Results from oil and energy companies have been much anticipated this earnings season with WTI Crude Oil prices hovering well over $80 a barrel during the third quarter.

This week’s earnings lineup features several top-rated stocks that belong to the Zacks Oils and Energy sector and here are a few to consider ahead of their Q3 reports on Wednesday, November 1.

APA APA: As one of the leading independent energy companies in the world, APA’s stock is attractive ahead of its Q3 results. APA’s stock is starting to make the case for being undervalued at 8.3X forward earnings and offers a generous 2.49% annual dividend yield.

Following a very tough to compete against quarter, Q3 sales are forecasted at $2.01 billion versus $2.87 billion a year ago with earnings expected at $1.08 per share compared to EPS of $1.97 a share in Q3 2022.

However, earnings estimates for the current quarter, fiscal 2023, and FY24 are noticeably higher over the last 30 days. More intriguing, The Zacks Earnings ESP (Expected Surprise Prediction) indicates APA could surpass Q3 earnings expectations with the Most Accurate Estimate having EPS at $1.10 per share and 1% above the Zacks Consensus.

Image Source: Zacks Investment Research

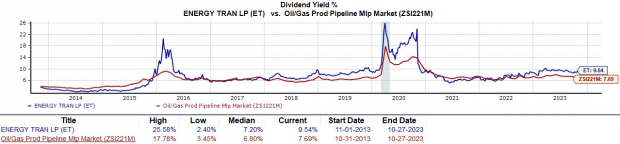

Energy Transfer ET: Operating diversified portfolios of energy assets primarily in the United States, Energy Transfer’s stock also stands out ahead of its Q3 report on Wednesday.

Energy Transfer’s stock trades reasonably at a 10.7X forward earnings multiple with ET offering a lucrative 9.53% dividend yield. After a strong Q3 2022, Energy Transfer’s earnings are only expected to dip -3% at $0.29 per share with sales projected to be down -5% to $21.68 billion as much of the risk to reward looks priced into ET shares.

Image Source: Zacks Investment Research

Marathon Oil MRO: Rounding out the list, Marathon Oil’s stock is worthy of consideration with earnings estimates nicely up for the current quarter, FY23, and FY24. Plus, Marathon’s stock trades at 10.2X forward earnings with a respectable 1.46% dividend yield.

As a leader in oil and natural gas exploration and production, the Zacks ESP suggests Marathon should reach earnings expectations despite EPS forecasted at $0.69 a share compared to $1.24 per share in what was a stellar Q3 2022. Quarterly sales are forecasted at $1.75 billion versus $2.25 billion in the prior year quarter although the risk to reward remains favorable for investors at Marathon’s current levels.

Image Source: Zacks Investment Research

Takeaway

Ahead of their quarterly reports, APA, Energy Transfer, and Marathon Oil’s stock all sport a Zacks Rank #2 (Buy). Attractive dividends and reasonable valuations make these Zacks Oils & Energy sector stocks intriguing with WTI Crude Oil still over $80 a barrel at the moment.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s credited with a “watershed medical breakthrough” and is developing a bustling pipeline of other projects that could make a world of difference for patients suffering from diseases involving the liver, lungs, and blood. This is a timely investment that you can catch while it emerges from its bear market lows.

It could rival or surpass other recent Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock And 4 Runners Up

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

APA Corporation (APA) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.