Here are three stocks with buy rank and strong value characteristics for investors to consider today, June 28th:

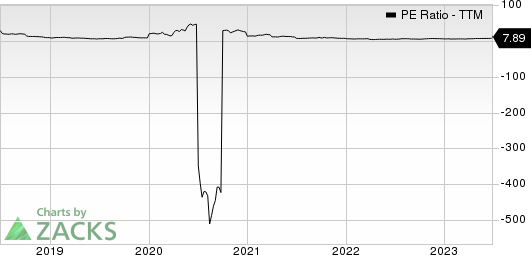

Covenant Logistics Group, Inc. CVLG: This company that provides transportation and logistics services carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 9.6% over the last 60 days.

Covenant Logistics Group, Inc. Price and Consensus

Covenant Logistics Group, Inc. price-consensus-chart | Covenant Logistics Group, Inc. Quote

Covenant Logistics has a price-to-earnings ratio (P/E) of 10.16, compared with 18.10 for the industry. The company possesses a Value Score of A.

Covenant Logistics Group, Inc. PE Ratio (TTM)

Covenant Logistics Group, Inc. pe-ratio-ttm | Covenant Logistics Group, Inc. Quote

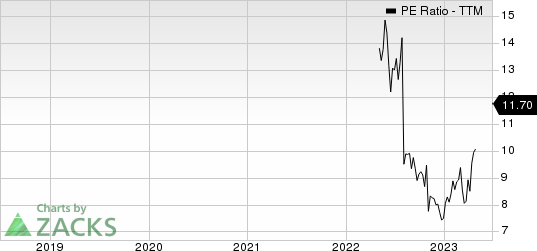

Core & Main, Inc. CNM: This wastewater infrastructure distributor carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4% over the last 60 days.

Core & Main, Inc. Price and Consensus

Core & Main, Inc. price-consensus-chart | Core & Main, Inc. Quote

Core & Main has a price-to-earnings ratio (P/E) of 16.07 compared with 16.10 for the industry. The company possesses a Value Score of B.

Core & Main, Inc. PE Ratio (TTM)

Core & Main, Inc. pe-ratio-ttm | Core & Main, Inc. Quote

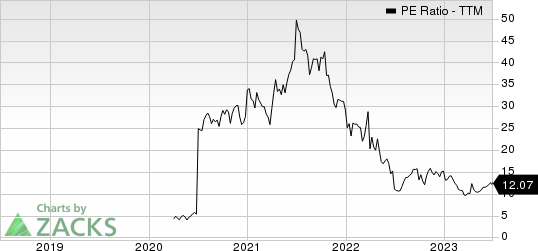

Afya Limited AFYA: This medical education company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.1% over the last 60 days.

Afya Limited Price and Consensus

Afya Limited price-consensus-chart | Afya Limited Quote

Afya has a price-to-earnings ratio (P/E) of 10.54, compared with 14.10 for the industry. The company possesses a Value Score of B.

Afya Limited PE Ratio (TTM)

Afya Limited pe-ratio-ttm | Afya Limited Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Afya Limited (AFYA) : Free Stock Analysis Report

Covenant Logistics Group, Inc. (CVLG) : Free Stock Analysis Report

Core & Main, Inc. (CNM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.