Home Depot HD reported earnings on Tuesday, and it was immediately clear that there had been a slowdown in spending at the home improvement retailer. Sales came in -3% below estimates, which was the biggest revenue miss in recent history. Earnings were able to beat expectations, however they still showed a -6% YoY decline.

Year of Moderation

CEO Ted Decker described the business’ recent performance aptly:

“After a three-year period of unprecedented growth for our sector, during which we grew sales by over $47 billion, we expected that fiscal 2023 would be a year of moderation for the home improvement market. Our sales for the quarter were below our expectations primarily driven by lumber deflation and unfavorable weather… We also observed more broad-based pressure across the business compared to when we reported fourth quarter results a few months ago.”

Suspicions that the post-Covid boom pulled forward a considerable amount of consumer spending can be confirmed by Home Depot’s earnings results. Of course, the big question is how much further will spending contract?

Earnings estimates have been downgraded across the board over the last two months and HD currently holds a Zacks Rank #4 (Sell). But, while there may be further murkiness in Home Depot’s earnings expectations, there are some reassuring datapoints that the worst may be near.

Image Source: Zacks Investment Research

Recovery in Homebuilder Sector

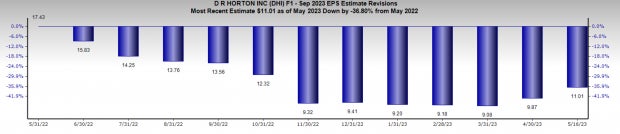

The homebuilding sector looks like it may have seen the lows in earnings expectations. D.R. Horton DHI has seen earnings estimates revised higher since bottoming at the end of 2022. Additionally, the homebuilder sector is one of the strongest industries in the market, currently sitting in the top 2% of the Zacks Industry Rank. Furthermore, share prices of DHI are pushing all-time highs, while the rest of the sector is putting up similar returns.

This improvement in earnings expectations for the homebuilder sector may be a good omen for Home Depot. It is possible that homebuilding companies may be a leading indicator for construction spending, meaning HD could see a jump in sales in the coming months.

Image Source: Zacks Investment Research

The image below shows that earnings estimates for HD are still pushing the lows. But, while HD and DHI are in adjacent sectors, the slight discrepancy in customers and their purposes could explain the disparity in performance and expectations.

Many HD customers are making home improvements, which is a decidedly discretionary expense. Alternatively, homebuilders are building new homes, and with the structural tightness in housing supply, may be benefitting from that fundamental difference.

Image Source: Zacks Investment Research

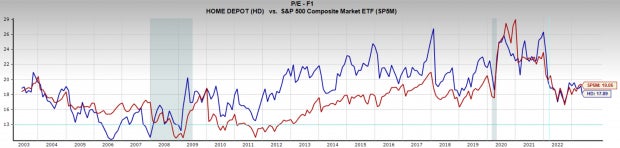

Valuation

Home Depot is trading at a one-year forward earnings multiple of 17.9x, which is below the market average of 19x, and below its 20-year median of 18.6x. While HD has rarely traded below the market average in terms of multiples in the last decade, you can see leading up to the financial crisis it did. So, while it is somewhat reassuring to see HD with a below average valuation, it shouldn’t be used to try and time a bottom.

Image Source: Zacks Investment Research

Technical Perspective

The technical chart pattern on Home Depot is somewhat reassuring. Below, we can see HD has traded down to a significant level of support. The $265-$280 level was held two times last year, and now following the poor earnings report it has actually reversed off this level again.

HD bears would expect this weak earnings report to send the stock through this level of support, but surprisingly, buyers have stepped up.

Image Source: TradingView

Bottom Line

The trade setup on HD is currently quite murky. While there are some reassuring variables the fundamental picture leans bearish. Particularly if the economy rolls over later this year, and goes into a recession, investors should expect HD earnings to continue the trend lower.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

The Home Depot, Inc. (HD) : Free Stock Analysis Report

D.R. Horton, Inc. (DHI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.