China, with the second-largest economy in the world, has taken the spotlight on the world stage; outshining the rest as takes the lead for digital payments and enabling wider digital transformation.

It was not too long ago that China’s economy was often regarded as lagging behind and creating ‘cheaper’ products. However, with its population of over 1.4 billion, its economic development and transformation have enabled it to invest heavily in research and development, foster entrepreneurship and attract foreign direct investment (FDI). As a result, it now leads the way for innovation, technology and adoption.

This has been particularly noticeable in the wider tech space, with leading giants such as BiteDance (the owners of TikTok) and Alibaba Group. Regarding fintech specifically, China has led the way compared to other regions across the globe when considering innovation and adoption of digital payments.

How did China get to being a leader in digital payments?

China Was Already Active and Ambitious Before the Pandemic With Digital Payments

Unlike much of the West, payment methods moved from cash to credit cards. Now, across many parts of the globe, we are witnessing a shift towards mobile payments. One reason why China has seen recent success may be partly down to the fact that China largely skipped the concept of credit cards – which are not as prevalent as in the United States or throughout Europe.

The rise of the Chinese economy and its growing middle class coupled with the boost of technology enabled significant growth for its tech sector. Rising disposable income, a growing middle class and enhanced digitalisation (particularly the rise of e-commerce) saw over 80 per cent of all payments made via mobile payment methods by 2018.

By the end of the same year, over 40 per cent of all global e-commerce transactions took place in China; as it conducted 11 times the number of mobile payments as in the United States, per year.

According to EY’s 2019 Fintech Adoption Index, the adoption rate of consumer fintech in China reached 87 per cent – meaning that percentage of China’s digitally active population used at least one fintech service.

The Pandemic Further Accelerated it

The pandemic led to an increased use of digital payments across the world. In China, 100 million adults made their first digital merchant payments after the start of the pandemic, the World Bank revealed.

China implemented some of the world’s strictest COVID measures, some of which lasted until the start of this year. These measures saw digital and contactless experiences flourish and adoption significantly accelerated. QR codes especially shone in terms of providing an effective contactless solution for health check-ins and payments.

By 2021, China saw 89 per cent of adults financially included (meaning having access to at least one bank account). Meanwhile, 82 per cent of adults used these bank accounts to make digital payments.

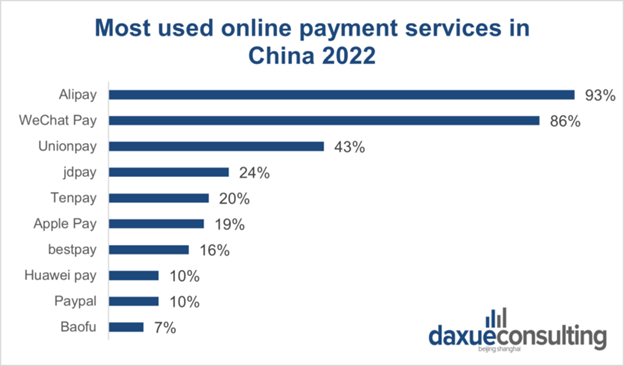

To put this success into perspective, only an average of 59 per cent of adults had an account in other countries in East Asia (while 23 per cent made digital payments). WeChat Pay and Alipay continued to dominate the Chinese digital payments market in 2021 – accounting for 91 per cent of all digital payments.

The Future Looks Ambitious for China

While China eased Covid restrictions at the start of the year, digital payments have continued to thrive. Significant economic development in China has enabled the government to ensure global competitiveness.

For instance, the country launched its 2022-2025 Fintech Development Plan, in which China aims to create a “digitalised, intelligent, green, and fair” fintech sector. Eight main tasks have been set by the plan – including building new digital infrastructure and improving fintech governance.

And let us not forget China’s efforts outside of China – for instance, its Digital Silk Road (DSR) initiative, aims to promote its digital expertise beyond its borders. Launched in 2015, the DSR has become a key digital policy of Beijing to promote its digital vision through technologies.

While the likes of Huawei and TikTok make headlines across the globe, China has been able to successfully promote technological inclusion and digital payments beyond its own borders. China sees not just digital payments but wider fintech as a whole playing a strong role in its economic development and growth.

China plans for its strengths in digital payments and the wider fintech scene to close socio-economic gaps within its own borders, as well as spread its know-how beyond China.

Image and article originally from thefintechtimes.com. Read the original article here.