Investors often pay close attention to dividend increases, as they can reflect a company’s financial health and stability. It’s typically a positive sign to see these increases, as it suggests that the company is performing well and has a solid foundation to sustain future growth.

And recently, we’ve seen several companies – Pool Corp. POOL, Sociedad Quimica y Minera SQM, and Marriott International MAR – announce increases to their payouts.

For those interested in reaping income from their investments, let’s take a closer look at each.

Sociedad Quimica y Minera

Sociedad Quimica Y Minera is one of the world’s largest lithium producers, with one of the industry’s least impactful water, carbon, and energy footprints. The company’s annual dividend presently yields a sizable 11.4%, crushing the Zacks Basic Materials sector average.

Impressively, the company has grown its dividend payout by nearly 60% over the last five years.

Image Source: Zacks Investment Research

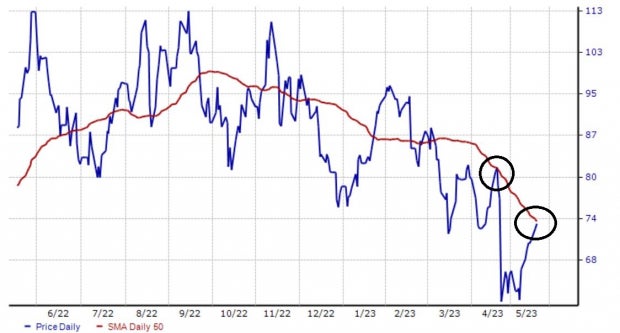

It’s worth noting that shares trade below the 50-day moving average, with them now heading up toward that level again. As we can see in the circle below, shares faced rejection the last instance it brushed up against the average.

Based on the previous reaction, it could be beneficial for investors to wait to see if shares can break through and reclaim the 50-day moving average.

Image Source: Zacks Investment Research

Pool Corp.

Pool Corp. is the world’s largest wholesale distributor of swimming pool supplies, equipment, and related products. The company’s annual dividend currently yields 1.2%, with its payout growing by more than 20% over the last five years.

Image Source: Zacks Investment Research

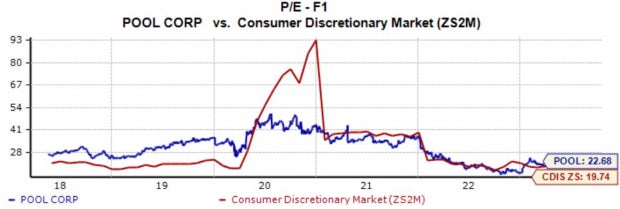

Shares are cheap on a relative basis, with the current 22.7X forward earnings multiple sitting well beneath the 30.8X five-year median and highs of 36.3X in 2022.

The stock carries a Style Score of “C” for Value.

Image Source: Zacks Investment Research

Marriott International

Marriott International is a worldwide operator, franchisor, and licensor of hotel, residential, and timeshare properties. Currently, the stock yields 1.9% annually and carries a favorable Zacks Rank #2 (Buy), with earnings expectations increasing across all timeframes.

Image Source: Zacks Investment Research

The company posted a big beat in its latest release, exceeding the Zacks Consensus EPS Estimate by 12% and delivering a positive 6.4% sales surprise. As shown below, the company’s top line has recovered nicely from pandemic lows.

Image Source: Zacks Investment Research

Bottom Line

Dividend increases are a positive announcement that investors can receive, providing a solid level of reassurance.

Typically, we’ll see companies boost payouts when business is fruitful and they’re confident in their future prospects.

And all three companies above – Pool Corp. POOL, Sociedad Quimica y Minera SQM, and Marriott International MAR – have recently boosted their payouts.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof… and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with “black gold.”

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you’ll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don’t want to miss these recommendations.

Download your free report now to see them.

Marriott International, Inc. (MAR) : Free Stock Analysis Report

Pool Corporation (POOL) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.