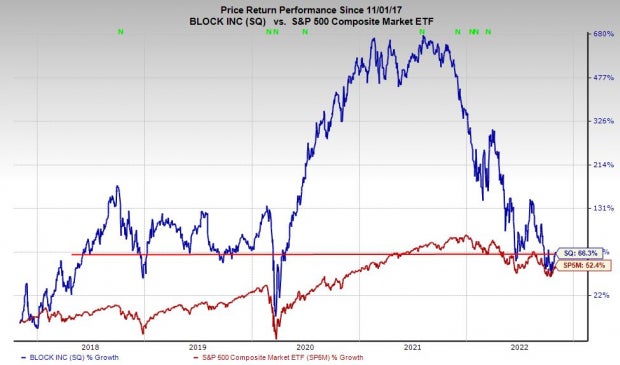

Block Inc. SQ, formally known as Square, has tumbled roughly 80% from its peaks and 60% in 2022. Wall Street has dumped the credit card reader turned financial tech standout on the back of rising interest rates, slowing consumer spending, tough-to-compete against periods, and other setbacks.

Despite the fall and the ongoing economic uncertainty, some investors might be wondering if now is a good time to buy SQ shares with Block set to release its quarterly results on Thursday, November 3.

Block’s Story

Block portfolio includes a range of point-of-sale offerings, broader payment software and infrastructure, business loans, peer-to-peer payments, bitcoin transactions, and much more. The company’s goal is to be a futuristic digital-native banking and financial services company for both consumers and businesses.

Block’s business-focused fintech offerings are catching on with larger sellers amid the continued e-commerce revolution. It has also successfully joined together its in-person POS segment with its digital commerce features. And Wall Street appreciates the long-term potential of its P2P platform the Cash App.

Block made a splash when it acquired “buy now, pay later” standout Afterpay in a $29 billion all-stock deal that closed back in January. Wall Street fears SQ overpaid, having bought the firm when tech valuation and consumer spending were peaking.

Image Source: Zacks Investment Research

Recent Growth & Outlook

Block is coming off to an impressive run of top-line growth that included 86% sales expansion in 2021 and 102% in 2020, which saw it climb from $4.7 billion in total FY19 revenue to $17.66 billion in 2021. These are nearly impossible-to-compete periods boosted by the covid economy.

Zacks estimates call for Block’s adjusted 2022 earnings to fall 49% YoY to $0.87 per share on 1% lower sales to come in at $17.56 billion. Peeking ahead, Block is projected to bounce back in 2023, with sales expected to surge 20% to $20.99 billion to boost earnings by 71%.

Image Source: Zacks Investment Research

Bottom Line

At around $60 per share, SQ is trading at levels it traded at throughout various parts of 2018 and 2019. Despite the beaten-down price, Block’s valuation remains sky-high for the current interest rate environment, trading at 70.5X expected FY22 earnings.

The rough reports from Amazon and others are not the best signs, and Block’s earnings outlook for FY22 and FY23 have fallen over the last year. Investors should pay close attention to SQ’s quarterly release and guidance to better understand its near-term outlook and gauge when it might be time to possibly buy some SQ shares again.

Despite the plummet from its highs and the uncertain outlook, 75% of the 31 brokerage recommendations Zacks has are “Strong Buys” or “Buys.” And the average Zacks price target of $148 a share offers 140% upside to the $60 SQ trades at ahead of its Q3 release on November 3.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.8% per year. So be sure to give these hand-picked 7 your immediate attention. See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Block, Inc. (SQ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.