With earnings season slowly winding down, one thing is for certain – we saw many surprises. Of course, the period is always hectic, but this cycle was critically important as we wade through a somewhat-cloudy economic outlook.

Several companies, including Apple AAPL, Uber Technologies UBER, and Applied Materials AMAT, all delivered results that had investors celebrating post-earnings.

Below is a chart illustrating the year-to-date performance of all three, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at how each currently stacks up.

Apple

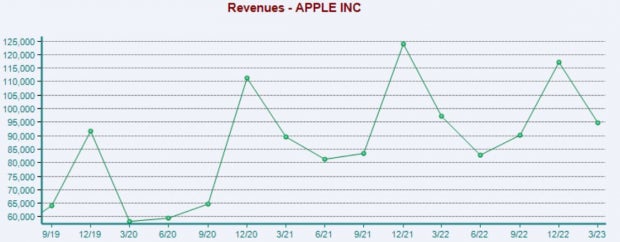

Apple’s quarterly results were watched like a hawk, as it was the last of the mega-cap tech giants yet to report. Fortunately for the market, the company delivered, exceeding earnings expectations by nearly 6% and posting revenue 2% ahead of estimates.

Image Source: Zacks Investment Research

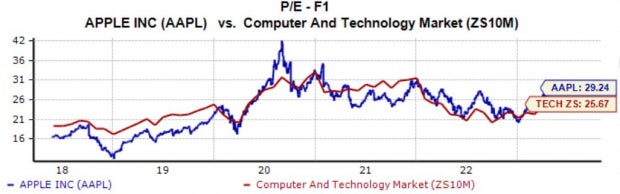

It’s worth noting that investors will have to fork up a premium for AAPL shares, with the current 29.2X forward earnings multiple sitting well above the five-year median and Zacks Computer and Technology sector average.

Image Source: Zacks Investment Research

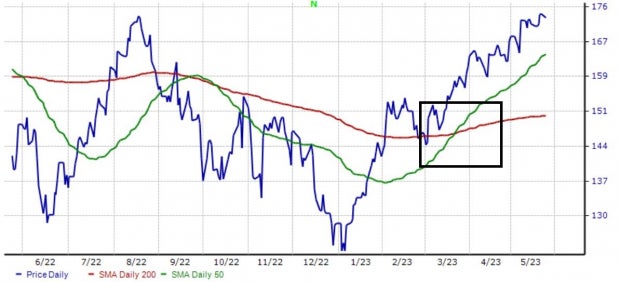

Shares recently witnessed the golden cross, as highlighted in the chart below. The golden cross occurs when the shorter 50-day moving average rises above the 200-day moving average, indicating near-term buying pressure.

Image Source: Zacks Investment Research

Uber Technologies

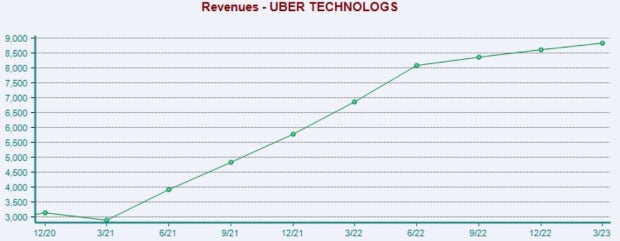

Uber shares found plenty of attention following its latest release; the company posted a positive EPS surprise of 20% and reported revenue modestly above expectations.

Image Source: Zacks Investment Research

Uber shares could entice growth-focused investors, further reinforced by the Style Score of “A” for Value. The company’s earnings are forecasted to skyrocket 100% in its current fiscal year (FY23) and an additional 1,270% in FY24.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 17% in FY23 and 18% in FY24.

Applied Materials

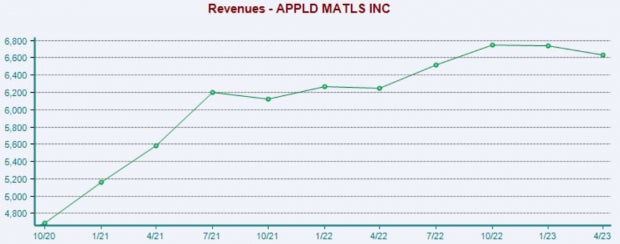

Like the stocks above, buyers stepped up in a big way post-earnings for AMAT shares, with the company delivering a 9% EPS beat and reporting revenue nearly 4% ahead of expectations.

Image Source: Zacks Investment Research

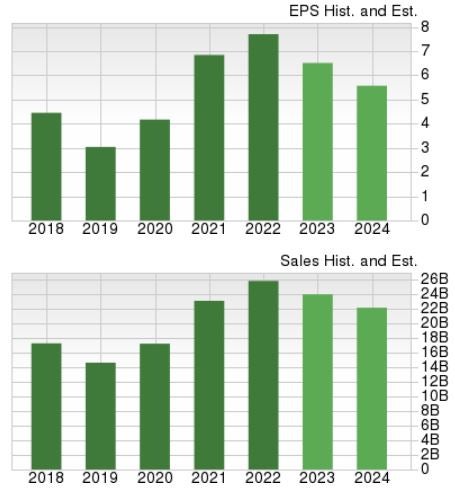

It’s worth noting that the company’s growth is forecasted to taper off, with earnings forecasted to pull back 6% in its current fiscal year (FY23) and a further 7% in FY23. This is illustrated in the chart below.

Image Source: Zacks Investment Research

Bottom Line

While earnings season is undeniably intense, it’s just the nature of the period. We managed to elude the so-called earnings ‘cliff’ many warned of, with many companies posting better-than-expected results and keeping sentiment in line.

And all three stocks above – Apple AAPL, Uber Technologies UBER, and Applied Materials AMAT – delivered results that had the market impressed post-earnings.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook names 5 hand-picked stocks with sky-high growth potential in a brilliant sector of Artificial Intelligence. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

Today you can invest in the wave of the future, an automation that answers follow-up questions … admits mistakes … challenges incorrect premises … rejects inappropriate requests. As one of the selected companies puts it, “Automation frees people from the mundane so they can accomplish the miraculous.”

Download Free ChatGPT Stock Report Right Now >>

Apple Inc. (AAPL) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.