The Fed’s tightening cycle has been a thorn in the side of the Zacks Computer and Technology sector in 2022, undoubtedly impacting many portfolios.

In his latest speech just given yesterday, Fed Chairman Jerome Powell acknowledged the idea of smaller interest rate hikes potentially starting in December and also reiterated that the Fed remains laser-focused on bringing inflation down.

The markets cheered on the relatively less-hawkish comments, providing stocks a significant boost into the closing bell.

During times of a potential market turnaround, a few of the mega-cap titans in the Zacks Computer and Technology sector, such as Apple AAPL, Alphabet GOOGL, and Microsoft MSFT, are undoubtedly worth visiting.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, it’s been anything but fun for these stocks in 2022. Still, long-term investors have been presented with a potentially strong buying opportunity after the less-than-ideal performance.

Let’s take a closer look at each one of these beloved stocks.

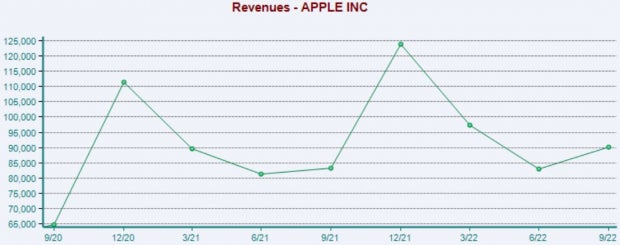

Apple

Analysts have primarily dialed back their near-term earnings outlook over the last several months, with the company’s upcoming quarter seeing the harshest revisions. The company is currently a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Still, Apple has been able to consistently post better-than-expected earnings results, exceeding earnings and revenue estimates in four consecutive quarters.

In its latest print, the tech titan posted a 2.4% bottom-line beat paired with a 1.9% sales surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

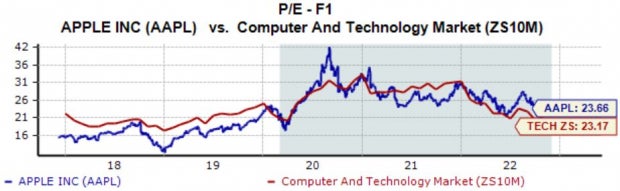

Apple shares currently trade at a 23.7X forward earnings multiple, a few ticks above the 23.3X five-year median and Zacks sector average of 23.2X.

Image Source: Zacks Investment Research

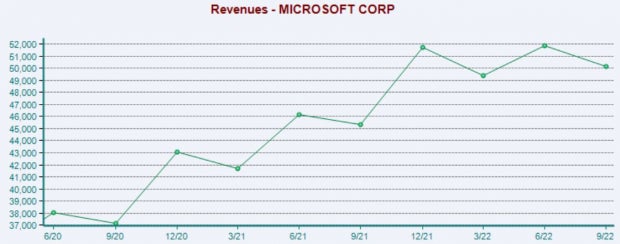

Microsoft

Over the last several months, analysts have turned bearish in their earnings outlook for MSFT, landing the stock into a Zacks Rank #4 (Sell).

Image Source: Zacks Investment Research

Like APPL, Microsoft has continued to beat quarterly estimates, exceeding revenue and earnings expectations in three of its last four quarters.

In its latest release, the giant posted a 2.6% EPS beat paired with a 1.3% sales surprise.

Image Source: Zacks Investment Research

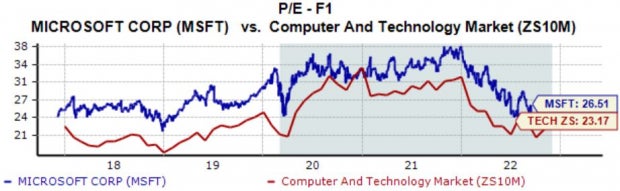

Further, MSFT shares currently trade at a 26.5X forward earnings multiple, below the 28.5X five-year median by a fair margin and above its Zacks sector average.

Image Source: Zacks Investment Research

Alphabet

Like MSFT, Alphabet’s near-term earnings outlook has turned negative over the last several months, pushing the stock into a Zacks Rank #4 (Sell).

Image Source: Zacks Investment Research

The company has struggled to exceed quarterly estimates as of late, falling short on both the top and bottom-line in three consecutive quarters.

In its latest print, GOOGL fell short of earnings expectations by roughly 15% and sales estimates by 1.9%.

Image Source: Zacks Investment Research

On a relative basis, Alphabet shares don’t appear expensive; the company’s current forward earnings multiple of 21.6X is below its 26.5X five-year median and its Zacks sector average.

Image Source: Zacks Investment Research

Bottom Line

It’s no secret that technology stocks have been hit hard in 2022, ending stellar runs.

Still, for investors with a long-term horizon, the less-than-ideal year-to-date performance has provided an opportunity to buy shares of Apple AAPL, Alphabet GOOGL, and Microsoft MSFT at prices not seen in some time.

However, all three companies’ near-term earnings outlooks have come under pressure, with analysts rolling back their estimates by fair margins.

A great approach would be to wait until positive earnings estimate revisions start rolling in, which would tell us that analysts once again have a positive outlook regarding each company’s bottom-line.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.