Shareholders can receive many positive announcements, such as upgraded guidance or news of a hot acquisition. Of course, dividend boosts are another one of these favorable announcements, with the news fully reflecting a shareholder-friendly nature.

And as of late, three companies – Altria MO, NetEase NTES, and Verizon Communications VZ – have all recently boosted their payouts. Let’s take a closer look at each for those interested in an income-focused approach.

Altria

Altria Group is a world-leading producer and marketer of cigarettes, tobacco, and other similarly related products. The company’s Board of Directors recently voted to increase its quarterly dividend by 4.3% to $0.98 per share.

As shown below, Altria has a long history of increasing its dividend payout, reflecting its shareholder-friendly nature.

Image Source: Zacks Investment Research

The company’s shares aren’t valuation stretched, with the current 8.9X forward earnings multiple sitting well below the 10.1X five-year median and the Zacks – Tobacco industry average. The stock sports a Style Score of “B” for Value.

Image Source: Zacks Investment Research

Altria is expected to post modest growth in its current year, with Zacks Consensus Estimates suggesting 3% earnings growth on 1% higher sales.

NetEase

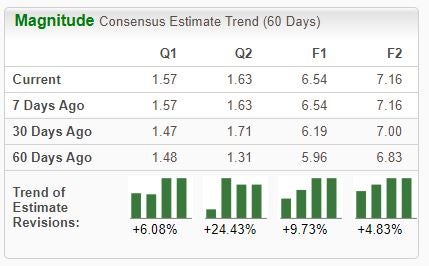

NetEase, a current Zacks Rank #1 (Strong Buy), is an Internet technology company engaged in the development of applications, services, and other technologies for the Internet in China. Analysts have taken their earnings expectations higher across all timeframes.

Image Source: Zacks Investment Research

The company recently announced an 11% increase to its quarterly dividend to $0.52 per share, compared to $0.47 per share previously. As shown below, the company’s payout has grown nicely over the recent years, sporting a 26% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Verizon Communications

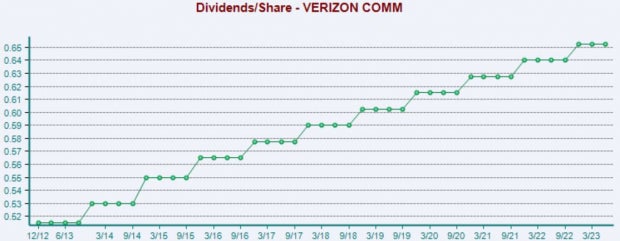

Verizon offers communication services in the form of local phone service, long-distance, wireless, and data services. The company recently announced a slight 2% boost to its quarterly payout, bringing the total to $0.65 per share.

Like those above, the company has shown a commitment to shareholders over the years, as illustrated below. VZ’s payout has grown by a modest 2% annually over the last five years.

Image Source: Zacks Investment Research

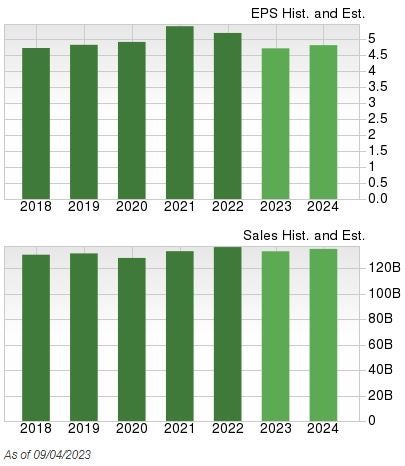

And the company generates ample cash to keep the dividend boosts coming, with VZ posting $5.6 billion in free cash flow in its latest quarter. It’s worth noting that the company’s top and bottom lines are forecasted to take hits in its current year (FY23), with estimates indicating 9% lower earnings on 2% lower sales.

Image Source: Zacks Investment Research

Bottom Line

Everybody loves dividends, as they provide a passive income stream, more than one way to profit from an investment, and a buffer against drawdowns in other positions.

And recently, all three companies above – Altria MO, NetEase NTES, and Verizon Communications VZ – have boosted their payouts, reflecting their shareholder-friendly natures.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to “insane levels,” and they’re likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Altria Group, Inc. (MO) : Free Stock Analysis Report

NetEase, Inc. (NTES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.