Here are three stocks with buy rank and strong value characteristics for investors to consider today, January 23:

International Consolidated Airlines Group S.A. ICAGY: This company which engages in the provision of passenger and cargo transportation services carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.5% over the last 60 days.

International Consolidated Airlines Group SA Price and Consensus

International Consolidated Airlines Group SA price-consensus-chart | International Consolidated Airlines Group SA Quote

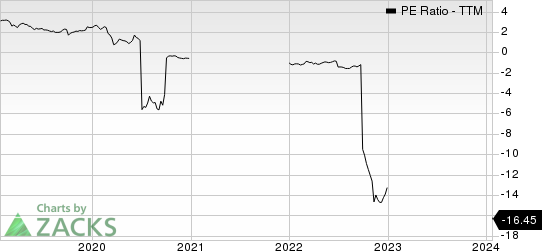

International Consolidated Airlines has a price-to-earnings ratio (P/E) of 4.04, compared with 5.30 for the industry. The company possesses a Value Score of A.

International Consolidated Airlines Group SA PE Ratio (TTM)

International Consolidated Airlines Group SA pe-ratio-ttm | International Consolidated Airlines Group SA Quote

Kodiak Gas Services, Inc. KGS: This compression services company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its next year earnings increasing 34.1% over the last 60 days.

Kodiak Gas Services, Inc. Price and Consensus

Kodiak Gas Services, Inc. price-consensus-chart | Kodiak Gas Services, Inc. Quote

Kodiak Gas Services has a price-to-earnings ratio (P/E) of 13.99 compared with 18.50 for the industry. The company possesses a Value Score of B.

Kodiak Gas Services, Inc. PE Ratio (TTM)

Kodiak Gas Services, Inc. pe-ratio-ttm | Kodiak Gas Services, Inc. Quote

Steelcase Inc. SCS: This furniture and architectural products company carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its next year earnings increasing 5.4% over the last 60 days.

Steelcase Inc. Price and Consensus

Steelcase Inc. price-consensus-chart | Steelcase Inc. Quote

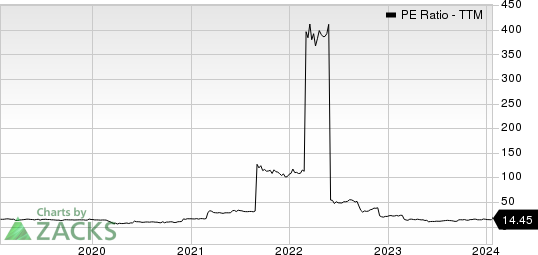

Steelcase has a price-to-earnings ratio (P/E) of 16.04 compared with 19.36 for the S&P. The company possesses a Value Score of A.

Steelcase Inc. PE Ratio (TTM)

Steelcase Inc. pe-ratio-ttm | Steelcase Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Steelcase Inc. (SCS) : Free Stock Analysis Report

International Consolidated Airlines Group SA (ICAGY) : Free Stock Analysis Report

Kodiak Gas Services, Inc. (KGS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.