Earnings season has winded down, though many notable companies are still slated to report in the coming weeks. Perhaps the most important of the bunch, hype-filled NVIDIA, will reveal its quarterly results on November 21st next week.

Throughout the period, there have been several notable positive surprises, including those from PepsiCo PEP, Pinterest PINS, and Shopify SHOP. All three saw buying pressure post-earnings, reflecting favorable reactions among market participants.

But what was there to like in the respective quarterly releases? Let’s take a closer look.

PepsiCo

PepsiCo posted results that beat expectations, exceeding the Zacks Consensus EPS Estimate by 4% and posting a modest 0.3% revenue surprise. Concerning growth rates, earnings improved 15% year-over-year, whereas sales grew 7% from the year-ago period.

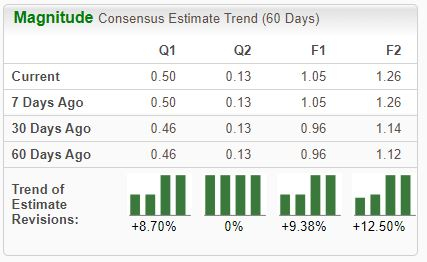

PEP is currently a Zacks Rank #2 (Buy), with the revisions trend particularly notable for its current fiscal year, up 4% to $7.55 per share since November of last year.

Image Source: Zacks Investment Research

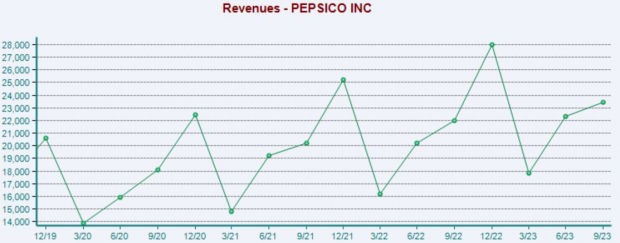

Continued business momentum aided the better-than-expected quarterly results, with consumer strength apparent throughout the period. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, PEP’s operating profit grew 20% year-over-year to $4 billion, primarily driven by favorable net pricing and effective productivity savings.

As reflected by these quarterly results, it’s apparent that the company’s cost-cutting measures have been successful. In fact, the company raised its FY23 EPS and maintained its revenue outlook, expecting growth rates of 13% and 10%, respectively.

Pinterest provides a platform to show its users visual recommendations based on their personal tastes and interests, generating revenues by delivering ads on its website and mobile application. The company is a Zacks Rank #1 (Strong Buy), with earnings expectations drifting higher nearly across all timeframes.

Image Source: Zacks Investment Research

Regarding the release, PINS delivered a 33% EPS beat and reported sales 3% ahead of expectations. Further, monthly active users (MAUs) totaled 482 million, improving 8% year-over-year and reflecting continued platform expansion.

PINS revenue continues to maintain its upward trajectory, with Q3 revenue of $763 million up 11% from the same period last year.

Regarding expectations, the company’s earnings are forecasted to climb 70% in its current year on 9% higher revenues, with estimates for its next year (FY24) suggesting an additional 20% earnings growth paired with a 16% sales increase.

Image Source: Zacks Investment Research

Shopify

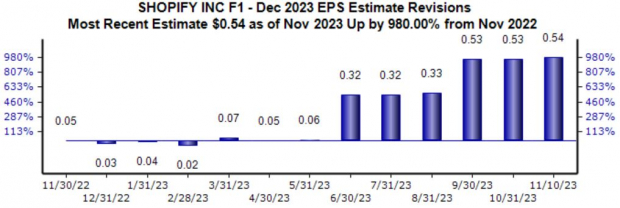

Shopify provides a multi-tenant, cloud-based, multi-channel e-commerce platform for small and medium-sized businesses. The revisions trend for its current fiscal year is impossible to ignore, up 980% over the last year to $0.54 per share.

Image Source: Zacks Investment Research

Regarding the release, Shopify exceeded the Zacks Consensus EPS Estimate by a sizable 130% and reported revenue 4% ahead of expectations, both well above year-ago figures.

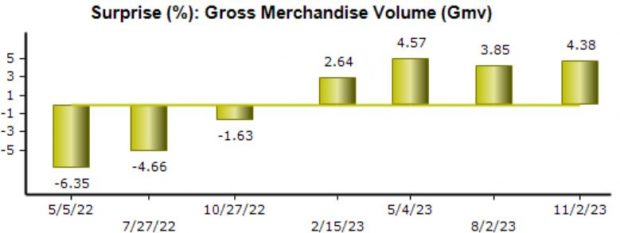

Concerning key metrics, Gross Merchandise Volume (GMV) is commonly focused on among investors. GMV totaled $56.2 billion throughout the quarter, reflecting growth of 22% billion from the same period last year.

The company has consistently exceeded consensus expectations surrounding GMV, as shown below.

Image Source: Zacks Investment Research

Investors will have to fork up a premium for shares, reflective of the company’s high-growth trajectory. Currently, SHOP shares trade at an 11.3X forward price-to-sales (F1), undoubtedly expensive but below the 22.7X five-year median.

Bottom Line

We’re on the tail end of earnings season now, with the majority of notable companies already revealing quarterly results.

And throughout the period so far, we’ve gotten many positive surprises, including those from PEP, Pinterest PINS, and Shopify SHOP.

4 Oil Stocks with Massive Upsides

Global demand for oil is through the roof… and oil producers are struggling to keep up. So even though oil prices are well off their recent highs, you can expect big profits from the companies that supply the world with “black gold.”

Zacks Investment Research has just released an urgent special report to help you bank on this trend.

In Oil Market on Fire, you’ll discover 4 unexpected oil and gas stocks positioned for big gains in the coming weeks and months. You don’t want to miss these recommendations.

Download your free report now to see them.

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.