Clorox will report earnings on Nov. 1

Clorox Co (NYSE: CLX) is set to report earnings next week on Tuesday, Nov. 1. The company’s CEO and CFO, Linda Rendle and Kevin Jacobsen, will also host a live Q&A audio webcast for analysts on the same day. Analysts are expecting CLX to report earnings of 73 cents per share for the third quarter, marking a drop from its second-quarter profits of 93 cents, which fell in line with analysts’ estimates.

A look back at Clorox’s last eight earnings reports shows the security managing a post-earnings pop just three times and averaging a 5.7% move, regardless of direction. This time around, options players are pricing in a slightly larger swing of 6.9%.

Speaking of options pits, Clorox’s are awash with activity today. So far, 3,604 calls and 2,760 puts have been exchanged, which is double the intraday average. The most popular position is the weekly 11/11 85-strike put, followed by the weekly 11/4 85-strike put, with positions being opened at the former.

Puts have been popular among options traders. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity sports a 10-day put/call volume ratio of 1.62, which stands higher than 88% of readings from the past year. In other words, puts are being picked up at a quicker-than-usual clip right now.

Analysts have also taken a bearish stance on the consumer goods name ahead of earnings. Of the 13 in coverage, just one calls CLX a “buy,” compared to five “hold” ratings, and seven “sell” or worse ratings. What’s more, the 12-month consensus price target of $129.49 is a 5.9% discount to current levels.

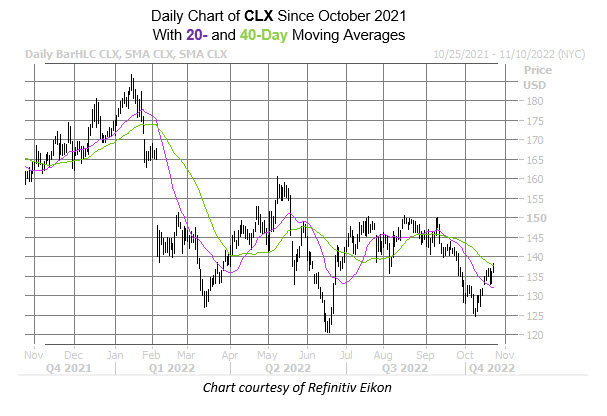

While Clorox stock is still down 21% in 2022, the shares look to be rebounding, breaking back above the 20-day moving average earlier this month. Today, CLX is up 1% at $137.62, though recent pressure at the 40-day moving average could keep some of these gains in check.

Still, Clorox provides a relatively rich valuation at a forward price-earnings ratio of 33.11 and a price-sales ratio of 2.36. This is further amplified by the company’s uninspiring growth estimates. The cleaning supply concern is estimated to report a 0.7% drop in both revenues and earnings for fiscal 2023.

Moreover, expectations remain low for Clorox’s revenue in fiscal 2024, with analysts predicting 3% growth. However, analysts predict 29.2% earnings growth for fiscal 2024. Regardless, the stock continues to be overpriced for anyone who isn’t a long-term dividend investor. CLX currently offers a high dividend yield of 3.46% at a forward dividend of $4.72.

Image and article originally from www.schaeffersresearch.com. Read the original article here.