Investors anxiously await the Fed’s announcement this week, where the broad consensus is that another 75 bps rate hike is on the way, putting the Fed Funds rate at 3.88%.

A hawkish Fed has been a thorn in the side of many stocks in 2022, causing volatility to headline the market. Other than energy, there have been little places to hide.

During times of heightened volatility, adding low-beta stocks can help blend in an extra layer of portfolio defense.

Stocks with a beta of less than 1.0 are less volatile than the general market, and the opposite is also true – stocks with a beta of higher than 1.0 are more volatile than the general market.

Three highly-ranked stocks with a beta of less than 1.0 – Archer Daniels Midland ADM, The Kroger Co. KR, and General Mills GIS – could all be considerations for investors looking to shield themselves against volatility.

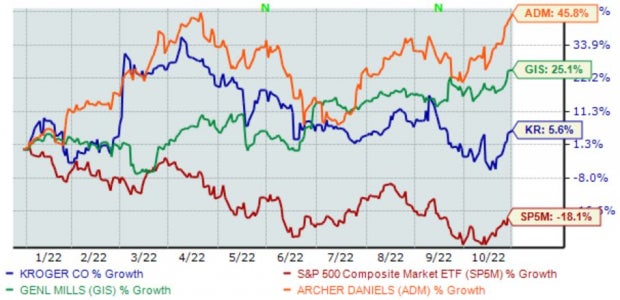

Below is a chart illustrating the performance of all three stocks in 2022, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three stocks have been notably strong year-to-date, indicating that buyers have stepped up to the plate. Let’s take a deeper dive into each one.

Archer Daniels Midland

Archer Daniels Midland is a leading producer of food and beverage ingredients and goods made from various agricultural products.

ADM’s earnings outlook has turned visibly bright over the last several months, helping push the stock into a favorable Zacks Rank #2 (Buy).

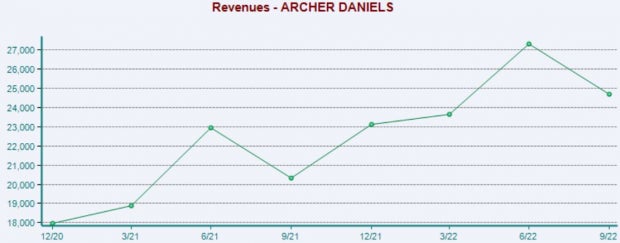

Image Source: Zacks Investment Research

ADM shares aren’t expensive; the company’s 13.2X forward P/E ratio sits nicely beneath its 14.2X five-year median and represents a 34% discount relative to its Zacks Consumer Staples sector average of 19.9X.

The company sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

For the cherry on top, Archer Daniels Midland has an impressive earnings track record, exceeding revenue and earnings estimates in eight consecutive quarters.

Just in its latest print, the company penciled in a 31% EPS beat paired with a 7.8% top-line beat.

Image Source: Zacks Investment Research

General Mills

General Mills is a global manufacturer and marketer of branded consumer foods sold through retail stores. We see their products on nearly every shelf. GIS sports a Zacks Rank #2 (Buy).

Analysts have raised their earnings outlook across nearly all timeframes over the last several months.

Image Source: Zacks Investment Research

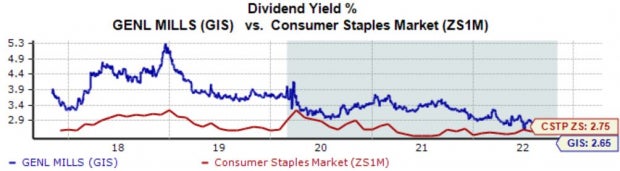

For those that like dividends, General Mills has got that covered; the company’s annual dividend currently yields 2.6%, just a tick below its Zacks Consumer Staples sector average.

Image Source: Zacks Investment Research

Similar to ADM, General Mills has consistently beaten quarterly estimates, surpassing earnings and revenue estimates in each of its last three quarters. Just in its latest print, the food giant registered an 11% EPS beat paired with a marginal 0.9% revenue beat.

Image Source: Zacks Investment Research

The Kroger Co.

Founded in 1883, the long-time retailer operates approximately 2,700 retail stores under various banners and divisions in 35 states. KR boasts a Zacks Rank #2 (Buy).

Kroger’s bottom-line outlook has improved notably over the last several months, with analysts nearly in complete agreement.

Image Source: Zacks Investment Research

KR’s valuation multiples don’t appear stretched; the company’s 11.5X forward earnings multiple is nicely beneath its 12.6X five-year median, reflecting a 51% discount relative to its Zacks Retail and Wholesale sector.

Further, the retail titan carries a Value Style Score of an A.

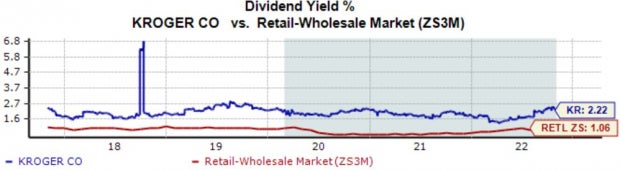

Image Source: Zacks Investment Research

The company’s dividend metrics would entice any investor seeking income; KR’s annual dividend yield currently comes in at 2.2%, notably higher than its Zacks sector average.

In addition, the company sports a sustainable 21% payout ratio paired with an impressive 13.2% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

Volatility has headlined the market year-to-date, with dramatic price swings occurring regularly.

A hawkish Fed has spoiled the fun, with geopolitical issues and lingering COVID-19 uncertainties also weighing heavily on stocks.

During times of heightened volatility, adding low-beta stocks, such as Archer Daniels Midland ADM, The Kroger Co. KR, and General Mills GIS, can help investors shield themselves from volatility.

All three carry a strong Zacks Rank, telling us that their near-term business outlook is bright.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention. See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS): Free Stock Analysis Report

Archer Daniels Midland Company (ADM): Free Stock Analysis Report

The Kroger Co. (KR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.