Here are three stocks with buy rank and strong income characteristics for investors to consider today, April 21st:

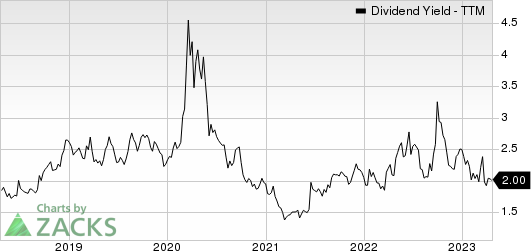

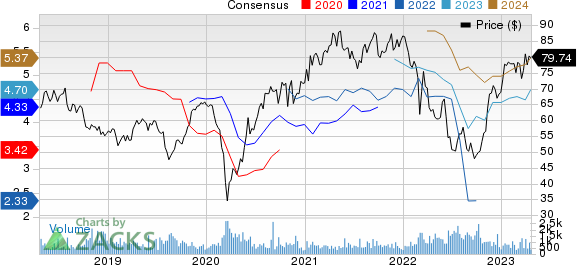

Worthington Industries, Inc. WOR: This industrial manufacturing company focused on value-added steel processing has witnessed the Zacks Consensus Estimate for its current year earnings increasing 15.9% over the last 60 days.

Worthington Industries, Inc. Price and Consensus

Worthington Industries, Inc. price-consensus-chart | Worthington Industries, Inc. Quote

This Zacks Rank #1 company has a dividend yield of 2%, compared with the industry average of 0.5%.

Worthington Industries, Inc. Dividend Yield (TTM)

Worthington Industries, Inc. dividend-yield-ttm | Worthington Industries, Inc. Quote

Ryerson Holding Corporation RYI: This industrial metals processing and distribution company has witnessed the Zacks Consensus Estimate for its current year earnings increasing 19.8% over the last 60 days.

Ryerson Holding Corporation Price and Consensus

Ryerson Holding Corporation price-consensus-chart | Ryerson Holding Corporation Quote

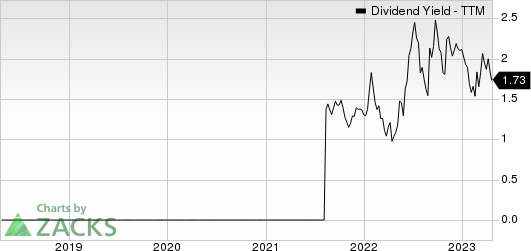

This Zacks Rank #1 company has a dividend yield of 1.7%, compared with the industry average of 1.3%.

Ryerson Holding Corporation Dividend Yield (TTM)

Ryerson Holding Corporation dividend-yield-ttm | Ryerson Holding Corporation Quote

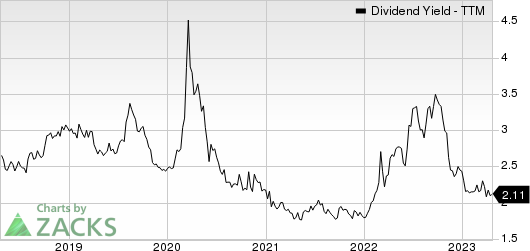

Siemens Aktiengesellschaft SIEGY: This technology company focusing on the areas of automation and digitalization has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.9% over the last 60 days.

Siemens AG Price and Consensus

Siemens AG price-consensus-chart | Siemens AG Quote

This Zacks Rank #1 company has a dividend yield of 2.1%, compared with the industry average of 0.0%.

Siemens AG Dividend Yield (TTM)

Siemens AG dividend-yield-ttm | Siemens AG Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

Siemens AG (SIEGY) : Free Stock Analysis Report

Ryerson Holding Corporation (RYI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Image and article originally from www.nasdaq.com. Read the original article here.