Pinterest (PINS) was a pandemic winner alongside other digital ad-focused stocks such as Snap, soaring from $15 to $85 in early 2021.

PINS tumbled from its peaks alongside many other growth stocks, while shedding some users gained during the pandemic. But buyers are back as Wall Street dives into growth stocks, with Pinterest up roughly 15% in 2023 heading into its Q4 earnings on February 6.

Digital Vision Boards

Pinterest became a hit with advertisers, small businesses, entrepreneurs, and others because paid content and ads fit seamlessly into the Pinterest platform. PINS is also constantly boosting its ad tech and video features. Most crucially, PINs is investing heavily in and rolling out far more features focused on e-commerce and shopping to expand its reach beyond ads and drive long-term engagement from users, brands, and businesses.

Pinterest closed Q3 with 445 million global monthly active users, flat from the year-ago period, but up 40% from the 322 million it closed the pre-covid period of Q3 FY19. On top of that, Pinterest’s average revenue per user climbed 11% last quarter as businesses find value in its engaged user base.

Pinterest is also more focused than ever on creating its own unique lane in the digital economy. Bill Ready took over as CEO in June 2022 from Google, where he had been president of commerce. “Through clear focus on increasing engagement that delights our users, we are deepening our monetization per user, and building personalized and relevant experiences that go from inspiration and intent to action,” he said in prepared Q3 remarks.

Pinterest is also moving forward with various growth initiatives amid an ongoing activist investor push from Elliott Management, which saw the firm add a board member in early December.

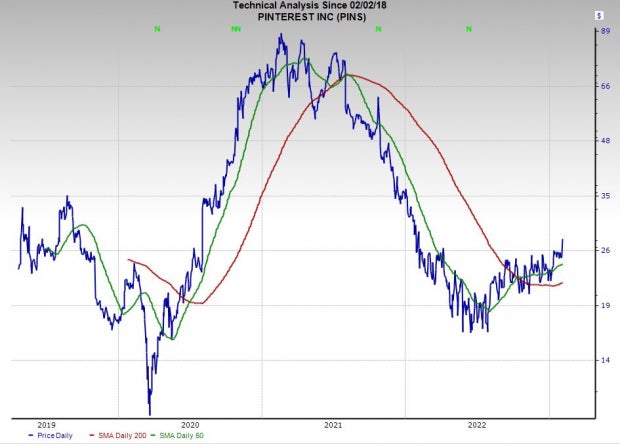

Image Source: Zacks Investment Research

Growth Outlook

Pinterest added 100 million new monthly active users in 2020 to close the year with 459 million. Meanwhile, its revenue climbed 48% to come on top of its 51% sales expansion in FY19 (its first year as a public company). The firm then boosted its revenue by another 52% in FY21 to $2.58 billion vs. $765 million in FY18.

Unfortunately, PINS slowly shed some users it grabbed while people were stuck at home, closing Q3 FY22 with 445 million. Despite the drop, PINS has experienced increased interest among younger users and it’s gaining more traction on mobile.

Zacks estimates call for Pinterest’s FY22 revenue to climb another 9% to $2.81 billion and then pop 16% higher in FY23 to $3.26 billion.

The company’s adjusted FY22 earnings are projected to slip by 47% to $0.60 a share. Yet, PINS EPS are projected to bounce back and hit $0.75 a share in FY23. Pinterest’s earnings estimates have trended slightly higher for FY22 and FY23, which is not easy at the moment.

Image Source: Zacks Investment Research

Bottom Line

Buying Pinterest heading into earnings comes with risks, especially given the massive market reactions to Meta (META) and Snap (SNAP). Investors willing to take on the possibility of a big move in either direction might want to consider PINS right now, while others should wait and see how its guidance shakes out.

Pinterest lands a Zacks Rank #3 (Hold) at the moment and it is part of an industry that currently ranks in the top 27% of over 250 Zacks industries. PINS stock has climbed roughly 25% in the last six months, including a 15% YTD surge. This runs has helped it break above its 50-day moving average.

Despite PINS comeback alongside the likes of Meta and other beaten-down names, it still trades 70% below its record at around $27 per share. On top of all that, Pinterest boasts a stellar balance sheet with $2.7 billion in cash and equivalents ($3.7 billion in total assets) vs. $548 million in total liabilities. Plus, the company is still operating from a strong position within two key growth areas of the economy: digital ads and e-commerce.

Just Released: Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for 2023?

From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%. Our Director of Research has now combed through 4,000 companies covered by the Zacks Rank and handpicked the best 10 tickers to buy and hold in 2023. Don’t miss your chance to still be among the first to get in on these just-released stocks.

Snap Inc. (SNAP) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.