Petroleo Brasileiro PBR, commonly known as Petrobras, is a Brazilian multinational energy company and one of the largest integrated oil and gas companies in the world. It is also one of the most compelling oil stock investments currently in the market. In addition to a historically low relative valuation, Petroleo Brasileiro also enjoys a Zacks Rank #1 (Strong Buy) rating, reflecting upward trending earnings revisions.

Furthermore, the technical price action in PBR stock is indicative of an imminent breakout and rally opportunity, while also showing considerable relative strength in the face of falling crude prices. All these bullish catalysts together lead me to believe PBR should be considered by investors looking for exposure to the energy market.

Analysts have unanimously raised their earnings estimates for Petroleo Brasileiro across timeframes, with next quarter earnings estimates increasing by 42%, and FY23 by 11.4%.

Image Source: Zacks Investment Research

Industry Leader at a Discount

Petroleo Brasileiro operates in various segments of the energy industry, including exploration and production, refining, distribution, and marketing of petroleum and petroleum products.

The company is a state-controlled company and plays a significant role in Brazil’s economy, both as a major employer and as a key player in the country’s energy sector. It is the largest energy firm in Latin America.

Not only is PBR one of the world’s major oil players, but it is also trading at an extremely reasonable valuation, massively limiting the downside risks. Today, Petrobras is trading at a one year forward earnings multiple of just 3.9x, which is just below the industry average of 4.1x, and well below its 10-year median of 8.8x.

Further sweetening the deal, PBR also offers a dividend yield of 2.1%, paying investors just to own the stock.

Image Source: Zacks Investment Research

Crude Prices Rolling Over… Temporarily

The action in the price of Crude Oil has surprised many over the last few weeks. After rallying aggressively up to $95 in late September, prices quickly reverted to the mid $80s. But then conflict in the Middle East flared up, and the price spiked again, however it was unable to sustain the rally, and this week rolled over again to $75.

It seems market participants are pricing the possibility of economic slowdown, which is bearish for the price of oil. Yet the evidence of an economic slowdown is still in the very early stages, and I think this move is too far forward looking.

The most recent GDP data showed that the US economy was expanding at an annualized rate of 4.9%, while the unemployment rate remains below 4%, and inflation continues to ease. These are indications that the economy is still robust, pointing to continuing strong demand for oil.

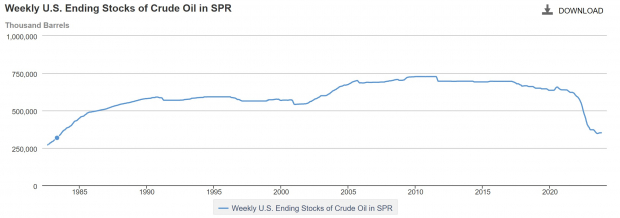

Additionally, while a single headline out of the middle east could send the price of oil higher, there is another catalyst domestically that could do the same, refilling the US Strategic Petroleum Reserve.

Currently, the Strategic Petroleum Reserve holds 351 million barrels of oil, which is near 30-year lows. Having such a low level of reserves put the country at risk, and the Biden administration knows this.

Fortunately for them, this -20% fall-off in the price of oil has created a fantastic opportunity for them to refill the stores at very reasonable prices. I consider this to be a highly likely outcome in the situation and should provide a strong and steady bid in the oil market.

Image Source: US Energy Information Administration

Technical Setup

PBR stock has so far put up a strong performance YTD, up 49% since the start of the year. Also impressive is that the stock has held up quite well in the face of a -20% correction in the price of oil. I have seen a number of oil stocks hold up during this sell off, which means oil stock investors are continuing to buy shares regardless of the temporary weakness.

It makes sense that investors are still focused on buying shares in oil companies, because like PBR many are at very reasonable valuations.

Making PBR even more of a compelling buy is its technical chart pattern. Since oil prices started selling off, PBR stock has been building out this very clean bull flag. If the price can break out above the $15.75 level, I would expect the stock to make new yearly highs.

Alternatively, if it loses the level of support at $14.80, it may be worth waiting for another opportunity to buy shares.

Image Source: TradingView

Bottom Line

Petroleo Brasileiro has several bullish catalysts on its horizon. With the downside protection of a depressed valuation, a top Zacks Rank, and technical pattern, the stock offers a convincing risk-reward setup.

So long as the US economy doesn’t spiral into a recession before the year end, which I consider unlikely, PBR should be a fantastic addition to investor’s portfolios.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to “insane levels,” and they’re likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Petroleo Brasileiro S.A.- Petrobras (PBR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.