Trading 53% from its highs, NVIDIA’s NVDA third quarter FY23 earnings will start to lay out a broader picture for semiconductors stocks going forward.

Fellow chipmaker Advanced Micro Devices AMD reported earnings earlier in the month that were on par with the Zacks Consensus Estimate. AMD shares have started to climb along with the recent boost in markets after better than expected CPI numbers last week. Now let’s look at NVIDIA to see if it might be able to start to rebound.

NVDA’s Significance

Investor sentiment toward semiconductors stocks this year has been low as consumers strayed away from technology products during a high inflationary environment. NVDA’s Q3 report will be crucial for Wall Street to see that one of the largest chip makers can start adapting to economic conditions where operating challenges have persisted for most companies.

As a worldwide leader in visual computing technologies and the inventor of the graphic processing unit (GPU) NVDA has evolved its focus from PC graphics to add artificial intelligence (AI) based solutions that now support high-performance computing (HPC), gaming, virtual reality (VR) platforms, and more.

NVIDIA’s advancements have made it a major player among big tech stocks as well. Among the top 10 largest components of the Nasdaq 100, NVDA’s performance is often a barometer of the health of the technology sector.

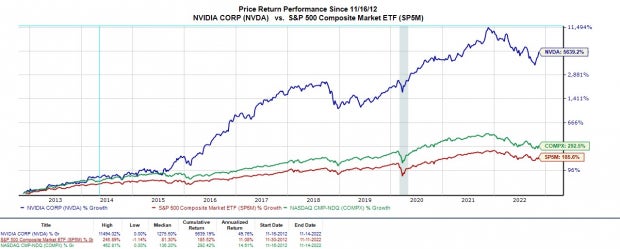

Image Source: Zacks Investment Research

NVDA’s performance over the last year has been significantly worse than the benchmark and drained the Nasdaq alongside most other big tech and growth stocks with Meta Platforms META notablly down big as well. This puts a ton of pressure on NVDA’s Q3 earnings and outlook if the stock hopes to turn things around in the near term.

Q3 Outlook

The Zacks Consensus Estimate for NVDA’s Q3 earnings is $0.71 per share, which would be a decline of -39% from $1.17 in the year prior quarter. Earnings estimates have largely trended down from $1.07 at the beginning of the quarter. Sales for Q3 are expected to be down -16% to $5.95 billion

Year over year, NVDA earnings are expected to decline -23% in fiscal 2023 at $3.42 per share. FY24 earnings are projected to stabilize and jump 31% to $4.50. Sales are expected to be up 1% in fiscal 2023 and rise another 13% in FY24 to $31.05 billion. This has the company in line to almost triple its 2020 revenue of $10.9 billion.

Performance & Valuation

NVDA is down -44% YTD to underperform the S&P 500’s -17% and the Nasdaq’s -28%. Over the last decade, NVDA stock is still up an astonishing +5,639% to crush the benchmark and the broader technology sector.

Image Source: Zacks Investment Research

Investors are certainly hoping that this year’s decline in NVDA turns out to be a long-term buying opportunity.

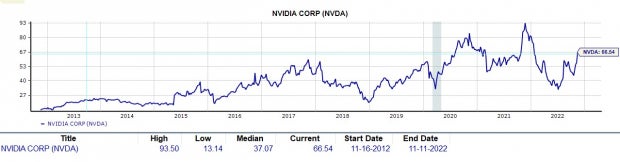

Trading around $163 per share NVDA trades at 47.7X forward earnings. This is above the industry average of 10.3X, but Wall Street has been okay with paying a premium for NVDA shares because of the company’s growth and technological advancement. NVDA also trades at a discount to its decade-high of 93.5X and near the median of 37X.

Image Source: Zacks Investment Research

Bottom Line

NVDA currently lands a Zacks Rank #3 (Hold) and its Semiconductor-General Industry is in the top 37% of over 250 Zacks Industries. The company’s Q3 report and more importantly its outlook will give an idea of how the company is dealing with the challenging operating environment.

NVIDIA trades at discount relative to its past and longer-term investors may be rewarded for holding the stock given its historical performance. Despite headwinds in fiscal 2023, the company is expected to return to growth in FY24 and the Average Zacks Price Target suggests 25% upside from current levels.

Just Released: Free Report Reveals Little-Known Strategies to Help Profit from the $30 Trillion Metaverse Boom

It’s undeniable. The metaverse is gaining steam every day. Just follow the money. Google. Microsoft. Adobe. Nike. Facebook even rebranded itself as Meta because Mark Zuckerberg believes the metaverse is the next iteration of the internet. The inevitable result? Many investors will get rich as the metaverse evolves. What do they know that you don’t? They’re aware of the companies best poised to grow as the metaverse does. And in a new FREE report, Zacks is revealing those stocks to you. This week, you can download, The Metaverse – What is it? And How to Profit with These 5 Pioneering Stocks. It reveals specific stocks set to skyrocket as this emerging technology develops and expands. Don’t miss your chance to access it for free with no obligation.

>>Show me how I could profit from the metaverse!

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.