Many stocks used the pandemic and the work from home trend as a springboard for outsized gains, and Block (SQ) was one of the main beneficiaries. Shares soared once the market absorbed the Covid shock, with the company’s Cash App gaining widespread adoption while stimulus checks rolled in. However, fast forward to the present day and the severity of the pullback since is on display; the stock is almost back to early pandemic levels.

With the company readying to present Q3 earnings at the start of next month, this is a point picked up by Jefferies analyst Trevor Williams, who thinks the retreat almost acts as a de-risking event.

“With continued underperformance since the 2Q print and valuation near the March ’20 trough, we believe the stock is more than discounting the bevvy of perceived risks (low-income consumer, SMBs, credit/ BNPL) that have weighed on sentiment,” Willams said. “We model in-line gross profit for 3Q, expect another modest cut to FY22 OpEx, and based on our modeling of Borrow and Interest Income, expect the Cash App update for October to imply upside to 4Q.”

Elsewhere, Williams doesn’t expect the Q3 print to offer any “major surprises” in either direction. The analyst believes Block’s business is “stronger” today than at the start of the pandemic with Cash App now ~50% of gross profit compared to 25% in 2019. Still, with sentiment so low, as noted above, SQ’s valuation is only a touch above the March 2020 lows. Additionally, Williams thinks that the risk posed by a recession next year is “much lower than what was feared during March ’20 lockdowns.”

So, what does this all mean for investors? Williams sticks with a Buy rating, although the price target does get a haircut and is reduced from $105 to $70. Nevertheless, there’s still upside of 25% from current levels. (To watch Williams’ track record, click here)

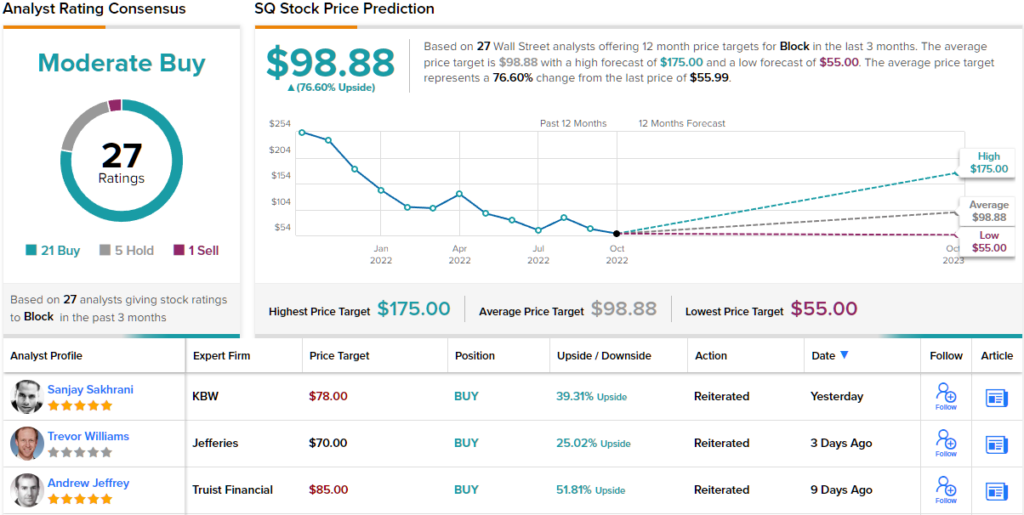

Overall, no fewer than 27 Wall Street analysts have weighed in on SQ stock, giving it 21 Buys, 5 Holds, and 1 Sell, for a Moderate Buy consensus rating. The average price target is higher than Williams will allow; at $98.88, the figure makes room for 12-month gains of ~77%. (See SQ stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.