DexCom, Inc. (DXCM) is a connected medical device standout that has posted steadily massive YoY growth as more people in the U.S. and globally suffer from diabetes.

DexCom posted an impressive second quarter and provided upbeat guidance once again, yet its stock tumbled since its release as Wall Street took profits following a huge run off its lows.

DXCM stock is currently down over 40% from its 2021 highs and trading 51% below its average Zacks price target even though it stands out in the connected health world that’s likely to become standard medical practice.

Vital Tech in a Growing Market

DexCom makes continuous glucose monitoring systems designed for people with both type 1 and type 2 diabetes. The connected-health firm allows people with diabetes the opportunity to place a small sensor on their bodies to help them continuously monitor their glucose levels in real-time and avoid the dreaded finger prick.

Users, caregivers, and others can monitor key levels via various compatible smart devices and wearables. DexCom’s goal is to help its users “make better decisions in the moment with the most accurate CGM” device to help “manage your diabetes with confidence” and “live a healthier, more confident life.”

Image Source: Zacks Investment Research

DexCom’s continuous glucose monitoring systems are part of a connected health revolution that appears poised to become the standard form of care and treatment in the future. DexCom’s addressable market is growing rapidly even though 1 in 10 people in the U.S. already have diabetes, according to the CDC.

Far more people currently have “prediabetes” in the U.S. Plus, rising diabetes rates are not just a U.S. issue considering that 1 in 10 people globally are living with diabetes and counting.

The DexCom G6 and DexCom G7 are currently covered by Medicare for people who meet certain criteria. The company is also expanding its reach far beyond the U.S.

Growth Outlook

DXCM is projected to post roughly 20% sales growth in 2023 and 2024 to reach $4.26 billion next year, based on Zacks estimates. This top line growth follows 26% average expansion during the trailing three years and even stronger sales growth prior to that stretch.

Meanwhile, Zacks estimates call for DexCom to grow its adjusted earnings by 41% this year and 30% higher next year. DXCM boasts an impressive history of bottom line beats and its positive earnings outlook helps it earn a Zacks Rank #2 (Buy) right now.

Other Fundamentals

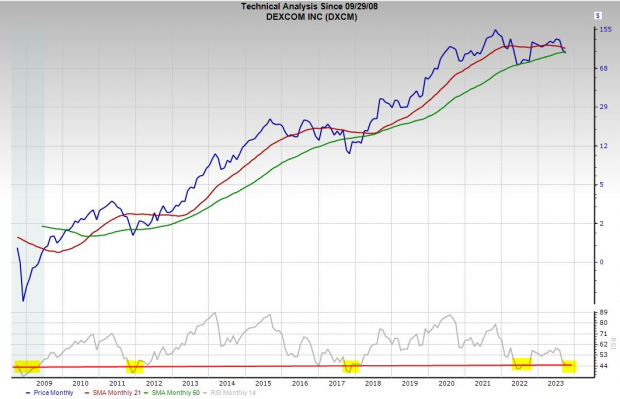

DexCom shares have soared over 3,600% during the past 20 years and 1,200% over the last 10 years vs. the S&P 500’s 164% and Zacks Tech Sector’s 230%. More recently, DXCM is up 183% over the past five years, which includes roughly sideways movement in the trailing 36 months.

DexCom has gone on a wild ride over the last three years, tumbling off its November 2021 highs alongside the Nasdaq. The stock then skyrocketed between June 2022 and the end of July 2023. Wall Street then utilized its earnings release as a chance to start cashing in.

Image Source: Zacks Investment Research

DXCM shares are currently trading 40% below their highs and 51% under their average Zacks price. The stock is trading below its 50-day and 200-day moving averages. But it could be set to find support around its 50-month moving average, which it has only broken below a few times over the last 15 years.

Buyers also seem to be nibbling after it recently fell below its 200-week moving average. And DexCom is trading at some of its most historically oversold RSI levels.

DXCM trades at a 22% discount to the Zacks Tech sector and 50% below its own three-year median, with a PEG ratio of 1.5. That said, one of the glaring drawbacks for DexCom in the new interest rate environment is that it is still trading at 63.7X forward 12-month earnings vs. Tech’s 22.7X.

Bottom Line

Wall Street is still super high on the stock, with 15 of the 17 brokerage recommendations Zacks has at “Strong Buys.” Therefore, investors who can handle some risk might want to consider taking a chance on DexCom in the fourth quarter.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to “insane levels,” and they’re likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

DexCom, Inc. (DXCM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.