The Zacks Consumer Staples sector has fared better than most in 2022, down roughly 9% and widely outperforming the general market.

Companies in the sector have the advantageous ability to generate revenue in the face of many economic situations, helping explain why it’s been a brighter spot in a dim market.

A big-time name in the realm, The Hershey Company HSY, is on deck to unveil Q3 earnings on November 4th, before the market open.

The Hershey Company is the largest chocolate manufacturer in North America and a global leader in chocolate and non-chocolate confectionery.

Currently, the company carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a B.

Let’s take a deeper dive into how it currently stacks up.

Share Performance & Valuation

HSY shares have been visibly strong in 2022, up more than 20% and crushing the S&P 500’s performance.

Image Source: Zacks Investment Research

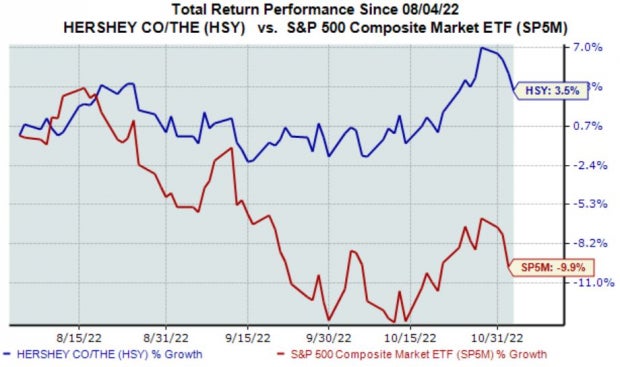

Over the last three months, shares have continued on their market-beating trajectory, up 3.5% and again outperforming the general market by a fair margin.

Image Source: Zacks Investment Research

Buyers have stepped up heavily for HSY shares in 2022, something we can’t say for the majority of stocks.

HSY shares trade at a 28.6X forward earnings multiple, above its five-year median of 24.1X by a fair margin and reflecting a 47% premium relative to its Zacks Consumer Staples sector average.

The company carries a Value Style Score of a C.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been primarily bullish regarding their earnings outlook, with two positive earnings estimate revisions hitting the tape over the last several months. The Zacks Consensus EPS Estimate of $2.07 indicates a slight 1.4% Y/Y decline in earnings.

Image Source: Zacks Investment Research

The company’s top-line is in better health; the Zacks Consensus Sales Estimate of $2.6 billion indicates an improvement of more than 10% Y/Y.

Quarterly Performance & Market Reactions

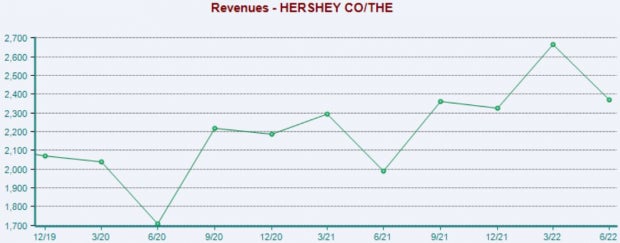

Hershey has an impressive earnings track record, exceeding revenue and earnings expectations in eight consecutive quarters.

Just in its latest print, the company registered a 6.5% EPS beat paired with a 6.6% revenue beat. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the market has liked what it’s seen from the company’s quarterly results, with shares moving upward following each of its last three prints.

Putting Everything Together

HSY shares have been a bright spot in an otherwise dim market in 2022, outperforming the S&P 500 by wide margins across multiple timeframes.

Shares trade above their five-year median forward earnings multiple and Zacks Consumer Staples sector average.

Two analysts have upped their earnings outlook, with estimates suggesting a Y/Y decline in earnings but an uptick in revenue – likely a reflection of margin compression.

The company has repeatedly exceeded estimates, and the market has cheered on its recent quarterly results.

Heading into the print, The Hershey Company HSY carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 2%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company The (HSY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.