Here are three stocks with buy rank and strong income characteristics for investors to consider today, March 20th:

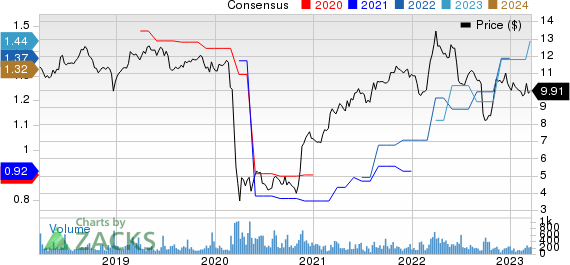

Trinity Capital Inc. TRIN: This business development company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 11.1% over the last 60 days.

Trinity Capital Inc. Price and Consensus

Trinity Capital Inc. price-consensus-chart | Trinity Capital Inc. Quote

This Zacks Rank #1 company has a dividend yield of 14.1%, compared with the industry average of 10.9%.

Trinity Capital Inc. Dividend Yield (TTM)

Trinity Capital Inc. dividend-yield-ttm | Trinity Capital Inc. Quote

OFS Capital Corporation OFS: This non-diversified management investment company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.1% over the last 60 days.

OFS Capital Corporation Price and Consensus

OFS Capital Corporation price-consensus-chart | OFS Capital Corporation Quote

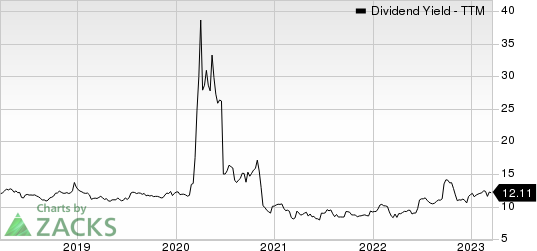

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 12.1%, compared with the industry average of 10.9%.

OFS Capital Corporation Dividend Yield (TTM)

OFS Capital Corporation dividend-yield-ttm | OFS Capital Corporation Quote

Whitestone REIT WSR: This community-centered shopping center real estate investment trust has witnessed the Zacks Consensus Estimate for its current year earnings increasing 7.5% over the last 60 days.

Whitestone REIT Price and Consensus

Whitestone REIT price-consensus-chart | Whitestone REIT Quote

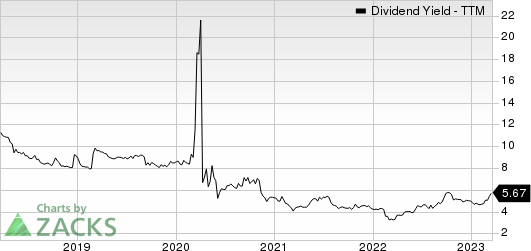

This Zacks Rank #1 company has a dividend yield of 5.7%, compared with the industry average of 4.8%.

Whitestone REIT Dividend Yield (TTM)

Whitestone REIT dividend-yield-ttm | Whitestone REIT Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

This Little-Known Semiconductor Stock Could Be Your Portfolio’s Hedge Against Inflation

Everyone uses semiconductors. But only a small number of people know what they are and what they do. If you use a smartphone, computer, microwave, digital camera or refrigerator (and that’s just the tip of the iceberg), you have a need for semiconductors. That’s why their importance can’t be overstated and their disruption in the supply chain has such a global effect. But every cloud has a silver lining. Shockwaves to the international supply chain from the global pandemic have unearthed a tremendous opportunity for investors. And today, Zacks’ leading stock strategist is revealing the one semiconductor stock that stands to gain the most in a new FREE report. It’s yours at no cost and with no obligation.

>>Yes, I Want to Help Protect My Portfolio During the Recession

Whitestone REIT (WSR) : Free Stock Analysis Report

OFS Capital Corporation (OFS) : Free Stock Analysis Report

Trinity Capital Inc. (TRIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.