else shape up heading into the report? Let’s take a closer look.

Share Performance & Valuation

Year-to-date, IBM shares have displayed stellar relative strength, declining roughly 5% and widely outperforming the S&P 500.

Image Source: Zacks Investment Research

Over the last three months, the picture remains the same; IBM shares have declined 4.8%, easily outperforming the general market’s decline of nearly 7%.

Image Source: Zacks Investment Research

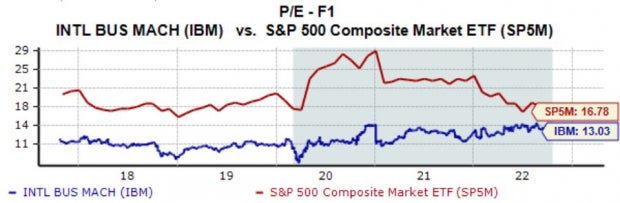

IBM shares trade at a 13.0X forward earnings multiple, reflecting a 22% discount relative to the S&P 500 but sitting above the five-year median of 11.1X.

Further, IBM carries a Style Score of a C for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

A singular analyst has lowered their earnings outlook for the quarter, with the Consensus Estimate Trend retracing marginally. The Zacks Consensus EPS Estimate of $1.78 suggests a Y/Y decline in earnings of roughly 30%.

Image Source: Zacks Investment Research

Revenues are expected to come in at $13.75 billion, reflecting a modest uptick from the revised year-ago quarter figure.

Quarterly Performance & Market Reactions

IBM has consistently exceeded earnings estimates, beating out the Zacks Consensus EPS Estimate in nine of its last ten quarters. Just in its latest print, the company penciled in a marginal 0.9% bottom-line beat.

Revenue results have also been primarily strong, with the company exceeding top-line estimates in six of its last ten quarters.

Further, the market has had mixed reactions in response to the company’s quarterly prints as of late, with shares moving downwards twice and upwards twice following its last four earnings releases.

Putting Everything Together

IBM shares have outperformed the general market across multiple timeframes in 2022, telling us buyers have defended them at a higher level than most.

The company’s valuation multiples may be considered a bit steep, with its forward P/E ratio sitting above its five-year median.

A singular analyst has lowered their earnings outlook for the quarter.

Further, the company has primarily exceeded quarterly estimates, with the market having mixed reactions following its last four prints.

Heading into the release, International Business Machines IBM carries a Zacks Rank #4 (Sell) with an Earnings ESP Score of -6.4%.

(NOTE: We are reissuing this article to correct a mistake. The original version, published on 10/18/2022, should no longer be relied upon.)

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.