Two stocks that are worthy of investors’ consideration going into their first-quarter earnings reports on Friday, April 28 are Colgate-Palmolive (CL) and WisdomTree (WT).

With Colgate and WisdomTree stocks both sporting a Zacks Rank #2 (Buy) at the moment, let’s see what’s in store for these companies ahead of earnings.

Colgate Q1 Preview

Renowned for its famous toothpaste brand Colgate is a global leader in the oral hygiene care market. Colgate’s first-quarter earnings are expected to slightly dip -5% year over at $0.70 per share. However, the Zacks Expected Surprise Prediction (ESP) indicates Colgate may beat earnings expectations with the Most Accurate Estimate having Q1 EPS at $0.71.

Image Source: Zacks Investment Research

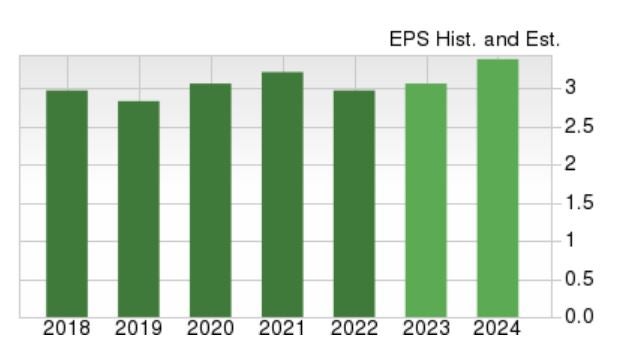

First-quarter sales are forecasted to be up 5% from the prior year quarter at $4.62 billion. Total sales are forecasted to rise 5% this year and edge up another 4% in FY24 to $19.73 billion. Annual earnings are forecasted to rise 5% in FY23 and jump another 10% in FY24 at $3.41 per share.

Image Source: Zacks Investment Research

WisdomTree Q1 Preview

Pivoting to WisdomTree, the company offers diversified exchange-traded products including digital funds and tokenized assets, as well as blockchain-native digital wallets.

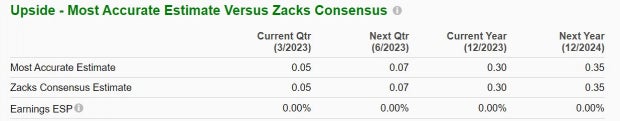

Solid annual top and bottom line growth is expected despite Q1 earnings forecasted to drop -44% YoY at $0.05 per share compared to EPS of $0.09 in the prior-year quarter. Still, the Zacks ESP indicates WisdomTree should reach its Q1 earnings expectations with the Most Accurate Estimate also having EPS at $0.05.

Image Source: Zacks Investment Research

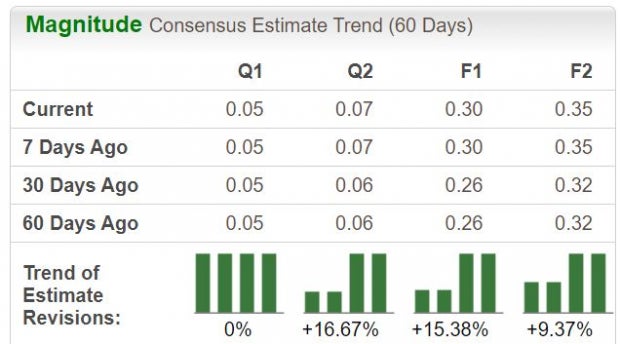

First-quarter sales are forecasted to be up 1% YoY to $79.27 million. Total sales are projected to rise 12% in FY23 and jump another 13% in FY24 to $382.47 million. Even better, WisdomTree’s annual earnings are now projected to jump 15% this year and climb another 18% in FY24 at $0.35 per share. Plus, earnings estimate revisions have trended higher over the last 30 days.

Image Source: Zacks Investment Research

Takeaway

The annual top and bottom line growth that is expected for Colgate and WisdomTree makes it quite possible that they will offer positive guidance during their Q1 reports.To that point, Colgate and WisdomTree stocks have an “A” Zacks Style Scores grade for Momentum in addition to their Zacks Rank #2 (Buy).

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

WisdomTree, Inc. (WT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.