Among the consumer discretionary sector, Royal Caribbean Cruises’ (RCL) stock is standing out with a Zacks Rank #1 (Strong Buy) and lands the Bull of the Day.

Royal Caribbean’s stock continues to gain steam with this summer’s peak travel season boosted by pent-up demand following the pandemic. This was reconfirmed in Royal Caribbean’s second quarter results last Thursday with the company impressively surpassing top and bottom-line expectations and raising its full-year EPS guidance.

Q2 Review

Driven by stronger pricing in correlation with higher demand, Royal Caribbean beat Q2 earnings expectations by 15% last week. Earnings came in at $1.82 per share compared to EPS estimates of $1.58.

More importantly, the company’s post-pandemic rebound now looks in full swing after posting an adjusted loss of -$2.08 a share in the prior-year quarter. On the top line, Q2 sales of $3.52 billion surpassed estimates by 4% and soared 61% from a year ago.

It’s also noteworthy that Royal Caribbean has now surpassed earnings expectations for six consecutive quarters.

Image Source: Zacks Investment Research

Higher Guidance

Strong Q2 results led to Royal Caribbean raising its full-year fiscal 2023 EPS guidance by 33% to between $6.00-6.20 a share. This makes Royal Caribbean shares very attractive as earnings estimate revisions should keep going up and are widely considered the most significant catalyst in the upward price movement of a stock.

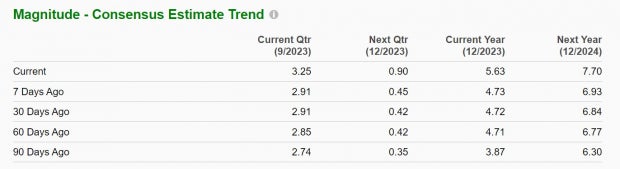

The Zacks Consensus for Royal Caribbean’s FY23 earnings has already soared 19% over the last week to estimates of $5.63 per share compared to $4.73 a share seven days ago. Fiscal 2024 EPS estimates have climbed 7% over the last week and are now expected at $7.70 a share compared to $6.93 per share a week ago.

Image Source: Zacks Investment Research

Stellar Performance

Correlating with the reassuring trend of rising earnings estimates throughout the year, Royal Caribbean stock has now soared +112% in 2023.

This has largely outperformed the S&P 500, Nasdaq, and Norwegian Cruise Line’s (NCLH) +41% while being roughly on par with Carnival Cooperation’s (CCL) +117%.

Royal Caribbean stock has wiped away any losses from the pandemic and is now up +113% over the last three years. This also tops the broader indexes, Norwegian’s +35%, and Carnival’s +28%. Despite this year’s impressive rally, Royal Caribbean’s stock still trades very reasonably at 18.6X forward earnings which is attractively below its industry average of 29.5X and the S&P 500’s 21.2X.

Image Source: Zacks Investment Research

Takeaway

Following strong Q2 results last week, the rally in Royal Caribbean stock may accelerate this year. Earnings estimates have continued to soar and the company’s P/E valuation is also supportive of the rally gaining more steam even with RCL shares up over +100% in 2023.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to “insane levels,” and they’re likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Carnival Corporation (CCL) : Free Stock Analysis Report

Norwegian Cruise Line Holdings Ltd. (NCLH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.