Investors love few things more than consistent, reliable dividend payouts. After all, who doesn’t love getting paid?

In 2022, it goes without saying that dividends have been a precious item for investors, helping to cushion the blow from drawdowns in other positions.

Income investors love to target Dividend Aristocrats, companies that have consistently increased their dividend payouts for a minimum of 25 consecutive years.

However, a step above is the elite Dividend Kings group, companies with at least 50 consecutive years of increased dividend payouts.

Clearly, companies in the Dividend King club have shown a commendable commitment to shareholders over decades of well-established and successful business operations.

And several companies are about to burst into the club.

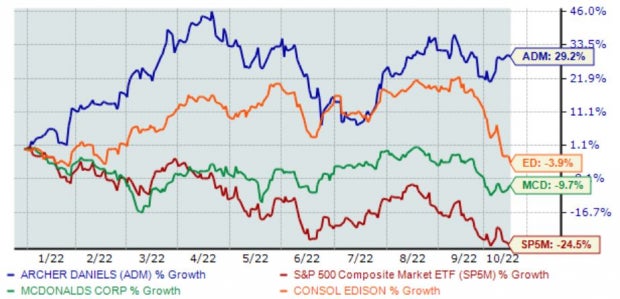

Archer Daniels Midland ADM, Consolidated Edison ED, and McDonald’s Corp. MCD are all just a few years from joining the group. Below is a chart illustrating the share performance of all three companies in 2022, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

For those looking to build up a cash pile, let’s dive deeper into each one.

Archer Daniels Midland

Archer Daniels Midland is a leading producer of food and beverage ingredients as well as goods made from various agricultural products.

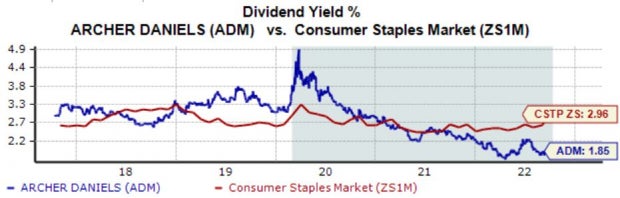

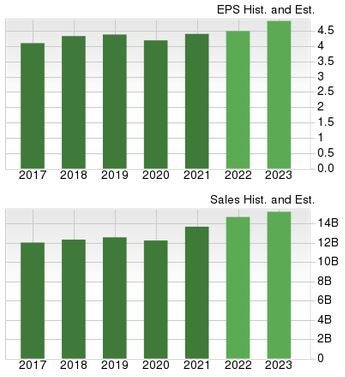

The company’s annual dividend yield comes in at 1.9%. In addition, ADM pays out just 25% of earnings and carries a rock-solid 4.1% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

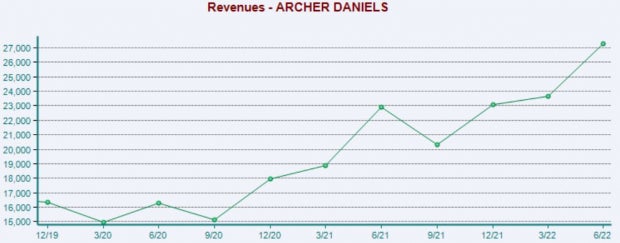

Archer Daniels Midland has an impressive earnings track record, exceeding revenue and earnings estimates in each of its last seven quarters.

Just in its latest print, ADM penciled in a double-digit 23% EPS beat paired with an 8% revenue beat. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

For the cherry on top, ADM shares are reasonably priced; the company’s 12.6X forward earnings multiple is notably below its 14.3X five-year median and represents a sizable 32% discount relative to its Zacks Consumer Staples sector.

The company sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

Consolidated Edison

Consolidated Edison is a diversified utility holding company with subsidiaries engaged in both regulated and unregulated businesses.

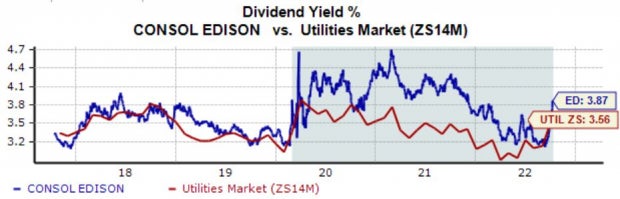

ED’s annual dividend yield comes in at a steep 3.9%, nicely above that of its Zacks Utilities sector average.

Further, the company pays out 70% of its earnings and carries a 2.7% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Consolidated Edison also carries a favorable growth profile, with earnings estimates suggesting Y/Y bottom-line growth of 2% and 7.4% in FY22 and FY23, respectively.

The company’s top line is also in solid standing; revenue is forecasted to increase by a solid 7.4% in FY22 and a further 3.7% in FY23.

Image Source: Zacks Investment Research

McDonald’s

McDonald’s is a long-time leading fast-food chain that nearly anybody could recognize, with its signature golden arches sitting at every corner.

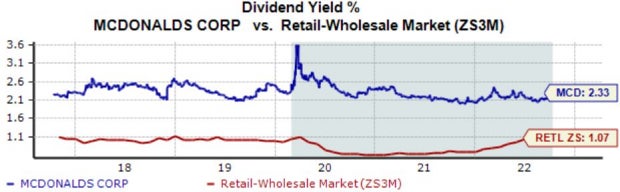

McDonald’s rewards its shareholders via its annual dividend that yields 2.3%, notably higher than its Zacks Retail and Wholesale sector average of 1.1%.

Further, the company has been dedicated to growing its dividend, carrying a robust 7.3% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

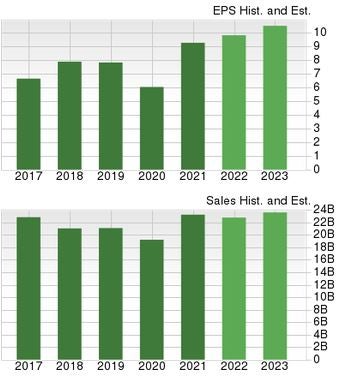

Like ED, McDonald’s sports a solid growth profile, with earnings forecasted to climb 5.7% in FY22 and a further 7.1% in FY23.

The company’s top line looks to take a hit in FY22, with the Zacks Consensus Sales estimate of $22.7 billion reflecting a 2.3% drop from FY21 sales of $23.2 billion.

Still, things kick back into the green in FY23, with estimates calling for 3.6% Y/Y revenue growth.

Image Source: Zacks Investment Research

MCD shares trade at a 24.1X forward earnings multiple, undoubtedly creeping into the higher side of the spectrum. Still, shares trade below their five-year median of 25.5X and highs of 28.6X in 2021.

MCD carries a Style Score of a D for Value.

Image Source: Zacks Investment Research

Bottom Line

There are few things in life sweeter than getting paid.

The thrill is even greater when the payday comes from your investments.

All three companies above – Archer Daniels Midland ADM, Consolidated Edison ED, and McDonald’s Corp. MCD – are about to become Dividend Kings in just a few years time.

For those that like payday, all three deserve consideration in a historically-volatile 2022.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McDonald’s Corporation (MCD): Free Stock Analysis Report

Consolidated Edison Inc (ED): Free Stock Analysis Report

Archer Daniels Midland Company (ADM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.