One of the wonderful things about the American economy is its ability to solve market problems. If you haven’t heard of the latest financial technology to hit the block — it’s a fintech app called Viffy.

Viffy is new with an uncertain future, but an interesting value proposition for consumers and influencers.

What is Viffy?

Viffy is a premium content creator platform fueled by everyday consumer spending.

In plain English, this means that at its core, Viffy is an attempt to solve a market problem. The issue is that most retailer spending occurs in brick-and-mortar locations. However, an increasing amount of audience attention is being drawn away from traditional retail marketing channels and into influencer marketing. This leaves brick-and-mortar retailers with little access to influencers whose traditional online reach doesn’t always well serve geographically fixed brick-and-mortar stores.

Viffy solves this problem through a three-way model.

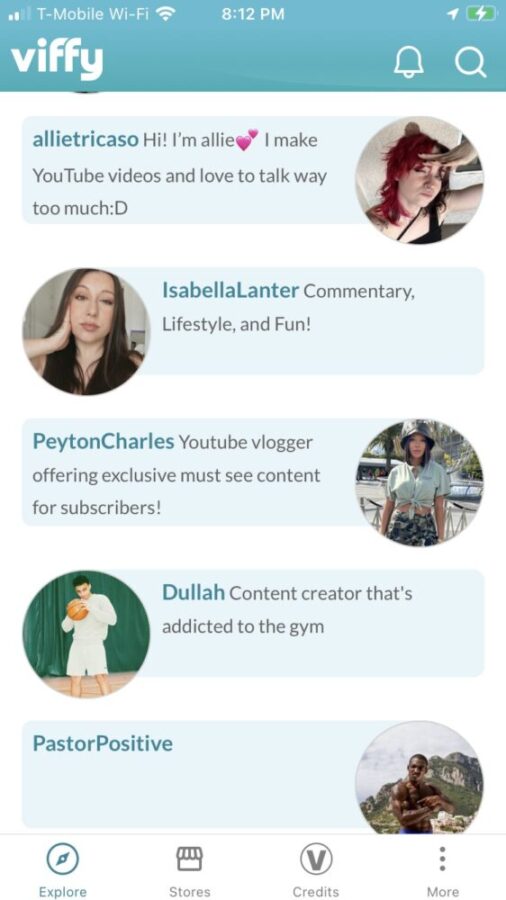

The Viffy app allows consumers to sign up and subscribe to the influencers who are available on the platform.

When consumers consent to allow Viffy to access their credit card data and make a purchase from a qualifying retailer, they receive credits on the app that can be redeemed to gain access to influencers.

Viffy then pays the influencers based on the number of credits they have. And the retailers fund the model through the increased sales driven by the app. This translates influencer popularity into retail sales, albeit somewhat indirectly.

Who Are the People Behind Viffy?

Viffy is the brainchild of Samuel Winslow, Benjamin Labbe, Marc Fafard, and Risto Laaksonen. The team’s primary experience is in mass payment processing systems, app development, and sales.

Viffy’s Uncertain Future

Viffy’s business model has the potential to solve a significant market problem. Usually, companies who do this profit handsomely. Take tech titans such as Alphabet, which developed the first search engine that achieved mass adoption, and consequently were able to achieve a dominant position in the search market.

Google is now worth $1.34 Trillion. However, Viffy is currently still in beta. Before it becomes massively valuable, it will need to grow its user base, influencer numbers, and retailer counts. This is notoriously difficult as the fintech environment is extremely competitive and Viffy will be going up against other apps such as Invisibly, which are also working to allow consumers to access content for free. Thus, its future value is uncertain.

A Good Value for Consumers

Despite its uncertain future, Viffy is a good value for some consumers. If you don’t mind sharing your credit card information and you have an influencer you like and want to support, it’s a good option. Unlike models such as Patreon, which requires cash out of pocket, the app allows you to earn credits for spending you may be making already. So, it’s an inexpensive way to get access to influencers you like and value.

A Good Value for Influencers As Well

Viffy also represented a value for influencers. Raising money as a social media influencer can be tremendously difficult. Viffy allows influencers to earn credits, which are translatable into USD. This allows them to monetize their content.

What About Incentives?

Since credit card companies and retailers fund the app, users of the app may find themselves with incentives to spend more. This is often the case with cash savings apps such as Ibotta or receipt scanning apps such as ReceiptPal. As the apps age and the user base of the app changes the internal economic incentives in the app change. Dilution is common in apps that utilize point systems as the managers of these apps often find they can retain users while paying them less.

In Viffy’s case, this is speculative as the app is in beta, and while there is no evidence to suggest that Viffy plans anything along these lines, misaligned incentives are sometimes an issue in point-based apps.

All in all, Viffy is an interesting app with an uncertain future, but a compelling value proposition for consumers and influencers.

You can learn more about Viffy at its website.

Viffy is available at the Apple app store and on Google Play.

For More On Up and Coming Fintechs:

Farm Together 2020: Yes, You Can Make A Ton Of Money In Farmland

Robinhood Traders Are Changing How People Invest

Investing With Technology – Tools To Build Wealth

Image and article originally from www.savingadvice.com. Read the original article here.